- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

Performance Food Group's (NYSE:PFGC) 25% CAGR outpaced the company's earnings growth over the same five-year period

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Performance Food Group Company (NYSE:PFGC) which saw its share price drive 209% higher over five years. It's also up 12% in about a month. But the price may well have benefitted from a buoyant market, since stocks have gained 6.7% in the last thirty days.

The past week has proven to be lucrative for Performance Food Group investors, so let's see if fundamentals drove the company's five-year performance.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

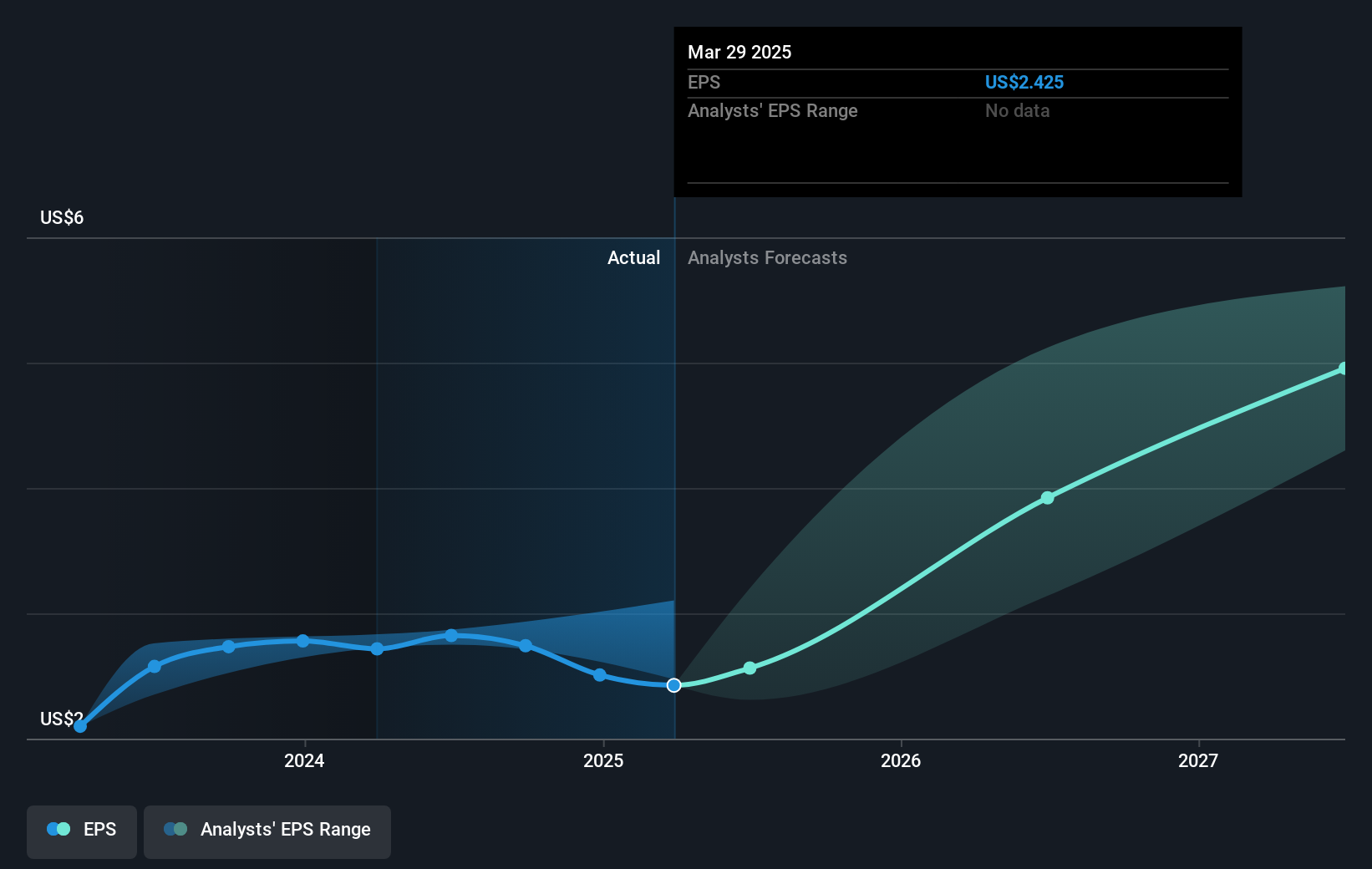

Over half a decade, Performance Food Group managed to grow its earnings per share at 21% a year. So the EPS growth rate is rather close to the annualized share price gain of 25% per year. This indicates that investor sentiment towards the company has not changed a great deal. In fact, the share price seems to largely reflect the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Performance Food Group has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Performance Food Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Performance Food Group shareholders have received a total shareholder return of 31% over one year. That's better than the annualised return of 25% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Performance Food Group you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives