- United States

- /

- Hospitality

- /

- NasdaqGS:DNUT

Can Krispy Kreme’s (DNUT) McDonald’s Partnership Scrutiny Reveal Deeper Transparency Challenges?

Reviewed by Sasha Jovanovic

- Bragar Eagel & Squire, P.C. recently announced an investigation into Krispy Kreme following a class action complaint alleging the company made false or misleading statements about its partnership with McDonald's, including claims of declining demand, unprofitability, and paused expansion plans.

- This development has heightened concerns about Krispy Kreme's transparency around key partnerships and has resulted in increased legal and investor scrutiny for the company.

- To understand how the scrutiny over Krispy Kreme’s McDonald's partnership impacts its outlook, let’s revisit its investment narrative in this new context.

Find companies with promising cash flow potential yet trading below their fair value.

Krispy Kreme Investment Narrative Recap

To invest in Krispy Kreme today, you have to believe the brand can rebound from recent disruptions and pivot successfully toward higher-margin, capital-light growth drivers. The recent class action investigation into the company’s disclosures around the McDonald's partnership adds new pressure to the investment case, as short-term confidence hinges on restoring revenue momentum and addressing concerns highlighted by legal and investor scrutiny.

Most relevant to this heightened scrutiny is the company’s decision announced in June to formally end the McDonald's partnership. This move directly affects expansion prospects and has already impacted near-term results, making future growth from other retail collaborations and franchise expansion key factors to watch.

Yet, amid restructuring efforts, it’s just as important for investors to watch for signs of continued margin pressure from Krispy Kreme’s high fixed-cost distribution network and...

Read the full narrative on Krispy Kreme (it's free!)

Krispy Kreme's outlook anticipates $1.8 billion in revenue and $145.4 million in earnings by 2028. This is based on a 4.8% annual revenue growth rate and a $596.8 million earnings increase from current earnings of -$451.4 million.

Uncover how Krispy Kreme's forecasts yield a $3.70 fair value, in line with its current price.

Exploring Other Perspectives

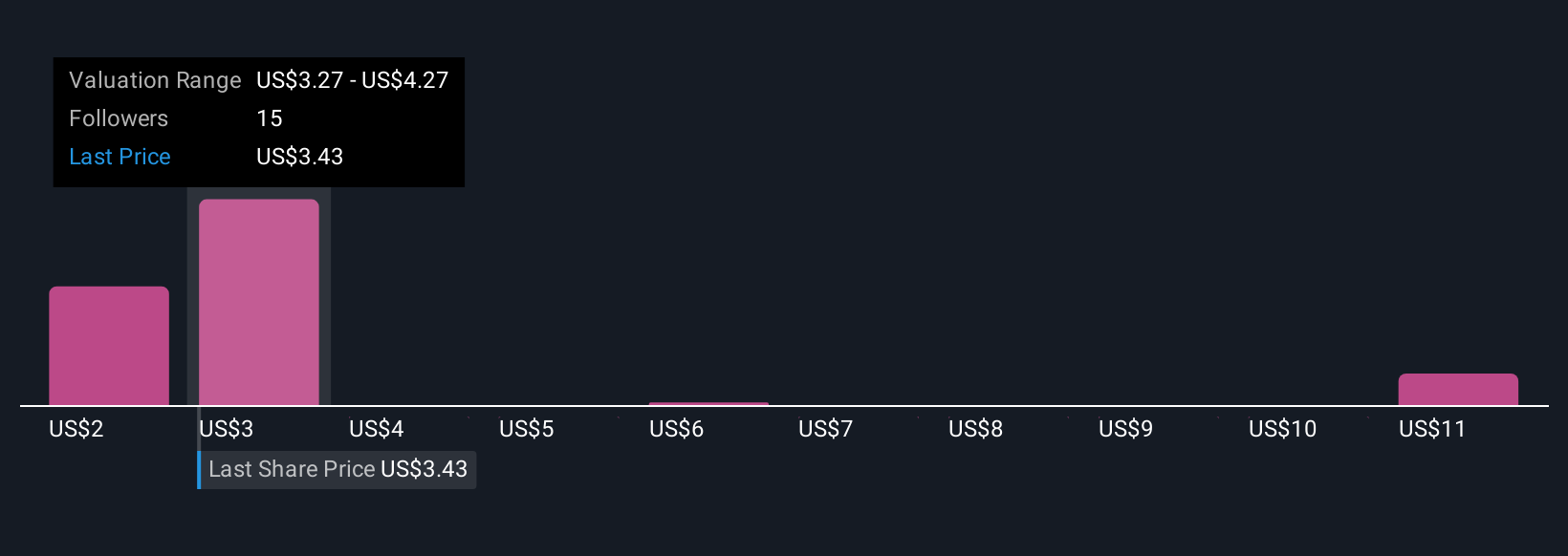

Eight Simply Wall St Community members estimated Krispy Kreme’s fair value between US$2.27 and US$12.25, with most clustering well below the current share price. With recent withdrawal of the full-year outlook and a challenging cost structure, it’s clear opinions diverge, explore the range of outlooks shaping market debate.

Explore 8 other fair value estimates on Krispy Kreme - why the stock might be worth 40% less than the current price!

Build Your Own Krispy Kreme Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Krispy Kreme research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Krispy Kreme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Krispy Kreme's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Krispy Kreme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNUT

Krispy Kreme

Produces doughnuts in the United States, the United Kingdom, Ireland, Australia, New Zealand, Mexico, Canada, Japan, and internationally.

Fair value with low risk.

Market Insights

Community Narratives