- United States

- /

- Consumer Services

- /

- NasdaqGS:AFYA

US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape with investors awaiting the Federal Reserve's rate decision, attention has turned to growth companies with high insider ownership. In uncertain times, stocks with significant insider investment often signal confidence from those who know the company best, making them an attractive option for potential investors.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 27.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 94.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Here's a peek at a few of the choices from the screener.

Afya (NasdaqGS:AFYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Afya Limited is a Brazilian medical education group with a market cap of $1.47 billion.

Operations: Afya Limited generates revenue from three main segments: Undergrad (R$2.68 billion), Continuing Education (R$160.66 million), and Segment Adjustment (R$238.30 million).

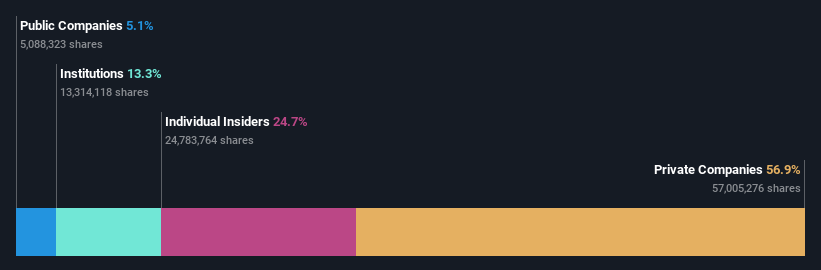

Insider Ownership: 24.7%

Afya Limited, a growth company with high insider ownership, is trading at 51.5% below its estimated fair value and shows strong earnings growth of 63.9% over the past year. Analysts expect its revenue to grow by 9.8% annually, outpacing the US market's forecasted growth of 8.8%. Recent financial results for Q2 2024 reported net income of BRL158.21 million compared to BRL82.79 million a year ago, indicating substantial profitability improvements and solidifying its position in the educational sector.

- Dive into the specifics of Afya here with our thorough growth forecast report.

- Our valuation report unveils the possibility Afya's shares may be trading at a discount.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform that helps advertisers improve marketing and monetization of their content globally, with a market cap of $37.63 billion.

Operations: AppLovin's revenue segments include $1.49 billion from Apps and $2.47 billion from its Software Platform.

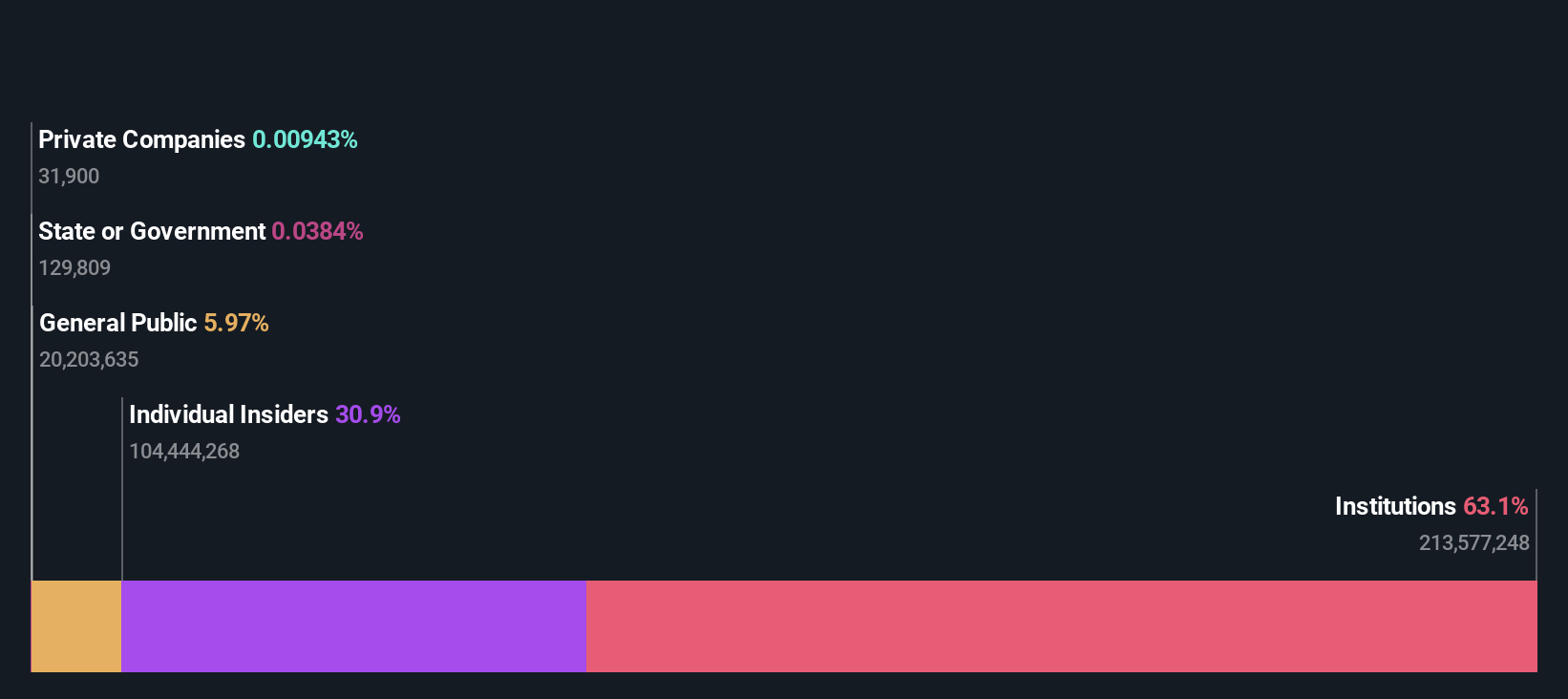

Insider Ownership: 38.4%

AppLovin, with significant insider ownership, is trading at 50.4% below its estimated fair value and exhibits strong earnings growth potential, forecasted to grow 24.2% annually. Recent Q2 2024 results showed a net income of US$309.97 million compared to US$80.36 million a year ago, reflecting substantial profitability improvements despite being dropped from several Russell indices in July 2024. Revenue for the same period increased to US$1.08 billion from US$750.17 million last year.

- Delve into the full analysis future growth report here for a deeper understanding of AppLovin.

- Upon reviewing our latest valuation report, AppLovin's share price might be too pessimistic.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. provides cloud-based digital intelligence solutions globally and has a market cap of $660.35 million.

Operations: Revenue from online financial information providers is $231.21 million.

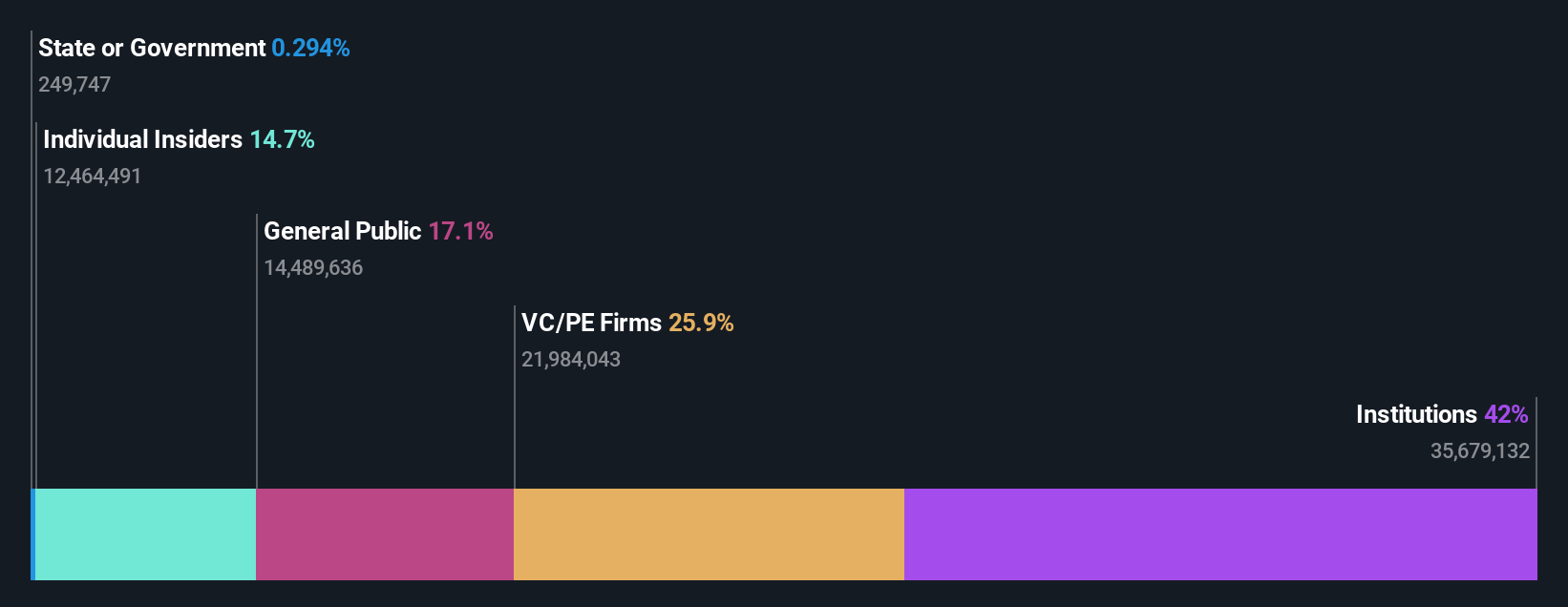

Insider Ownership: 25.6%

Similarweb, a growth company with high insider ownership, recently raised $27.48 million through a follow-on equity offering and appointed Kipp Bodnar to its board, enhancing its strategic direction. The company reported Q2 2024 revenue of $60.64 million, up from $53.68 million a year ago, and significantly reduced its net loss to $0.74 million from $9.29 million last year. Revenue for 2024 is projected between $246-$248 million, indicating continued growth momentum despite shareholder dilution over the past year.

- Take a closer look at Similarweb's potential here in our earnings growth report.

- The analysis detailed in our Similarweb valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Get an in-depth perspective on all 177 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFYA

Very undervalued with high growth potential.