- United States

- /

- Hospitality

- /

- NasdaqGM:ARKR

Ark Restaurants Full Year 2024 Earnings: US$1.08 loss per share (vs US$1.65 loss in FY 2023)

Ark Restaurants (NASDAQ:ARKR) Full Year 2024 Results

Key Financial Results

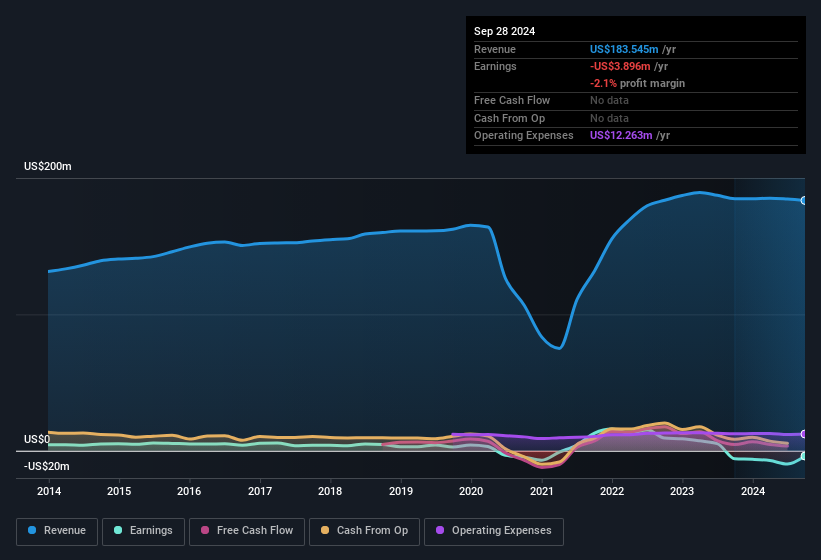

- Revenue: US$183.5m (flat on FY 2023).

- Net loss: US$3.90m (loss narrowed by 34% from FY 2023).

- US$1.08 loss per share (improved from US$1.65 loss in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Ark Restaurants shares are down 15% from a week ago.

Risk Analysis

Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Ark Restaurants (1 is potentially serious) you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ARKR

Ark Restaurants

Through its subsidiaries, owns and operates restaurants and bars in the United States.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives