- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Is Direct Mobile Sports Betting Approval in Missouri Reshaping the Investment Case for DraftKings (DKNG)?

Reviewed by Simply Wall St

- DraftKings Inc. announced that the Missouri Gaming Commission granted it a direct mobile sports betting license, allowing independent online sportsbook operations statewide pending final approvals, with a planned launch for December 1, 2025.

- This move positions Missouri as the 29th U.S. state for DraftKings’ regulated betting presence and removes the requirement for land-based casino partnerships within the state.

- We'll explore how direct market access in Missouri may influence DraftKings' growth potential and reshape its broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

DraftKings Investment Narrative Recap

To be a DraftKings shareholder, you generally need to believe in the continued legalization and adoption of online sports betting across new markets, creating opportunities for long-term growth. The news of Missouri granting DraftKings a direct mobile sportsbook license supports the key catalyst of expanding legal market access, though its effect may not materially impact the most immediate short-term catalysts or address the primary risks linked to regulatory and tax uncertainties. DraftKings’ recent financial results, with Q2 2025 net income at US$157.94 million and revenue growth exceeding prior periods, remain the most relevant parallel to the Missouri news, underlining that new market entries may reinforce top-line momentum if regulatory frameworks remain stable. This is particularly important for investors focused on DraftKings' path toward sustained profitability in a competitive industry. Yet, in contrast, investors should also be aware of how shifting state tax policies could ...

Read the full narrative on DraftKings (it's free!)

DraftKings' narrative projects $9.5 billion revenue and $1.3 billion earnings by 2028. This requires 20.5% yearly revenue growth and a $1.6 billion earnings increase from current earnings of -$304.5 million.

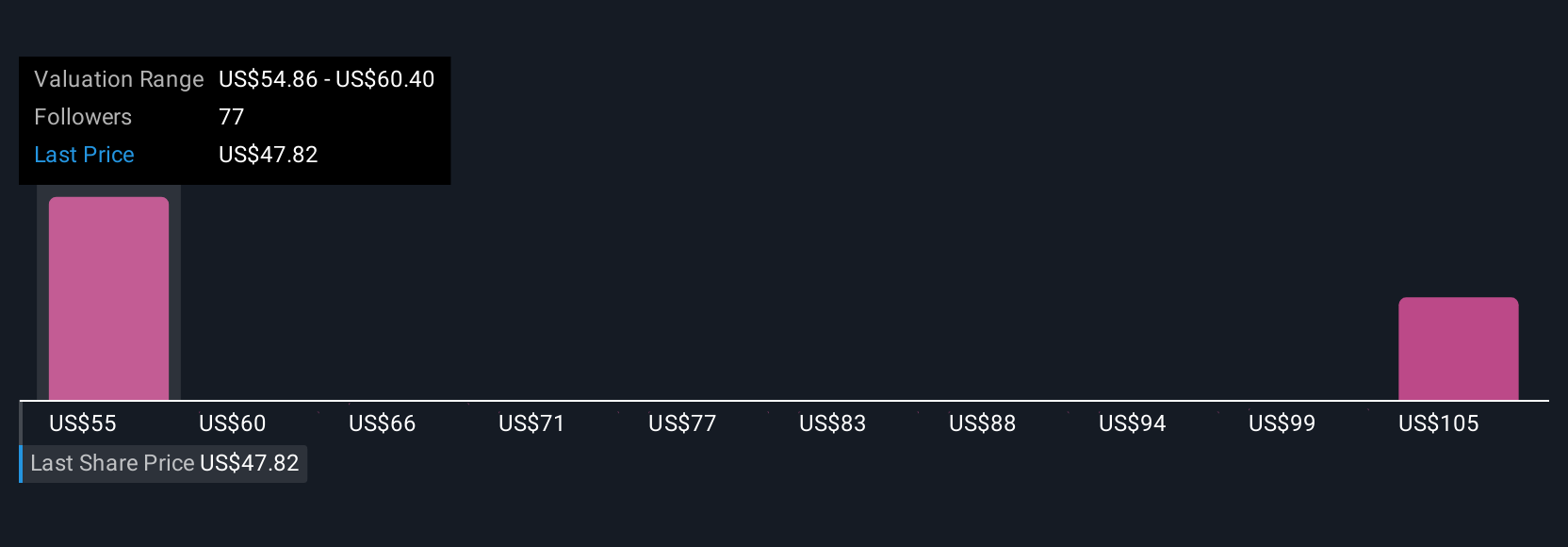

Uncover how DraftKings' forecasts yield a $54.86 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members set DraftKings’ fair value between US$54.86 and US$110.65. As new states open up and regulatory trends unfold, you’ll find a wide spectrum of views on the company’s prospects, explore how these perspectives relate to the risks and growth opportunities ahead.

Explore 4 other fair value estimates on DraftKings - why the stock might be worth just $54.86!

Build Your Own DraftKings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DraftKings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DraftKings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DraftKings' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives