- United States

- /

- Healthtech

- /

- NasdaqGM:LFMD

3 High-Ownership Growth Stocks With Earnings Up To 105%

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of cautious optimism, with indices like the Dow Jones and S&P 500 extending their winning streaks, investors are closely monitoring earnings reports and potential tariff changes that could impact economic growth. In this environment, companies with high insider ownership often attract attention for their alignment of interests between management and shareholders, particularly when these firms demonstrate significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.6% | 29.8% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

We'll examine a selection from our screener results.

LifeMD (NasdaqGM:LFMD)

Simply Wall St Growth Rating: ★★★★☆☆

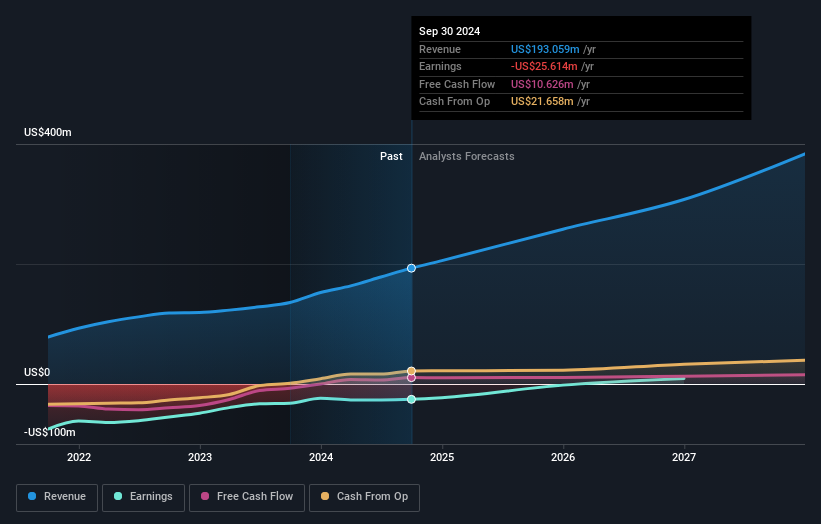

Overview: LifeMD, Inc. is a direct-to-patient telehealth company facilitating connections between consumers and healthcare professionals in the United States, with a market cap of $271.51 million.

Operations: The company's revenue is primarily derived from its Telehealth segment, which generated $158.44 million, and its Worksimpli segment, contributing $54.02 million.

Insider Ownership: 16.1%

Earnings Growth Forecast: 105.2% p.a.

LifeMD is experiencing rapid growth, with earnings forecasted to grow over 100% annually and revenue expected to outpace the US market. Despite recent volatility in share price and significant insider selling, the company remains strategically focused on expanding its telehealth services, including a recent integration with LillyDirect for obesity treatments. LifeMD's expansion into behavioral health further diversifies its offerings. However, negative shareholder equity presents a concern amidst these growth initiatives.

- Dive into the specifics of LifeMD here with our thorough growth forecast report.

- Our valuation report unveils the possibility LifeMD's shares may be trading at a discount.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Growth Rating: ★★★★★☆

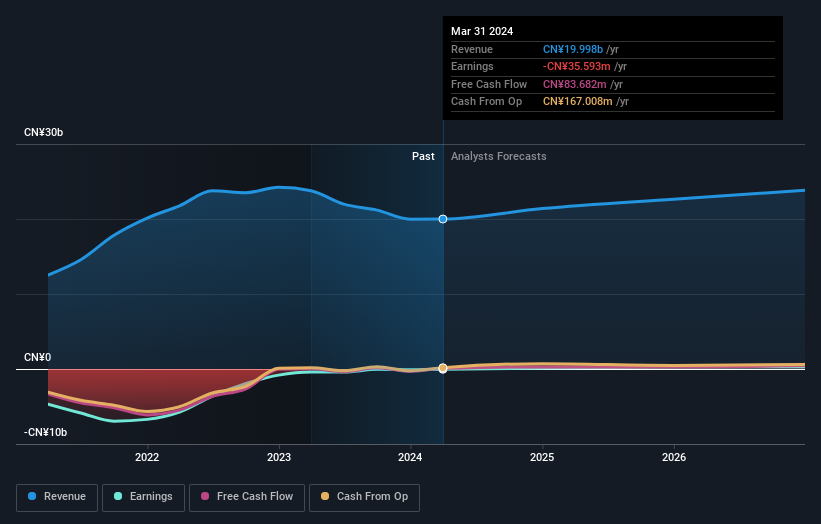

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market cap of approximately $544.33 million.

Operations: The company's revenue primarily comes from its online retail operations, generating approximately CN¥23.07 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 31% p.a.

Dingdong (Cayman) is showing promising growth, with earnings projected to increase significantly at 31% annually, outpacing the US market. The company recently reported a substantial turnaround in profitability, achieving a net income of CNY 89.18 million for Q4 2024. Despite trading well below its estimated fair value, Dingdong's strategic initiatives include a $20 million share repurchase program funded by existing cash reserves, indicating confidence in its financial position and future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Dingdong (Cayman).

- According our valuation report, there's an indication that Dingdong (Cayman)'s share price might be on the cheaper side.

Onity Group (NYSE:ONIT)

Simply Wall St Growth Rating: ★★★★☆☆

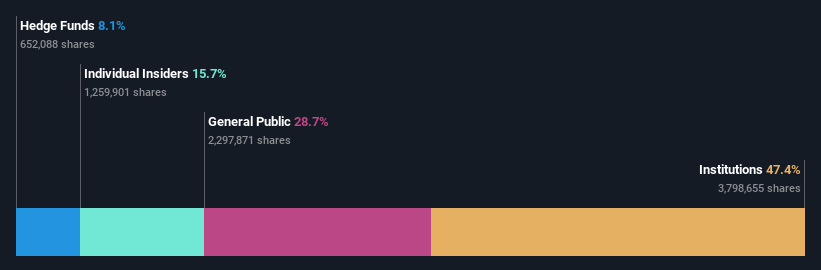

Overview: Onity Group Inc. is a financial services company that originates and services forward and reserve mortgage loans in the United States, the United States Virgin Islands, India, and the Philippines, with a market cap of approximately $264.76 million.

Operations: The company's revenue is derived from two main segments: Servicing, which contributes $866.70 million, and Originations, accounting for $109.30 million.

Insider Ownership: 15.7%

Earnings Growth Forecast: 35.6% p.a.

Onity Group is experiencing significant earnings growth, projected at 35.6% annually, surpassing US market expectations. The company's recent profitability turnaround, with a net income of US$33.9 million for 2024, highlights its improving financial health despite revenue declines. Onity's new EquityIQ® reverse mortgage product could enhance its market position. Trading at a low price-to-earnings ratio of 8.2x compared to the US market suggests potential undervaluation amidst ongoing M&A discussions.

- Delve into the full analysis future growth report here for a deeper understanding of Onity Group.

- Upon reviewing our latest valuation report, Onity Group's share price might be too pessimistic.

Turning Ideas Into Actions

- Click this link to deep-dive into the 199 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LFMD

LifeMD

Operates as a direct-to-patient telehealth company that connects consumers to healthcare professionals for medical care in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives