- United States

- /

- Food and Staples Retail

- /

- NYSE:USFD

Bowyer Research Opposes Special Meeting Proposal at US Foods Holding (NYSE:USFD)

Reviewed by Simply Wall St

US Foods Holding (NYSE:USFD) experienced significant investor activity when Bowyer Research filed a statement with the SEC opposing a proposal for new stockholder meeting thresholds. Over the past month, US Foods' stock price increased by 18%, a move bolstered by strong Q1 2025 earnings where both sales and net income rose notably. Additionally, the company announced a substantial share buyback program, enhancing investor confidence. This positive momentum within US Foods paralleled broader market growth of nearly 4% over the same period, suggesting the company's developments added weight to the upward market trend.

Be aware that US Foods Holding is showing 1 weakness in our investment analysis.

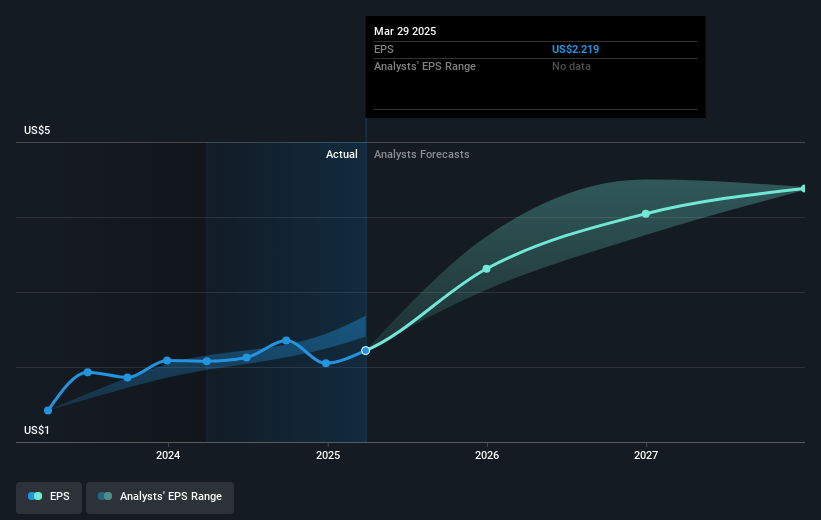

The recent developments surrounding US Foods Holding, particularly the opposition to the proposal for new stockholder meeting thresholds and the company's enhanced momentum due to the strong Q1 2025 earnings, could potentially influence its narrative and strategic outlook. The substantial share buyback program may bolster investor confidence, while reinforcing the company's focus on delivering shareholder value. These actions are likely to reflect positively in the revenue and earnings forecasts, particularly as the company leverages its investments in e-commerce and strategic acquisitions like Pronto and Jake's Finer Foods to broaden its market presence.

Over a longer-term period of five years, US Foods has delivered a total return of 302.40%. This stark contrast to the past year’s 4.2% earnings growth highlights the company's extensive value creation during this time frame. Over the last year, US Foods has outperformed the US Market, which returned 11.6%, further solidifying its position in the industry. The company's share performance compared to the broader market suggests that investors have responded favorably to its ongoing initiatives and strategic plans.

With the share price currently at US$67.04, presenting a 15.3% discount to the consensus analyst price target of US$79.16, there appears to be room for growth if the company's projected revenue and earnings improvements are realized. If US Foods continues on its current trajectory, focusing on enhancing customer engagement and optimizing operations, it may narrow the gap between its current market value and the analysts' target in the foreseeable future, while fostering sustained investor interest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USFD

US Foods Holding

Engages in marketing, sale, and distribution of fresh, frozen, and dry food and non-food products to foodservice customers in the United States.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives