- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Why Airbnb's (NASDAQ:ABNB) High Growth may be Already Factored-In

Looking back on 2020 and 2021, Airbnb, Inc. (NASDAQ:ABNB) managed to hold relatively steady in a time when half of the world was under some form of lockdown. The company came out of the pandemic by improving not only their top line, but expanding and refining services. Sometimes pressure does create steel.

Today, we will review the fundamentals, and examine if the company can create enough value to justify the current valuation.

Check out our latest analysis for Airbnb

Fundamentals

Looking briefly at the price action, we see that the stock rebounded some 23% since March 7th, indicating a short term uptrend. While it is quite early, investors are already pricing-in the impact of this vacation season, where a strong resurgence of global and local tourism activity can be expected.

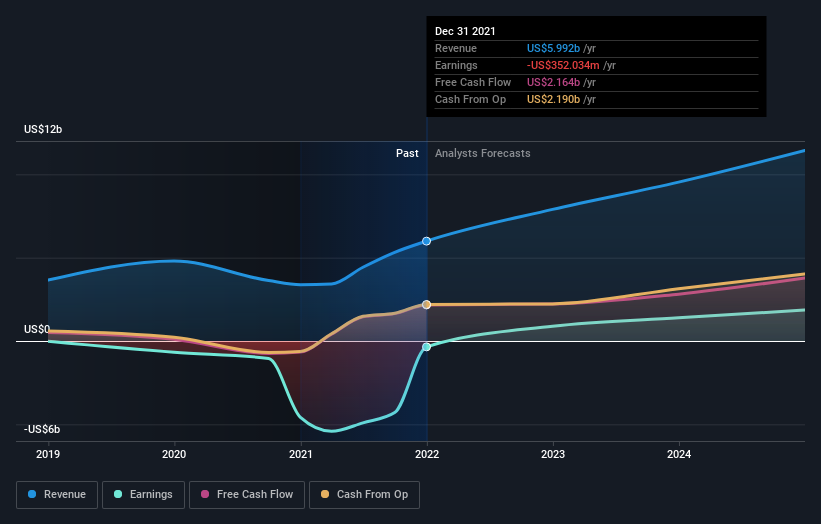

ABNB is expected to resume the growth trajectory from 2019 and continue revenue growth well into 2025. The company booked some losses during the past 2 years, but actually turned positive cash flows. The losses may be carried over as expenses which will provide some cost efficiencies, while the positive cash flows give investors an indication of how profitable they can expect the company to become in the future, and the cash capacity for reinvestment (CapEx) into improving the service.

Currently, AirBnb has an operating cash flow margin of 36.5% which we can sometimes associate with an EBITDA margin after income stabilizes. The operating cash flows are close to the free cash flows, but this difference might increase in the future as the company starts investing in CapEx. In any case, this gives us an indication as to where we can expect future margins to converge. Additionally, AirBnb's competitor, Booking Holdings (NASDAQ:BKNG) has a pre-pandemic FCF margin of 30%, and currently at 23%. Given the quality of AirBnb and the aggressive taking of market share from competitors, it might be reasonable to assume that the company can surpass Booking Holdings in profitability margins and deliver even more cash flows to investors. This is perhaps part of the reason why AirBnb is trading some US$15b higher than Booking.

Future Estimates

In the chart below, we can see how analysts view the company's future and use their estimates to build our own expectation for AirBnb.

Taking into account the latest results (released Feb. 15th), the consensus forecast from Airbnb's 37 analysts is for revenues of US$7.90b in 2022, which would reflect a major 32% improvement in sales compared to the last 12 months. Earnings are expected to improve, with Airbnb forecast to report a statutory profit of US$1.31 per share and formally breaking-even again.

Price and Value

The consensus price target was unchanged at US$199, implying that the stock is getting closer to its mark. Analysts have different opinions and currently, the most bullish analyst values Airbnb at US$250 per share, while the most bearish prices it at US$114.

Since this estimate is quite spread out, investors might be better off estimating if AirBnb can pull off the required earnings based on the industry PE multiple of 19.5x as US$105b / 19.5 = 10.5b in annual earnings or free cash flows. If you think that ABNB can reach this earnings number in a few years (the sooner the better), then the current valuation is likely justified - If on the other hand you think they will end up making more than this, then you might feel that there is an upside to the stock.

Keep in mind that the recent downfall in tech and growth stocks reminded us that cash does matter. Investors can wait, but the company must execute according to a realistic timeline.

The Bottom Line

AirBnb is quietly gaining price appreciation as investors make their estimates for the current vacation season. People seem to be starved for travel and experiences, which may contribute to a healthy rebound for the stock.

While growth is great, it is also priced-in, and the current valuation seems to imply that the company will eventually make about US$10.5b in free cash flows - a number not to be underestimated. If investors feel that AirBnb can surpass this figure within a reasonable time horizon, then they might find the stock to have upside.

Even so, be aware that Airbnb is showing 2 warning signs in our investment analysis , you should know about...

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives