- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Investors in Airbnb (NASDAQ:ABNB) have unfortunately lost 36% over the last year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Airbnb, Inc. (NASDAQ:ABNB) have tasted that bitter downside in the last year, as the share price dropped 36%. That's disappointing when you consider the market declined 19%. Airbnb may have better days ahead, of course; we've only looked at a one year period.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Before we look at the performance, you might like to know that our analysis indicates that ABNB is potentially undervalued!

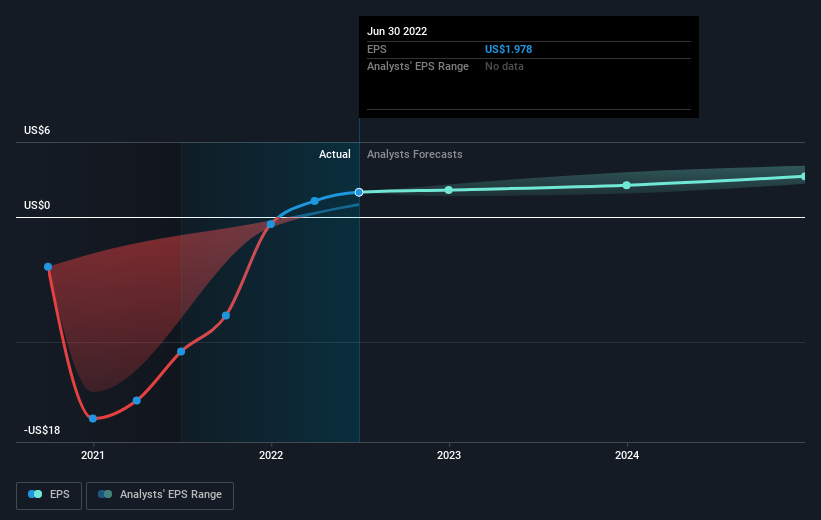

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Airbnb grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Airbnb's earnings, revenue and cash flow.

A Different Perspective

We doubt Airbnb shareholders are happy with the loss of 36% over twelve months. That falls short of the market, which lost 19%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 9.4%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Airbnb better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Airbnb , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives