- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

Can DraftKings (DKNG) Leverage NBCUniversal Deal to Strengthen Its Competitive Position in Sports Betting?

Reviewed by Sasha Jovanovic

- DraftKings announced a multi-year advertising agreement with NBCUniversal, securing exclusive integrations and digital sponsorships across a range of NBCUniversal's high-profile sports properties, including the NFL, PGA TOUR, Premier League, and major tentpole events like Super Bowl LX and the NBA All-Star Weekend.

- This collaboration gives DraftKings broad exposure to tens of millions of sports fans across linear, streaming, and digital platforms, while also providing exclusive promotional access in categories such as online sports betting, iGaming, and daily fantasy sports, deepening its connection with sports audiences year-round.

- We will examine how rising competition from well-funded prediction markets, highlighted by Kalshi’s recent expansion, may influence DraftKings’ investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

DraftKings Investment Narrative Recap

To be a DraftKings shareholder right now, you need to believe in the company's ability to convert broad market access and media partnerships into sustainable growth, despite mounting competitive and regulatory pressures. While the sweeping NBCUniversal advertising agreement boosts DraftKings' brand visibility and audience reach, it does not materially change the most important near-term catalyst: ongoing expansion into newly legalized sports betting states. The most significant risk remains rising competition from emerging prediction market platforms and the potential for further regulatory intervention, which could weigh on growth and margins.

Among recent announcements, DraftKings' entry into Missouri with a direct mobile sports betting license stands out. This move adds another regulated market to the platform and directly supports the company’s core user acquisition catalyst, reinforcing the importance of geographic expansion to offset headwinds from well-funded rivals and uncertain regulatory shifts.

However, investors should also watch closely for...

Read the full narrative on DraftKings (it's free!)

DraftKings' narrative projects $9.5 billion revenue and $1.3 billion earnings by 2028. This requires 20.5% yearly revenue growth and a $1.6 billion increase in earnings from the current level of -$304.5 million.

Uncover how DraftKings' forecasts yield a $52.83 fair value, a 62% upside to its current price.

Exploring Other Perspectives

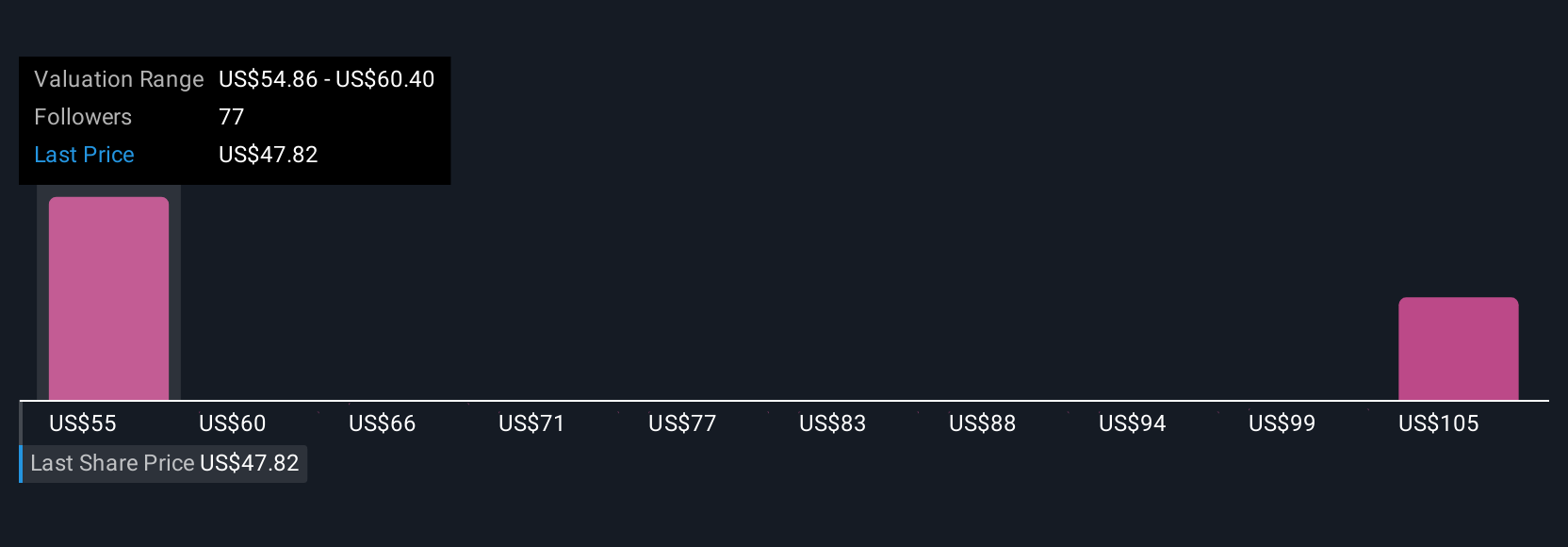

Six fair value estimates from the Simply Wall St Community range sharply between US$51.71 and US$104.66 per share. With persistent legal and regulatory risk at the forefront, you may find wide differences in expectations, explore a range of community perspectives to gauge your own stance.

Explore 6 other fair value estimates on DraftKings - why the stock might be worth just $51.71!

Build Your Own DraftKings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DraftKings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DraftKings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DraftKings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives