- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Assessing Kroger Stock After 1,000 Corporate Job Cuts and Recent Share Price Gains

Reviewed by Bailey Pemberton

If you are eyeing Kroger stock and wondering whether it still has upside after a sustained run, you are definitely not alone. This grocery giant has quietly delivered an impressive 24.5% return over the last year, and a substantial 130.7% return over the past five years. While that growth has caught the attention of long-term investors, the last month has also seen a steady 2.5% climb, even in the face of some headline-making changes, including the announcement that 1,000 corporate jobs are being cut after Kroger’s high-profile Albertsons deal fell through.

Despite a swirl of news around leadership transitions and ongoing efforts to boost efficiency, market sentiment has remained surprisingly resilient. In fact, Kroger shares have ticked up 1.4% just in the past week, signaling that investors may see new opportunities ahead rather than increased risk. Part of that optimism comes down to fundamentals: on widely used valuation measures, Kroger currently scores a 5 out of 6 for being undervalued, suggesting that even after all these gains, the stock might not be fully priced in.

To really dig into whether Kroger is still a bargain, we need to break down what goes into that valuation score and, more importantly, reflect on how these methods stack up against an even better metric for uncovering market mispricing. Let’s get into the numbers and see what’s really going on beneath the surface.

Approach 1: Kroger Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This approach gives investors a clearer sense of what the business is really worth based on its ability to generate cash over time, rather than relying solely on market sentiment or earnings multiples.

For Kroger, the latest trailing twelve months’ Free Cash Flow stands at about $2.21 billion. Looking forward, analysts expect Kroger’s Free Cash Flow to grow steadily, projecting figures such as $2.78 billion in 2026 and reaching $3.16 billion by 2030. While analyst estimates cover only the next five years, Simply Wall St extends these forecasts further and suggests modest continued growth beyond 2030.

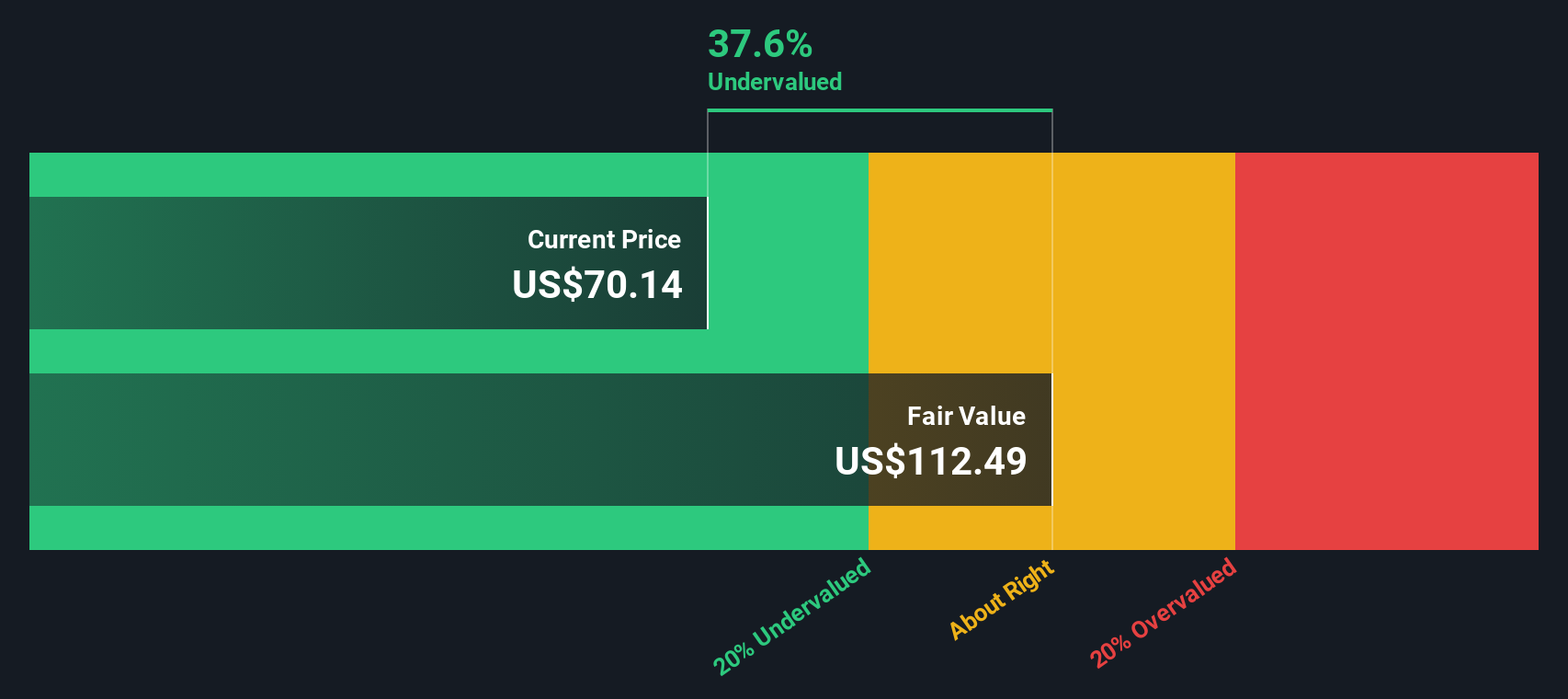

When all projected cash flows are added up and appropriately discounted, the DCF model calculates Kroger’s fair value at $87.93 per share. Considering the current market price, this implies the stock is trading at a 21.4% discount. In other words, the shares are considered 21.4% undervalued relative to their projected intrinsic worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kroger is undervalued by 21.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kroger Price vs Earnings

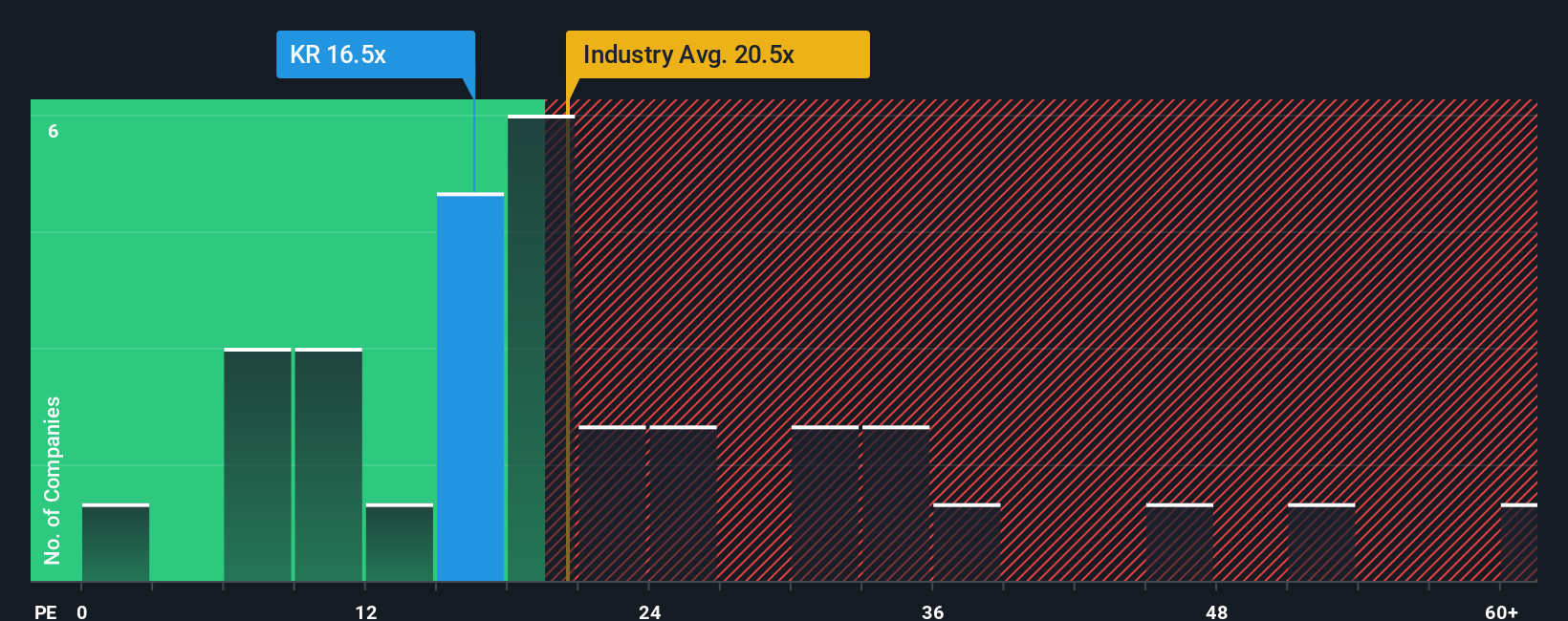

For profitable companies like Kroger, the Price-to-Earnings (PE) ratio stands out as a widely used and suitable valuation metric. This multiple allows investors to assess how much they are paying for each dollar of current earnings. It is a straightforward way to compare value across companies with consistent profits.

When evaluating the “right” PE ratio for a business, it is important to consider factors such as expected earnings growth and risk. Higher growth prospects, strong profit margins, and lower risk typically justify a higher PE, while slower-growing or riskier companies often command a lower multiple.

Currently, Kroger trades at a PE ratio of 16.9x. This is noticeably lower than the Consumer Retailing industry average of 21.2x and below the peer group average of 22.9x. On the surface, this makes Kroger appear attractively priced compared to both its sector and rivals.

Simply Wall St offers a proprietary “Fair Ratio” tailored to Kroger, calculated as 22.0x based on the company’s unique mix of earnings growth, industry standing, profit margins, risks, and market cap. Unlike peer or industry averages, the Fair Ratio provides a more nuanced benchmark by factoring in the dynamics that genuinely influence a company’s valuation.

Comparing Kroger’s actual PE ratio (16.9x) to the Fair Ratio (22.0x) suggests that the stock may be undervalued, as it is trading below what would be considered fair given the company’s growth outlook and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kroger Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a clear, user-friendly framework for connecting your perspective about Kroger's story, such as future trends or risks, with your own forecasts, like expected revenue, profit margins, and fair value estimates, rather than relying strictly on historical data or generic metrics.

On Simply Wall St’s Community page, Narratives empower millions of investors to articulate their views, layer in their financial assumptions, and instantly see how their unique story maps to a fair value for the company. Narratives bridge the gap between a company’s strategic direction and the numbers, allowing you to compare your fair value to the current price and decide if you think Kroger is worth buying or selling today.

Because Narratives automatically update when major news, earnings releases, or other key events occur, they provide a dynamic, real-time reflection of evolving investor thinking. For a concrete example, some investors expect Kroger's health-focused expansion and digital investments to fuel growth, supporting bullish targets as high as $85.00 per share. Others are more cautious, valuing the company at just $63.00 based on concerns about competition and cost pressures.

Do you think there's more to the story for Kroger? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion