- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

DraftKings (DKNG): A Fresh Look at Valuation After Recent Surge in Bearish Sentiment and Share Price Slide

Reviewed by Simply Wall St

The recent slide in DraftKings (DKNG) stock, down more than 27% over the past month, has caught the attention of traders and investors as bearish sentiment from retail participants has sharply intensified. The decline comes amid heated debates about valuation, rising competition, and a wave of technical selling that is pressuring shares to new lows.

See our latest analysis for DraftKings.

Behind DraftKings’ steep 1-month share price decline, a mix of technical pressure and shifting sentiment is at work, even as the company presses forward with new app launches, recent acquisitions, and a board refresh. The stock’s momentum has clearly faded in the short term, with its 1-year total shareholder return at -16.9%, but long-term holders have still seen substantial gains over three years, reflecting the brand’s potential if execution improves.

If you’re curious where investor momentum is headed next, now is an ideal moment to broaden your search through fast growing stocks with high insider ownership.

With shares cratering and sentiment downbeat, the key question now is whether DraftKings is simply cheap after a technical rout or if the market has already factored in all future growth, leaving little room for upside from here.

Most Popular Narrative: 40.1% Undervalued

Compared to the recent close at $30.65, the most widely followed market narrative assigns a fair value of $51.20 to DraftKings, suggesting the stock price does not currently reflect what analysts view as the company's long-term potential. This valuation creates a major catalyst at the center of the bull case.

"Ongoing product innovation in live betting, in-game personalization, and AI-driven trading is increasing user engagement and dynamic pricing opportunities, which should boost average revenue per user (ARPU) and improve long-term earnings potential."

Want to know the bold projections fueling this target? Revenue growth, profit margin expansion, and a premium profit multiple are at the heart of this outlook. Find out which financial leap the narrative is banking on. See which forecasts drive their valuation call and why they think DraftKings could be seriously mispriced.

Result: Fair Value of $51.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory changes or intensified competition from new prediction market entrants could quickly undermine bullish forecasts and increase downside risk.

Find out about the key risks to this DraftKings narrative.

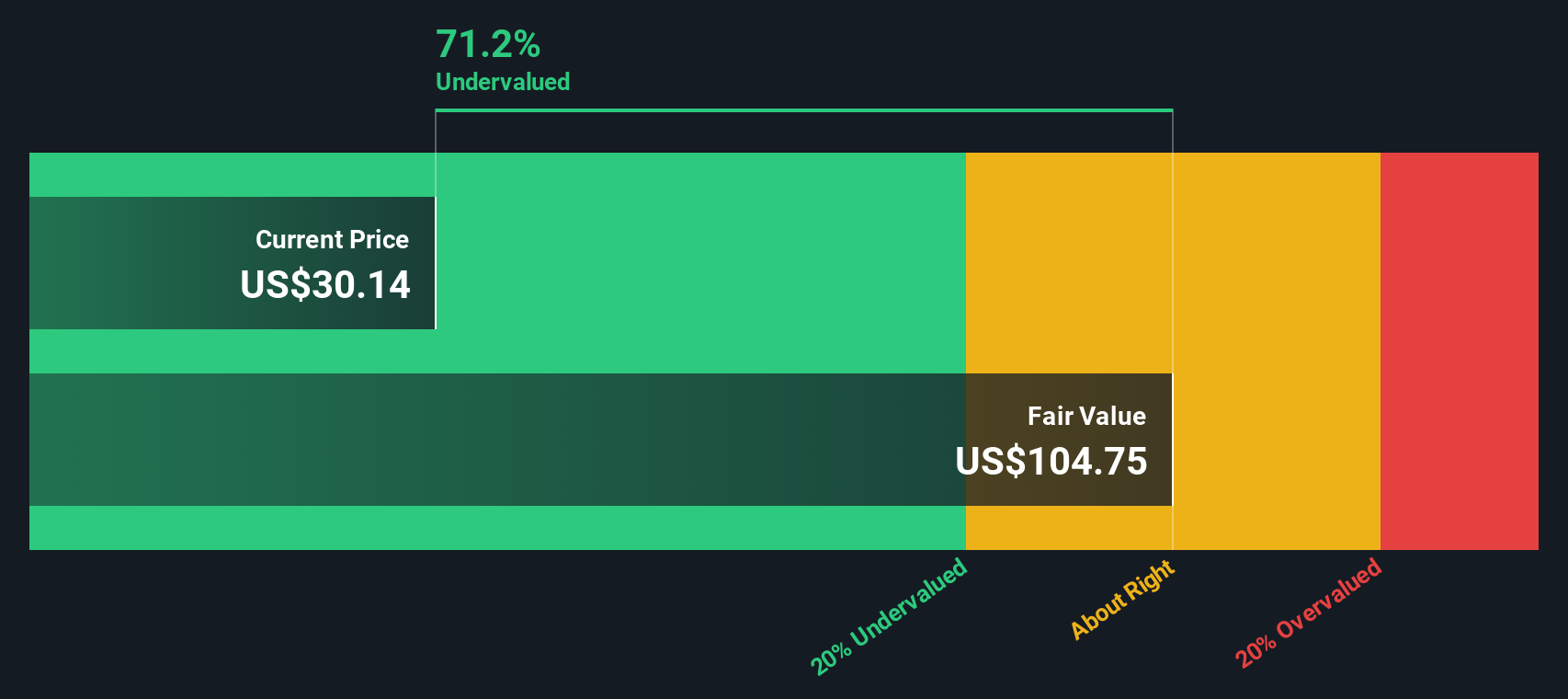

Another View: Our DCF Model Signals Big Upside

While the most-followed market narratives lean on earnings growth and multiple expansion, the SWS DCF model paints a more dramatic picture. According to our DCF analysis, DraftKings appears significantly undervalued, with a fair value estimate of $104.66. This is over three times its current price. Is the market missing something fundamental, or is the model too optimistic given today’s risk factors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DraftKings Narrative

If you see things differently, or want to dive into the numbers and shape your own perspective, you can put together a personal view in just a few minutes, your way with Do it your way.

A great starting point for your DraftKings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your chance to find unique opportunities beyond DraftKings. Don’t miss out on under-the-radar stocks that could offer significant potential for your portfolio.

- Tap into strong financials and see which companies make the grade among these 3586 penny stocks with strong financials.

- Capitalize on healthcare’s next big frontier by checking out these 34 healthcare AI stocks, which is transforming the future of medicine and diagnostics.

- Boost your income stream by targeting reliable yields in these 21 dividend stocks with yields > 3%, offering over 3% returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)