- United States

- /

- Hospitality

- /

- NasdaqGS:CBRL

Cracker Barrel (CBRL): Rethinking Valuation After Activist Pressure, Earnings Update, and $100M Buyback Announcement

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 11% Undervalued

According to the most widely followed narrative, Cracker Barrel Old Country Store is currently trading at an 11% discount to fair value based on forward-looking analyst and consensus assumptions.

The company's strategic transformation includes enhancing its menu with craveable items and simplifying processes in the back of the house. This is expected to improve execution and lower labor costs, potentially boosting net margins. Investment in digital and off-premise channels, along with a more profitable dine-in focus and streamlined offerings, has already improved EBITDA and is expected to continue supporting future profitability.

If you want to discover what is driving this undervaluation call, unlock the deep dive behind this fair value. The consensus narrative is not just projecting typical recovery; it is leaning on critical changes in guest experience, efficiency, and a revamped profit outlook. Curious which financial drivers and turnaround bets are factored into this calculation? The numbers behind the narrative may surprise you.

Result: Fair Value of $51.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stubbornly weak consumer demand or worsening supply chain disruptions could quickly change this outlook and put additional pressure on Cracker Barrel’s recovery hopes.

Find out about the key risks to this Cracker Barrel Old Country Store narrative.Another View: SWS DCF Model Raises Questions

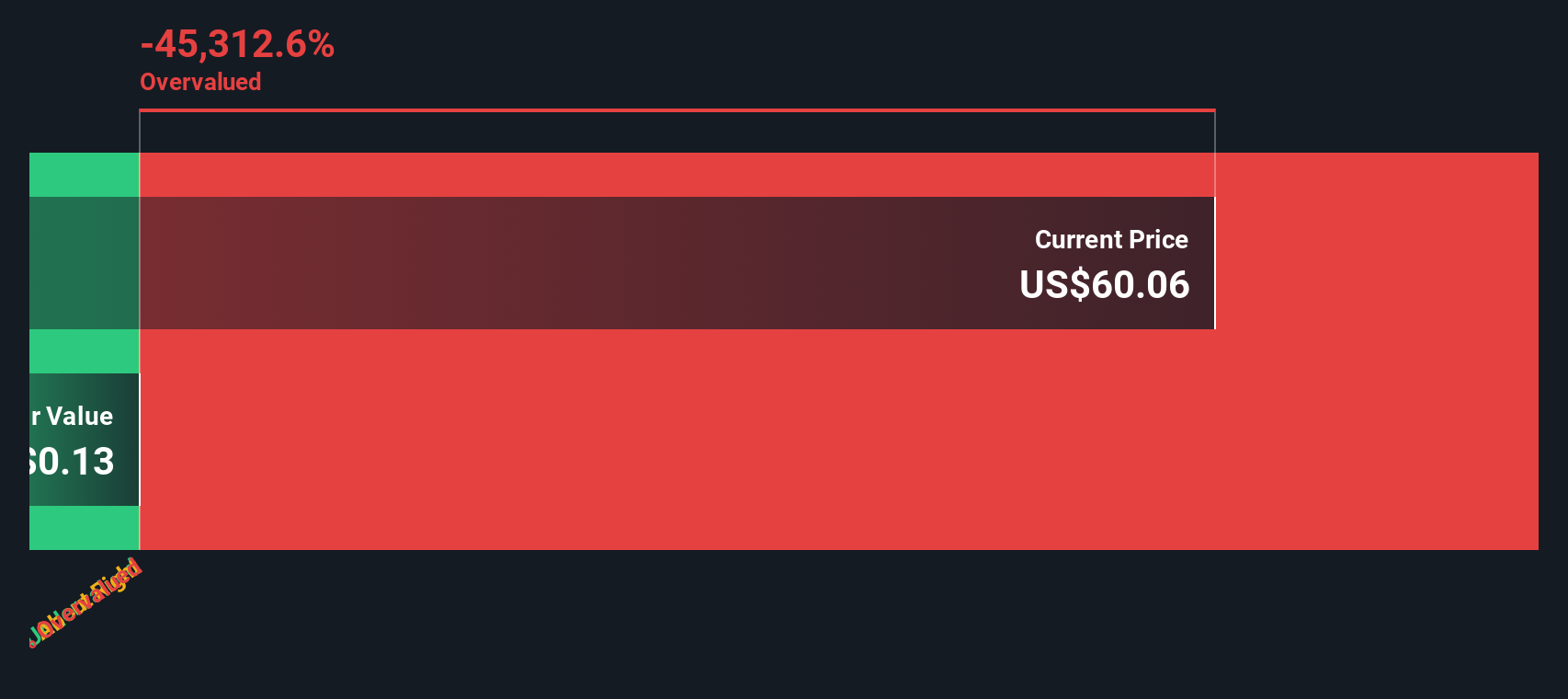

While the headline narrative sees Cracker Barrel as undervalued, our SWS DCF model offers a different perspective and suggests the stock may in fact be overvalued. Could the market’s optimism be missing something deeper?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cracker Barrel Old Country Store Narrative

If you’re not convinced by these takes, or if you’d rather dig into the numbers yourself, you can craft your own opinion in just a few short minutes. Do it your way

A great starting point for your Cracker Barrel Old Country Store research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the chance to expand your investment strategy beyond Cracker Barrel. Don’t let this moment pass by; the right stock could be one click away.

- Uncover companies leading the AI revolution by checking out the latest advancements and growth stories with our AI penny stocks.

- Amplify your income potential by focusing on stocks offering consistent cash flow and attractive yields through our dividend stocks with yields > 3%.

- Stay ahead of the curve by tracking undervalued opportunities in today’s market landscape using our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBRL

Cracker Barrel Old Country Store

Develops and operates the Cracker Barrel Old Country Store concept in the United States.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion