- United States

- /

- Hospitality

- /

- NasdaqGS:BLMN

Did Bloomin' Brands' (NASDAQ:BLMN) Share Price Deserve to Gain 57%?

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Bloomin' Brands, Inc. (NASDAQ:BLMN) share price is up 57% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 12%.

View our latest analysis for Bloomin' Brands

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Bloomin' Brands actually saw its EPS drop 15% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

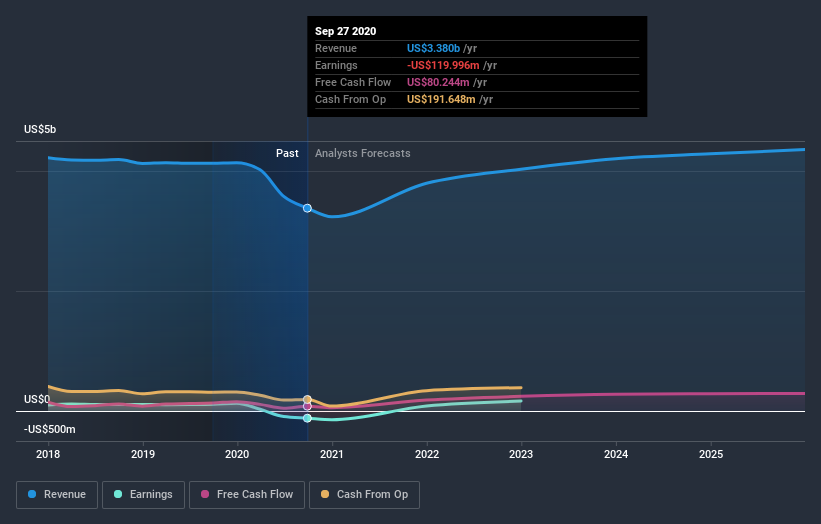

The revenue reduction of 3.0% per year is not a positive. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Bloomin' Brands will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Bloomin' Brands' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Bloomin' Brands shareholders, and that cash payout contributed to why its TSR of 70%, over the last 5 years, is better than the share price return.

A Different Perspective

Bloomin' Brands provided a TSR of 13% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Bloomin' Brands (of which 1 shouldn't be ignored!) you should know about.

Bloomin' Brands is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Bloomin' Brands or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bloomin' Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BLMN

Bloomin' Brands

Through its subsidiaries, owns and operates casual, polished casual, and fine dining restaurants in the United States and internationally.

Proven track record slight.

Market Insights

Community Narratives