- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (NYSE:KR) Reports Full Year Earnings Growth But Q4 Sales Fall By 7%

Reviewed by Simply Wall St

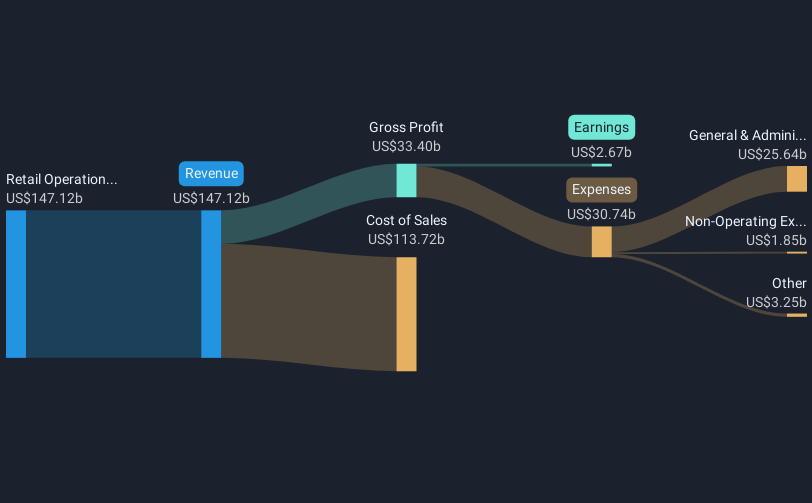

Kroger (NYSE:KR) recently announced its earnings and corporate guidance for 2025, projecting a modest sales growth of 2 to 3% without fuel. Despite a 1% decline in fourth-quarter sales, the company reported a full-year net income increase from the previous year and higher earnings per share. This performance contributed to a 7.68% increase in its stock price over the last quarter, alongside executive leadership changes including the resignation of Chairman Rodney McMullen. In contrast, broader market conditions have been volatile, with major indexes like the Dow and S&P 500 experiencing significant declines amid economic concerns and tariff issues. While Kroger's strategic developments, such as its new agreement with Express Scripts, may have bolstered investor confidence, the overall rise in its stock compared to a struggling market highlights its distinct company-specific factors amidst unfavorable economic sentiment.

Click here and access our complete analysis report to understand the dynamics of Kroger.

Over the last five years, Kroger has delivered a total shareholder return of 143.73%, reflecting its strong performance despite market fluctuations. Key factors supporting this performance include its earnings growth, averaging 4.6% annually, with a notable acceleration of 24.5% in the past year. Additionally, Kroger's Price-To-Earnings Ratio of 17.3x indicates it is trading at good value compared to both its peers and the broader Consumer Retailing industry. Furthermore, the company's reliability in paying dividends, currently offering a yield of 2.01%, adds to its investor appeal.

Recent partnerships, such as the one with Express Scripts, have enhanced Kroger's market presence, aligning with its efforts to expand distribution channels and retail partnerships. While over the last year, Kroger underperformed the US Consumer Retailing industry, its one-year return exceeded the US market's 11.1% gain, showcasing its market resilience. These elements contribute to its consistent appeal among long-term investors.

- Understand the fair market value of Kroger with insights from our valuation analysis—click here to learn more.

- Assess the potential risks impacting Kroger's growth trajectory—explore our risk evaluation report.

- Is Kroger part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued with solid track record and pays a dividend.