- United States

- /

- Hospitality

- /

- NasdaqGS:CZR

Does Caesars Stock Offer Value After a 40% Drop and Digital Expansion News?

Reviewed by Bailey Pemberton

If you have been wrestling with what to do about Caesars Entertainment stock, you are definitely not alone. The company’s roller-coaster ride has caught the eye of value-seekers and skeptics alike. After a rough 1-year stretch with shares down over 40.7%, some investors are wondering if the worst is already reflected in the price. While the stock dropped 5.3% just over the past week, it has actually managed to hold flat across the last 30 days, hinting at a possible shift in how the market views its future risks and rewards.

Against this backdrop, Caesars Entertainment’s value score stands at a robust 5 out of 6, suggesting it is undervalued by most of the usual yardsticks. That impressive score indicates there could be opportunity here, even after years of share price declines that have left the stock at levels more than 50% below where it traded five years ago. Recent market developments, including shifting investor appetite for riskier assets and changing consumer spending trends, have shaped how the stock is perceived. These factors have also created potential entry points for value-minded buyers.

So, how does Caesars stack up under a closer look at the classic valuation methods? Let’s dig into the numbers check by check, but stick around because at the end, I will share an even more insightful way to interpret what the valuation metrics are really telling us.

Why Caesars Entertainment is lagging behind its peers

Approach 1: Caesars Entertainment Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company's future cash flows and then discounting them back to their value today using a rate that reflects risk and the time value of money. This approach gives investors an estimate of what the business is really worth, based on expected cash generation rather than near-term earnings or market sentiment.

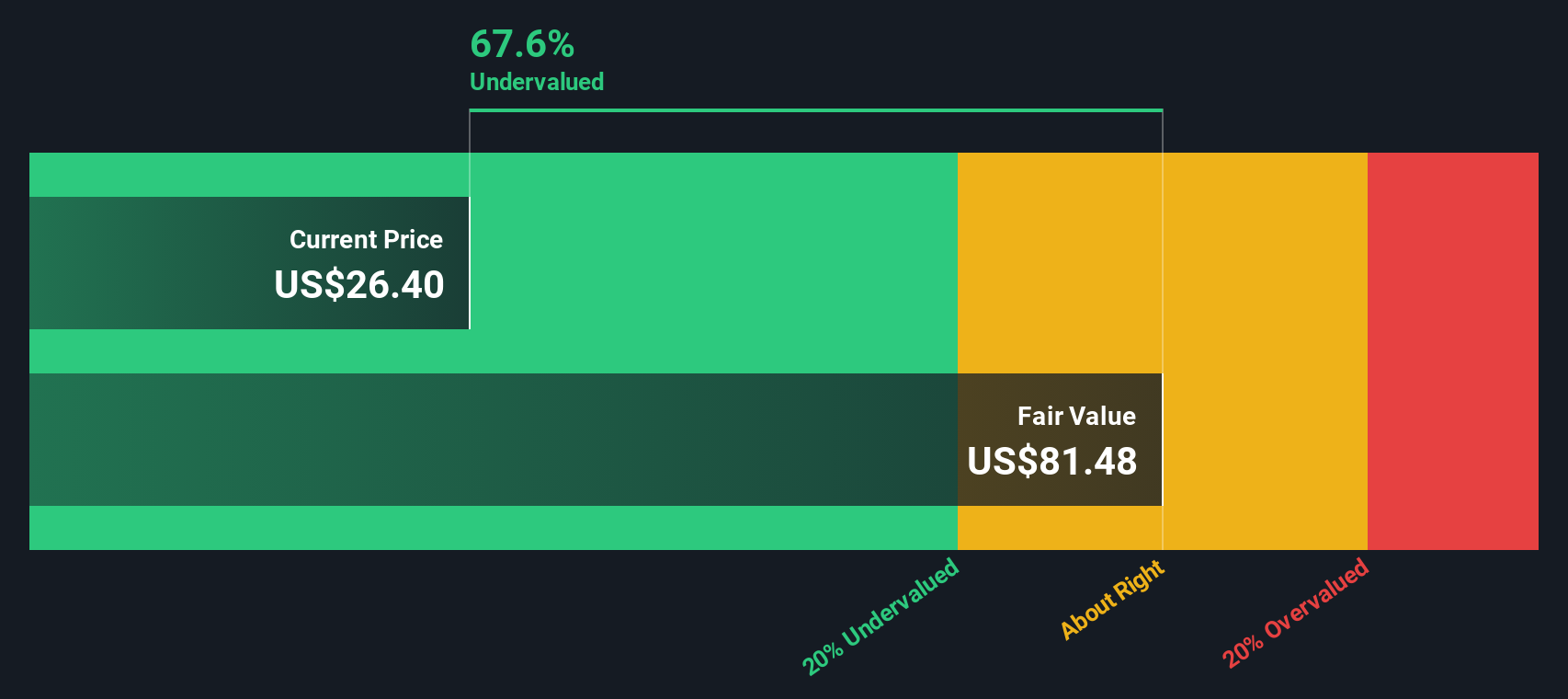

For Caesars Entertainment, the DCF analysis begins with its most recent reported Free Cash Flow, which comes in at $39.7 Million. Looking ahead, analyst projections indicate Free Cash Flow will grow significantly, reaching over $1.32 Billion by 2027. Simply Wall St then extrapolates FCF for the following years, suggesting continued growth up to $2.24 Billion by 2035.

All these future cash flows are discounted back to today’s dollars using a two-stage Free Cash Flow to Equity model. The result is an estimated intrinsic value per share of $81.86. Compared to the current share price, this valuation implies the stock trades at a steep 67.8% discount to its underlying value, highlighting a potential opportunity for value-oriented investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Caesars Entertainment is undervalued by 67.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Caesars Entertainment Price vs Sales

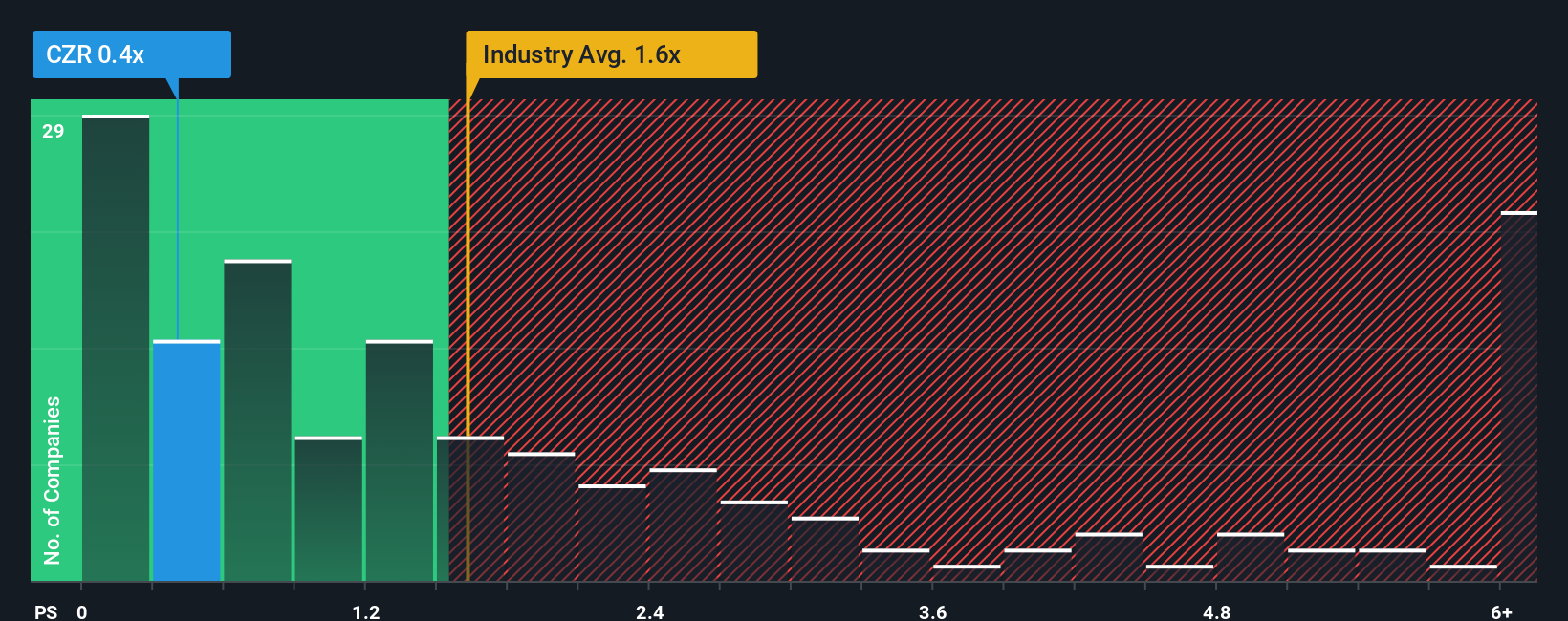

For companies like Caesars Entertainment, which may not consistently produce positive earnings, the Price-to-Sales (P/S) ratio is a useful tool for gauging valuation. The P/S ratio helps investors assess how the market values each dollar of the company’s revenue, offering insight even when profits are volatile or negative. Normally, higher growth expectations or lower risk profiles support a higher "fair" P/S multiple. Companies with slower growth or higher risks tend to see their P/S ratio trade closer to or below the industry average.

Currently, Caesars Entertainment trades at a P/S ratio of 0.48x. This stands well below the Hospitality industry average of 1.70x and the peer average of 2.18x, highlighting a marked discount. At first glance, this significant gap may look like a buying opportunity, but it's important to dig deeper before deciding if it is genuinely undervalued.

Simply Wall St’s proprietary “Fair Ratio” gives a comprehensive benchmark for what Caesars’ P/S multiple ought to be, factoring in the company’s specific growth outlook, industry characteristics, profit margins, size, and unique risk profile. Unlike simple peer or industry comparisons, the Fair Ratio (at 1.53x) offers a more balanced perspective on where the stock should trade today. Comparing the Fair Ratio to the actual P/S multiple shows Caesars trades far below even this tailored benchmark, supporting the view that the market is currently undervaluing the company’s sales potential.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Caesars Entertainment Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives—a more dynamic tool that connects your view of Caesars Entertainment’s story with concrete numbers and forecasts. A Narrative is simply your personal perspective on what will drive the company's fortunes, whether that is digital growth or labor risks, paired with your estimates of future revenue, margins, and a resulting fair value. On Simply Wall St’s Community page, millions of investors use Narratives to turn their views into actionable valuations that update automatically as fresh news or earnings roll in.

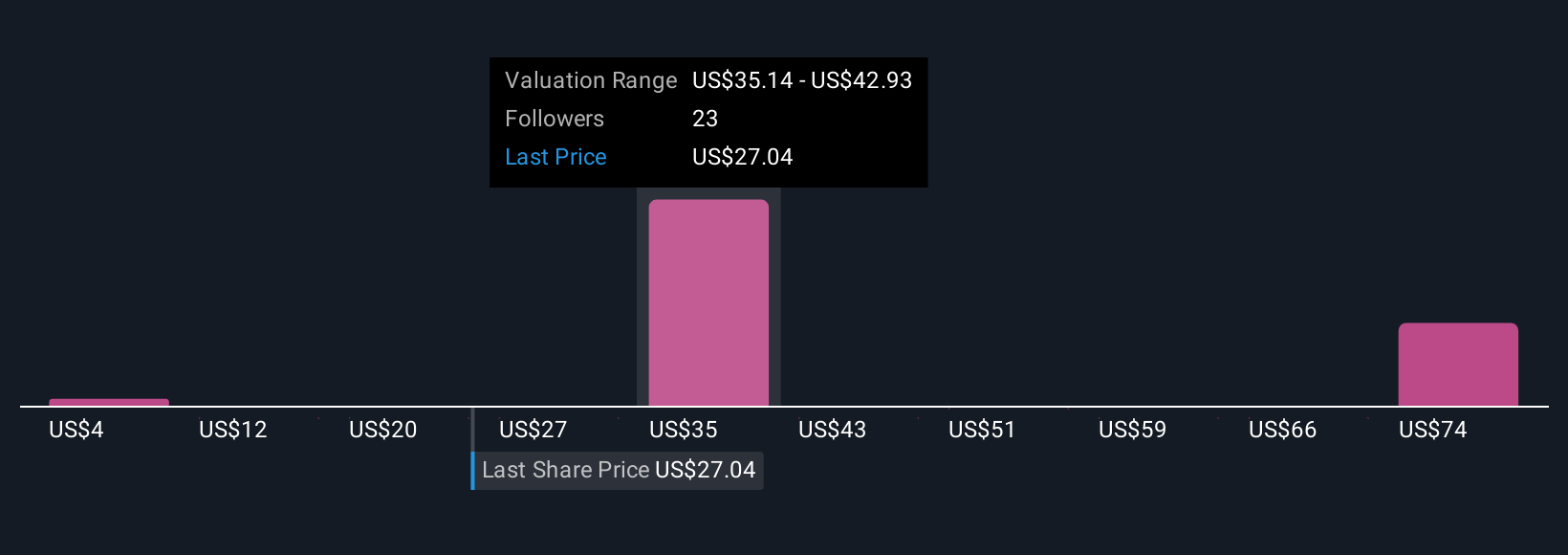

Narratives help you decide when to act by transparently comparing your Fair Value to today’s price. This offers real-time context for buy or sell decisions as the story develops. For example, for Caesars Entertainment, a bullish investor might base their Narrative on digital expansion, room upgrades, and loyalty growth, arriving at a fair value as high as $61 per share, while a cautious view focused on debt and labor risks might support a value closer to $27. With Narratives, you are in control, interpreting the investment story on your terms with the latest info always in view.

Do you think there's more to the story for Caesars Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CZR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives