- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

Top Growth Companies With Insider Stakes In October 2025

Reviewed by Simply Wall St

As of October 2025, the U.S. stock market has shown robust gains, with major indices such as the Nasdaq and S&P 500 closing higher amid a backdrop of ongoing government shutdowns and fluctuating commodity prices. In this environment, growth companies with substantial insider ownership can be particularly appealing to investors, as they often indicate strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.1% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.4% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Here's a peek at a few of the choices from the screener.

Atour Lifestyle Holdings (ATAT)

Simply Wall St Growth Rating: ★★★★★★

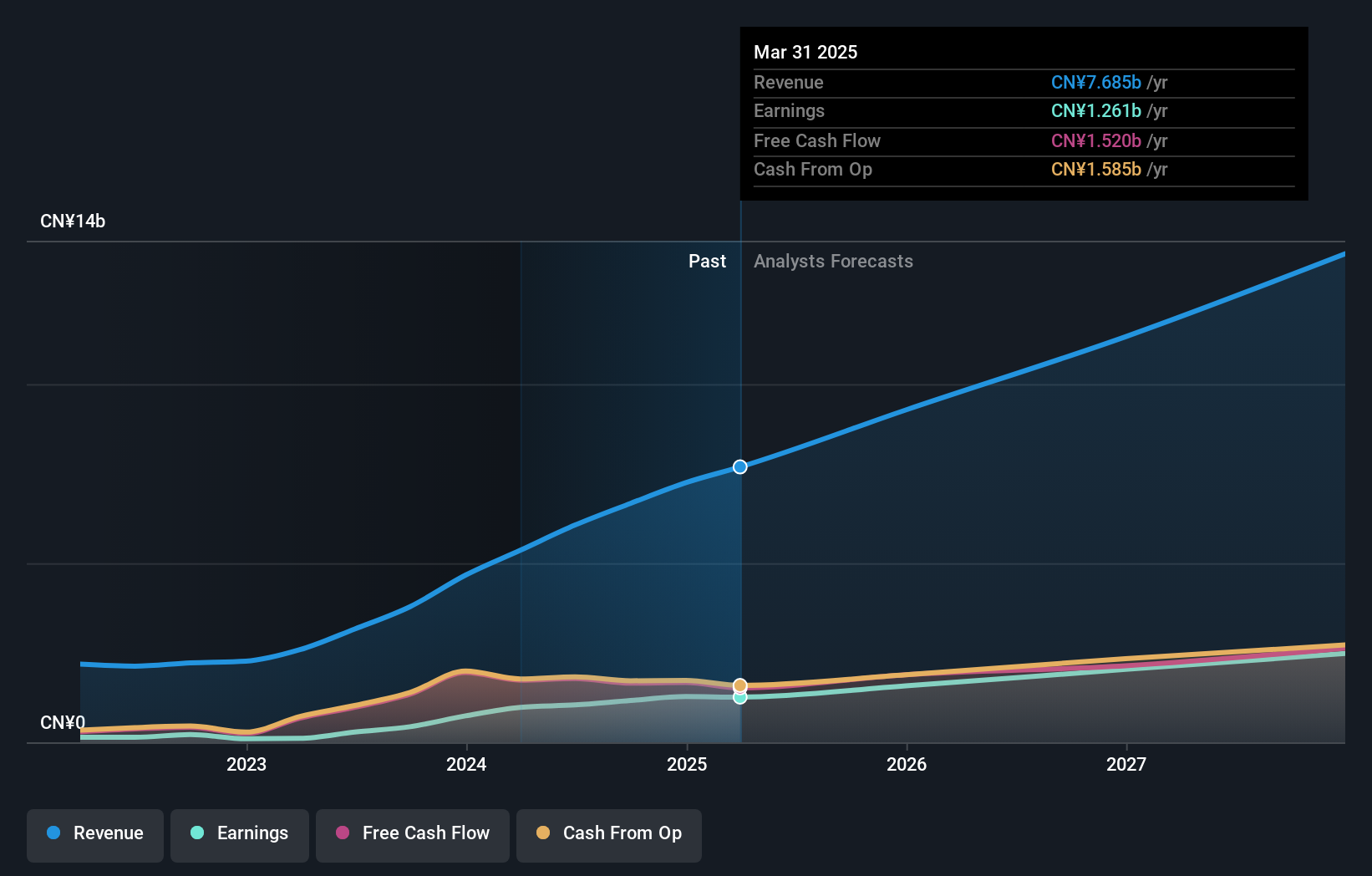

Overview: Atour Lifestyle Holdings Limited, with a market cap of $5.20 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

Operations: The company generates its revenue primarily from the Atour Group segment, which reported CN¥8.36 billion.

Insider Ownership: 18.2%

Revenue Growth Forecast: 21.1% p.a.

Atour Lifestyle Holdings shows strong growth potential, with earnings and revenue forecasted to grow significantly above market averages. Recent financials reflect robust revenue increases, despite a decline in sales figures. The company expects a 30% rise in total net revenues for 2025. Although insider trading activity is not substantial, Atour's high return on equity forecasts and its strategic considerations for a Hong Kong listing suggest confidence in its growth trajectory amidst delisting concerns in the US.

- Get an in-depth perspective on Atour Lifestyle Holdings' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Atour Lifestyle Holdings' share price might be too pessimistic.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. is a provider of enterprise cloud applications with a market capitalization of approximately $64.40 billion.

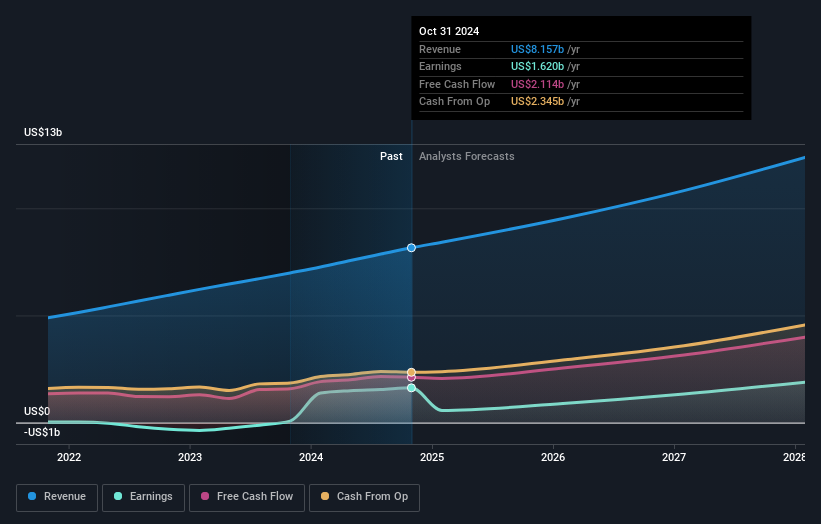

Operations: The company generates revenue primarily from its cloud applications segment, amounting to $8.96 billion.

Insider Ownership: 19.2%

Revenue Growth Forecast: 11.2% p.a.

Workday's growth trajectory is supported by significant insider ownership and strategic expansions in AI and partnerships. Recent collaborations, such as with Flywire for education payment solutions and Lattice for talent management integration, enhance its platform offerings. Despite a dip in profit margins, Workday's earnings are projected to grow significantly faster than the market. The company's share repurchase program underscores confidence in its valuation, while ongoing acquisitions aim to bolster long-term growth prospects amidst evolving enterprise needs.

- Navigate through the intricacies of Workday with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Workday's shares may be trading at a premium.

Arista Networks (ANET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arista Networks Inc develops, markets, and sells data-driven networking solutions for AI, data centers, campus, and routing environments globally with a market cap of approximately $184.11 billion.

Operations: The company's revenue is primarily derived from its computer networks segment, which generated approximately $7.95 billion.

Insider Ownership: 17.3%

Revenue Growth Forecast: 16.5% p.a.

Arista Networks is experiencing robust growth in revenue and earnings, with forecasts suggesting it will outpace the US market. Despite no substantial insider buying recently, insider ownership remains significant. The company has strategically expanded its leadership team to focus on cloud and AI systems, reflecting a commitment to innovation. Recent buybacks totaling over $1 billion indicate confidence in its valuation. Arista's raised guidance for 2025 underscores strong momentum across AI, cloud, and enterprise sectors.

- Unlock comprehensive insights into our analysis of Arista Networks stock in this growth report.

- The analysis detailed in our Arista Networks valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Click here to access our complete index of 202 Fast Growing US Companies With High Insider Ownership.

- Seeking Other Investments? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives