- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

Domino’s (DPZ) Valuation Review After UK CEO Exit and Management’s Confident Profit Growth Outlook

Reviewed by Simply Wall St

Domino's Pizza (DPZ) is back in the spotlight after its UK CEO, Andrew Rennie, unexpectedly resigned just weeks after he flagged a supply glut and tough competitive dynamics in the British pizza market.

See our latest analysis for Domino's Pizza.

The leadership shake up in the UK comes after a solid run in the business. However, the 1 year total shareholder return of minus 7.66 percent and a 90 day share price return of minus 8.21 percent suggest momentum has cooled, even as management talks up longer term market share gains at a 424.64 dollar share price.

If Domino’s shifting leadership has you rethinking where growth and conviction might line up, this could be a good moment to explore fast growing stocks with high insider ownership.

With the shares down over the past year but still trading above some estimates of intrinsic value, is Domino’s quietly setting up for a rebound, or are investors already paying up for all the growth to come?

Most Popular Narrative Narrative: 14.5% Undervalued

With the narrative fair value of $496.65 sitting well above Domino's last close at $424.64, the story leans toward upside if the assumptions land.

The recent full national rollout on DoorDash, building on last year's Uber Eats integration, is expected to be a multiyear growth driver, allowing Domino's to tap into a broader, digitally native customer base and meet rising consumer preference for at-home dining and off-premise consumption. This is expected to support higher delivery segment revenues and increased market share.

Curious how steady mid single digit growth, firmer margins and a richer earnings multiple can still justify a premium fair value? The narrative lays out the math behind that optimism, including how earnings and share count trends are expected to work together. Want to see the specific profit profile that has to materialise for this target to hold?

Result: Fair Value of $496.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in global pizza demand and bumpier international expansion could undermine same store sales momentum and pressure the premium valuation case.

Find out about the key risks to this Domino's Pizza narrative.

Another Angle on Valuation

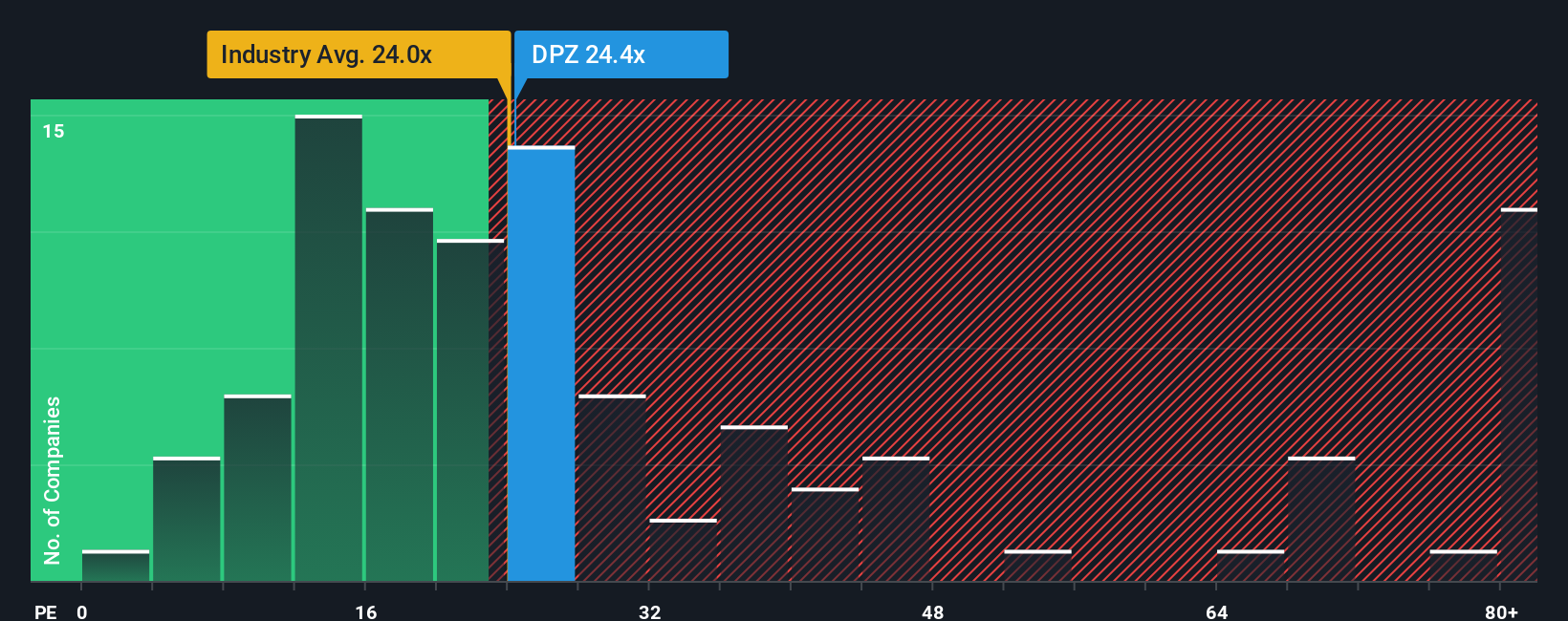

While the narrative suggests upside, a simple earnings multiple points the other way. Domino's trades on a P E of 24.3 times, richer than the US Hospitality average at 21.3 times, its peer average at 23.3 times, and above a fair ratio of 20.7 times. This hints at valuation risk rather than hidden value. Could sentiment be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Domino's Pizza Narrative

If this view does not quite match your own, or you prefer to dig into the numbers yourself, you can build a custom take in under three minutes: Do it your way.

A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Do not stop at one stock idea when you can quickly scan curated opportunities with strong fundamentals, smart themes, and compelling risk reward trade offs on Simply Wall Street.

- Capture potential multi baggers early by reviewing these 3576 penny stocks with strong financials that already show robust financial strength instead of just hype.

- Position your portfolio for tomorrow's innovations by assessing these 24 AI penny stocks powering breakthroughs in automation, data intelligence, and next generation software.

- Explore potential value ahead of the crowd by screening these 927 undervalued stocks based on cash flows that our cash flow models flag as trading below intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026