- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Airbnb’s (NASDAQ:ABNB) Results on Thursday Should Provide Valuable Insights About the Company’s Valuation

Airbnb, Inc. ( NASDAQ:ABNB ) has become a popular ‘reopening play’ for investors wanting exposure to the expected recovery in travel when the Covid 19 pandemic ends. The timing of the expected recovery is now in doubt as the Covid-19 Delta variant has resulted in another wave of infections around the world.

Airbnb will be reporting second quarter results on Thursday. These results will be interesting as the latest wave of infections only began in the last few weeks of the quarter. For most of the second quarter, it appeared that the vaccines were slowing the spread of Covid-19 and pandemic would soon be over. Airbnb’s results should give us a good idea of what a more sustained recovery will look like.

In a letter to shareholders in May , the company emphasized the fact that revenue was severely impacted by the pandemic in the second quarter of 2020. This means second quarter revenue this year is likely to be significantly higher on a year-on-year basis, but may still be lower than second quarter revenue for 2019.

Investors will also need to consider the company’s valuation in light of its longer- term outlook. A rebound in travel and tourism is very likely to result in the stock price rising, but that may in fact be a selling opportunity. On the other hand, a delayed recovery may result in a very attractive buying opportunity for long term investors.

Check out our latest analysis for Airbnb

Is Airbnb still cheap?

Airbnb appears to be overvalued by 27% at the moment, based on our calculation of its intrinsic value. This is based on the revenue and earnings forecasts of 25 analysts. The stock is currently priced at US$149.15 on the market compared to our intrinsic value estimate of $117.93.

The key assumption behind this estimate is the growth rates and forecast profit margin. You can see a breakdown of the estimated valuation here .

Can we expect growth from Airbnb?

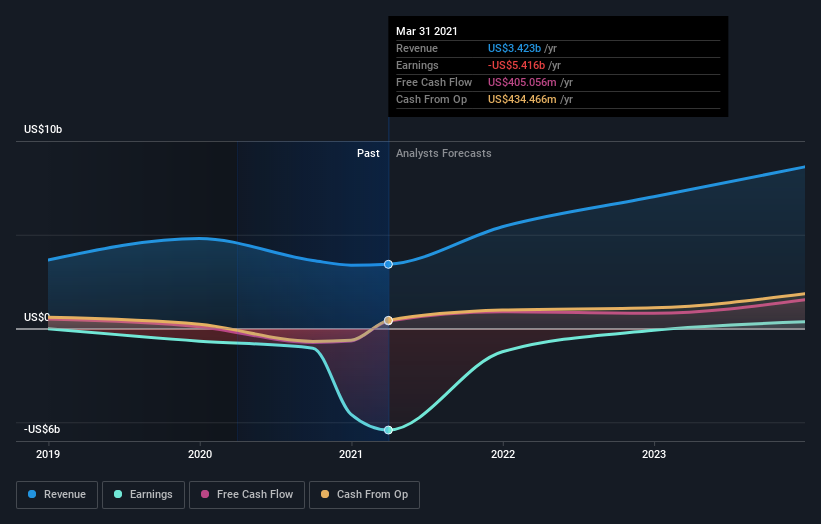

Analysts expect Airbnb’s revenue this year to be 61% higher than last year’s very depressed level. Revenue is then expected to grow at 29% in 2022 and 23% in 2023. To put these forecasts in perspective, the company achieved growth rates of 43% in 2018 and 32% in 2019. In 2020 revenue fell by 30% as a result of the pandemic.

The other aspect of the valuation that we need to consider is the profit margin. The company is currently expected to break even in 2023 with a net income margin of 4.4%. That doesn’t leave much of a margin of safety if expenses are higher than expected, or revenue is lower than expected. The profit margin is expected to improve quite quickly after 2023, but forecasts that far out are less certain.

What this means for you:

Airbnb’s share price is 30% below the February high, but remains quite richly priced relative to analyst forecasts. The rich valuation isn’t surprising as Airbnb is a very popular company, and the stock has become a reopening play . However, if the company can outperform analyst forecasts over the long term, then the current price may turn out to be a bargain.

In the meantime, the stock price will probably be very sensitive to news regarding travel restrictions and lockdowns over the next few quarters. Thursday’s results should give us a good idea of how quickly Airbnb’s revenue can rebound during a more sustained reopening of economies and the tourism industry. It's also likely that analysts will update their forecasts after the results are published.

Another aspect of Airbnb that investors should consider is the types of shareholders that currently own its shares. We previously covered the ownership structure here , and the latest list of major shareholders is included in our full analysis for Airbnb .

If you are no longer interested in Airbnb, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives