- United States

- /

- Hospitality

- /

- NasdaqGS:CBRL

Is Recent Momentum and Value Interest Altering The Investment Case For Cracker Barrel (CBRL)?

Reviewed by Simply Wall St

- In the past four weeks, Cracker Barrel Old Country Store experienced significant positive momentum, earning a high momentum score and strong analyst rating while maintaining a valuation that some investors consider appealing. This combination of momentum and valuation has drawn increased interest from the market, highlighting the company's position among value-focused investors.

- Recent analysis shows that Cracker Barrel's high beta of 1.45 means its share price shows pronounced movement compared to broader market trends, reflecting heightened investor sensitivity to both company performance and sector shifts.

- With investor attention drawn by the momentum and value attributes, we'll explore how this renewed interest may influence Cracker Barrel's long-term investment narrative.

Cracker Barrel Old Country Store Investment Narrative Recap

To be a Cracker Barrel Old Country Store shareholder, you likely need to believe in the company’s ongoing ability to increase guest satisfaction and drive repeat visits, especially as it rolls out menu improvements and store refreshes. The recent strong stock momentum and appealing valuation have not materially shifted the key near-term catalyst: management’s success in executing its guest experience and menu initiatives. The biggest risk remains macroeconomic uncertainty and its impact on consumer spending, which continues to be a critical factor for the business outlook.

Among recent announcements, Cracker Barrel’s introduction of new summer menu items such as Campfire Meals and specialty desserts directly ties into its catalyst of elevating the guest experience and driving higher same-store sales. Expanding menu offerings is part of a broader push to remain relevant with evolving consumer tastes and to bolster in-store traffic, making this rollout especially relevant as the company seeks to sustain its recent momentum.

By contrast, investors should also be aware of heightened consumer anxiety, which could weigh on traffic trends if pressures on discretionary spending persist...

Read the full narrative on Cracker Barrel Old Country Store (it's free!)

Cracker Barrel Old Country Store's outlook anticipates $3.6 billion in revenue and $101.1 million in earnings by 2028. This scenario reflects a 0.7% annual revenue decline and a $65.1 million increase in earnings from the current $36.0 million.

Exploring Other Perspectives

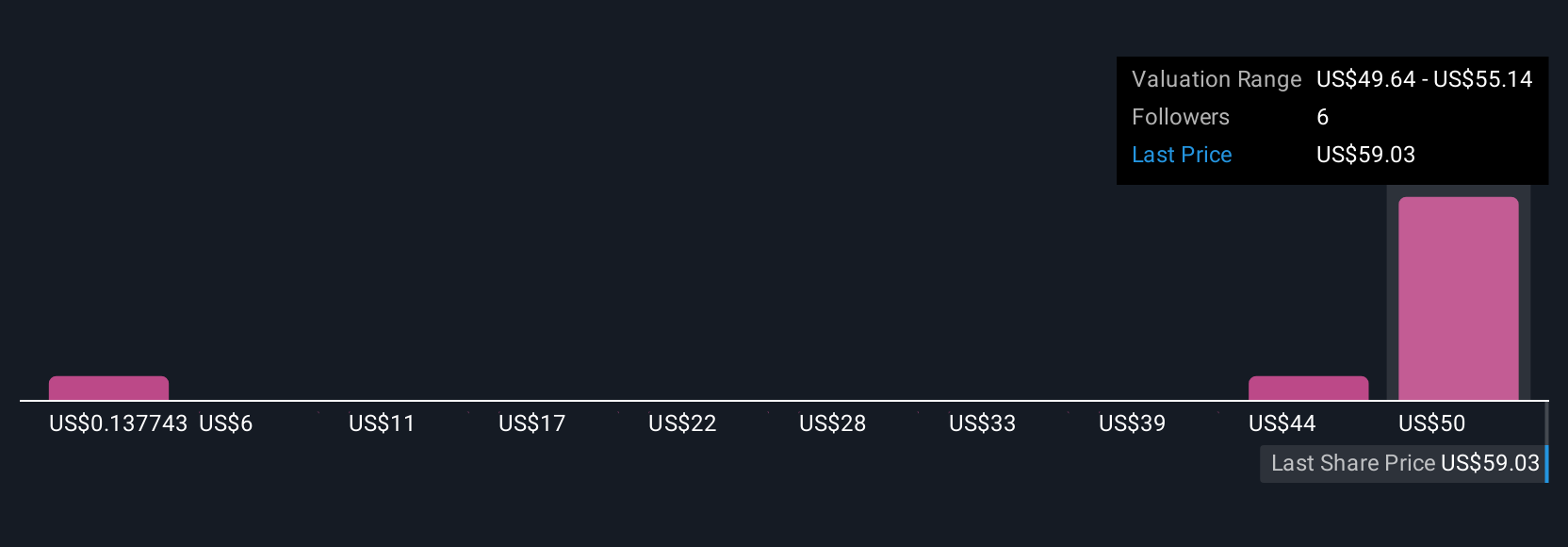

Three investor perspectives from the Simply Wall St Community estimate Cracker Barrel’s fair value between US$0.14 and US$45.92. As opinions on future revenue growth and consumer sentiment vary widely, your view on the risks to consumer spending could play a significant role in shaping your outlook here.

Build Your Own Cracker Barrel Old Country Store Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cracker Barrel Old Country Store research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Cracker Barrel Old Country Store research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cracker Barrel Old Country Store's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBRL

Cracker Barrel Old Country Store

Develops and operates the Cracker Barrel Old Country Store concept in the United States.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives