- United States

- /

- Software

- /

- NasdaqGS:MNDY

3 US Stocks That May Be Trading Below Estimated Intrinsic Value

Reviewed by Simply Wall St

As major U.S. indexes opened sharply lower recently, driven by a decline in tech stocks following earnings reports, investors are closely watching economic data and Federal Reserve decisions on interest rates. In this environment of fluctuating market conditions, identifying stocks that may be trading below their estimated intrinsic value can provide opportunities for investors seeking potential growth at a relative discount.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $19.03 | $37.92 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | $84.27 | $168.24 | 49.9% |

| Bank of Marin Bancorp (NasdaqCM:BMRC) | $22.73 | $44.35 | 48.7% |

| California Resources (NYSE:CRC) | $52.32 | $104.35 | 49.9% |

| UFP Technologies (NasdaqCM:UFPT) | $274.00 | $537.57 | 49% |

| WEX (NYSE:WEX) | $173.76 | $343.51 | 49.4% |

| Vitesse Energy (NYSE:VTS) | $25.12 | $49.46 | 49.2% |

| ChromaDex (NasdaqCM:CDXC) | $3.58 | $7.15 | 49.9% |

| AeroVironment (NasdaqGS:AVAV) | $216.60 | $419.13 | 48.3% |

| Rapid7 (NasdaqGM:RPD) | $41.30 | $81.71 | 49.5% |

Let's review some notable picks from our screened stocks.

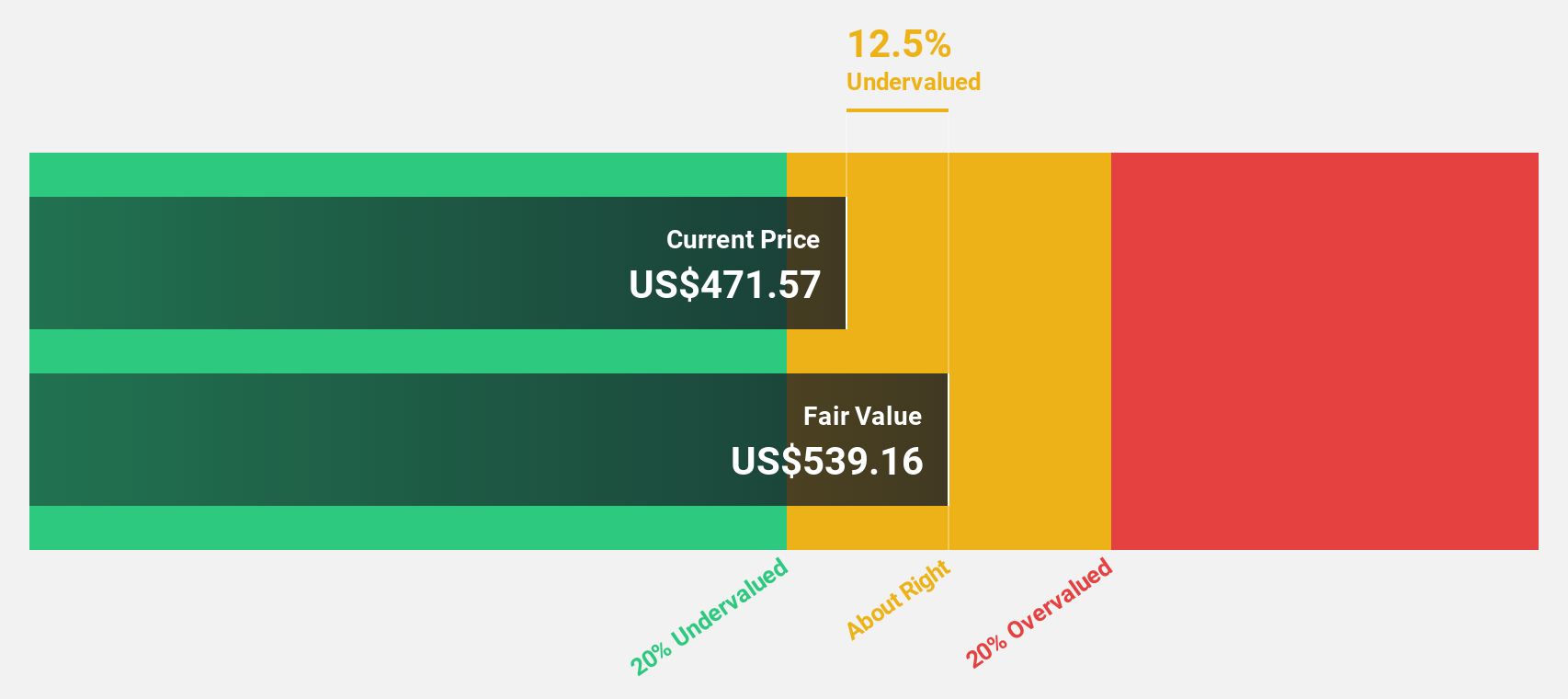

Duolingo (NasdaqGS:DUOL)

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $12.84 billion.

Operations: The company generates revenue of $634.49 million from its educational software segment.

Estimated Discount To Fair Value: 37.3%

Duolingo is trading at US$299.97, significantly below its estimated fair value of US$478.71, suggesting it may be undervalued based on cash flows. The company recently became profitable and forecasts show earnings growing significantly faster than the market, with a high return on equity expected in three years. Recent partnerships with WEBTOON and Sony Music aim to enhance user engagement and expand content offerings, potentially supporting future revenue growth beyond the current forecast of 22.3% annually.

- Insights from our recent growth report point to a promising forecast for Duolingo's business outlook.

- Dive into the specifics of Duolingo here with our thorough financial health report.

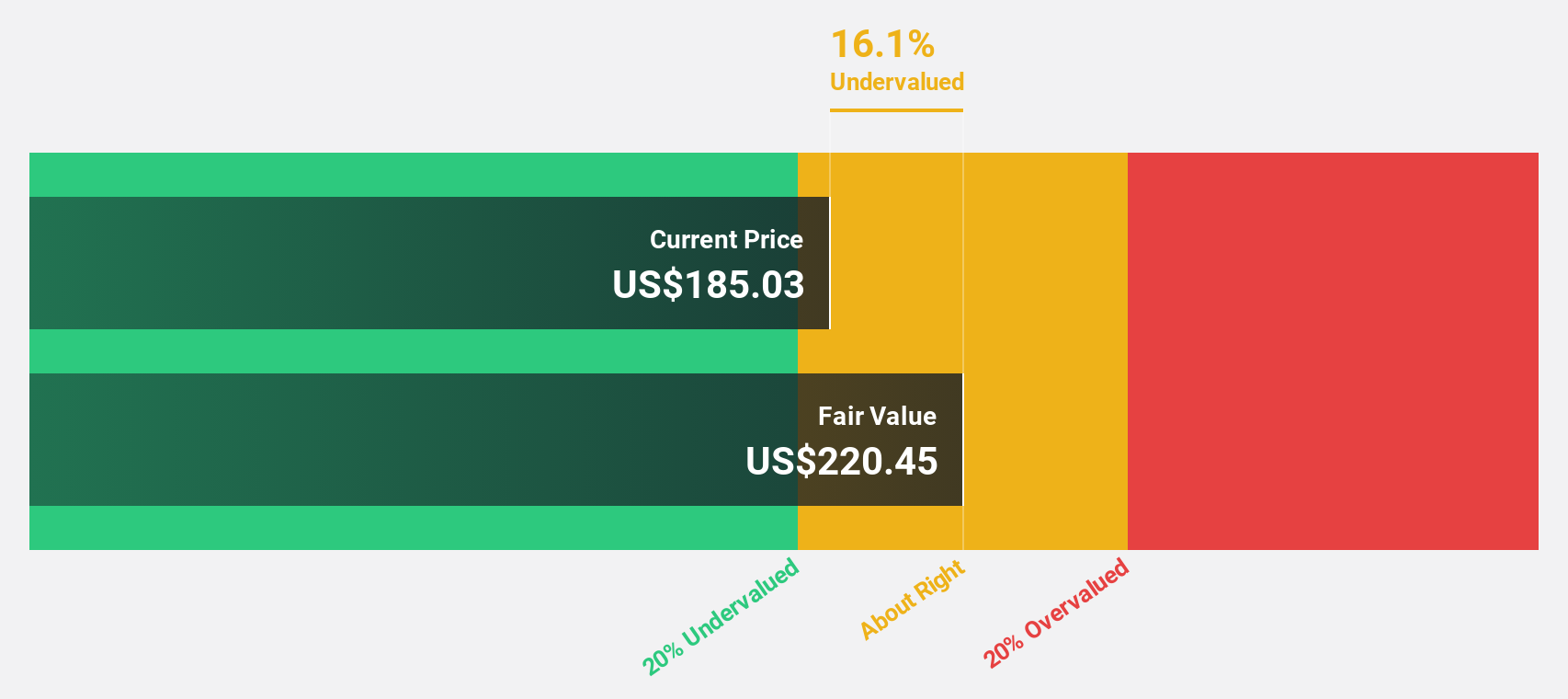

monday.com (NasdaqGS:MNDY)

Overview: monday.com Ltd., along with its subsidiaries, develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $15.08 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, totaling $844.78 million.

Estimated Discount To Fair Value: 14.6%

monday.com, trading at US$300.23, is valued below its fair value of US$351.61. The company recently turned profitable with earnings expected to grow significantly faster than the market at 27.9% annually. Despite recent shareholder dilution, revenue forecasts show a robust growth trajectory of 20.9% per year, supported by strong Q2 results and new product offerings like the Portfolio management solution aimed at enhancing enterprise client workflows and productivity.

- In light of our recent growth report, it seems possible that monday.com's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of monday.com.

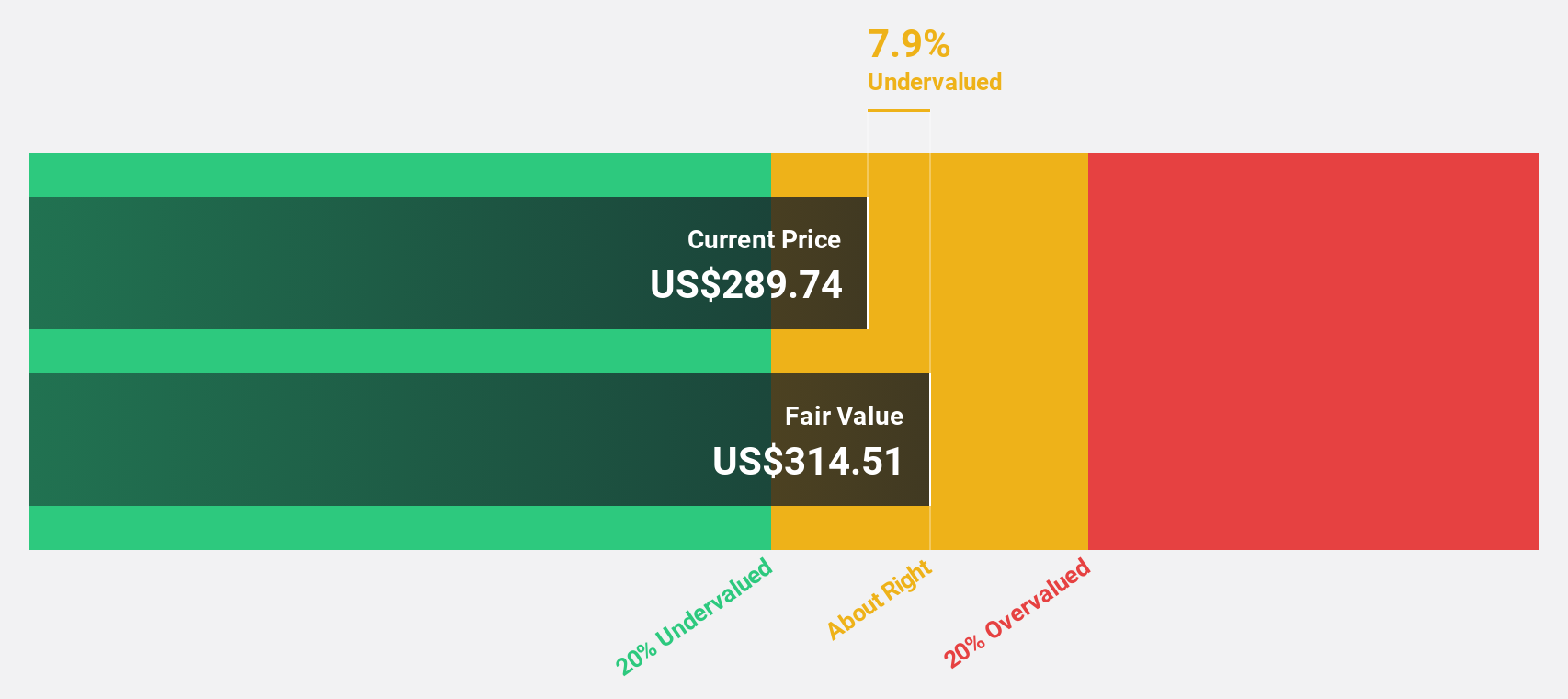

Zscaler (NasdaqGS:ZS)

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $28.95 billion.

Operations: The company generates revenue primarily from sales of subscription services to its cloud platform and related support services, totaling approximately $2.17 billion.

Estimated Discount To Fair Value: 31.8%

Zscaler, trading at US$186.78, is considered undervalued with an estimated fair value of US$274.01, suggesting a significant discount. Despite past shareholder dilution and insider selling, Zscaler's earnings are projected to grow 40.23% annually as it aims for profitability within three years. Recent strategic integrations with Okta and Airtel highlight its focus on enhancing cybersecurity solutions and expanding market reach, potentially bolstering future cash flows amidst growing demand for secure digital transformations.

- The growth report we've compiled suggests that Zscaler's future prospects could be on the up.

- Navigate through the intricacies of Zscaler with our comprehensive financial health report here.

Key Takeaways

- Navigate through the entire inventory of 193 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.