- United States

- /

- Food

- /

- NasdaqGS:SFD

Top Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. market rebounds with major stock indexes bouncing back and the S&P 500 hitting new all-time highs, investors are closely watching economic indicators like interest rate changes and government shutdown impacts. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive consideration for those seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.97% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.46% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.70% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.90% | ★★★★★★ |

| Ennis (EBF) | 5.72% | ★★★★★★ |

| Employers Holdings (EIG) | 3.03% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.89% | ★★★★★☆ |

| DHT Holdings (DHT) | 8.30% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.50% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.59% | ★★★★★☆ |

Click here to see the full list of 128 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Smithfield Foods (SFD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smithfield Foods, Inc. is a company that produces packaged meats and fresh pork both in the United States and internationally, with a market cap of approximately $8.92 billion.

Operations: Smithfield Foods, Inc. generates revenue primarily from its Packaged Meats segment at $8.48 billion, followed by Fresh Pork at $8.07 billion, and Hog Production contributing $3.29 billion.

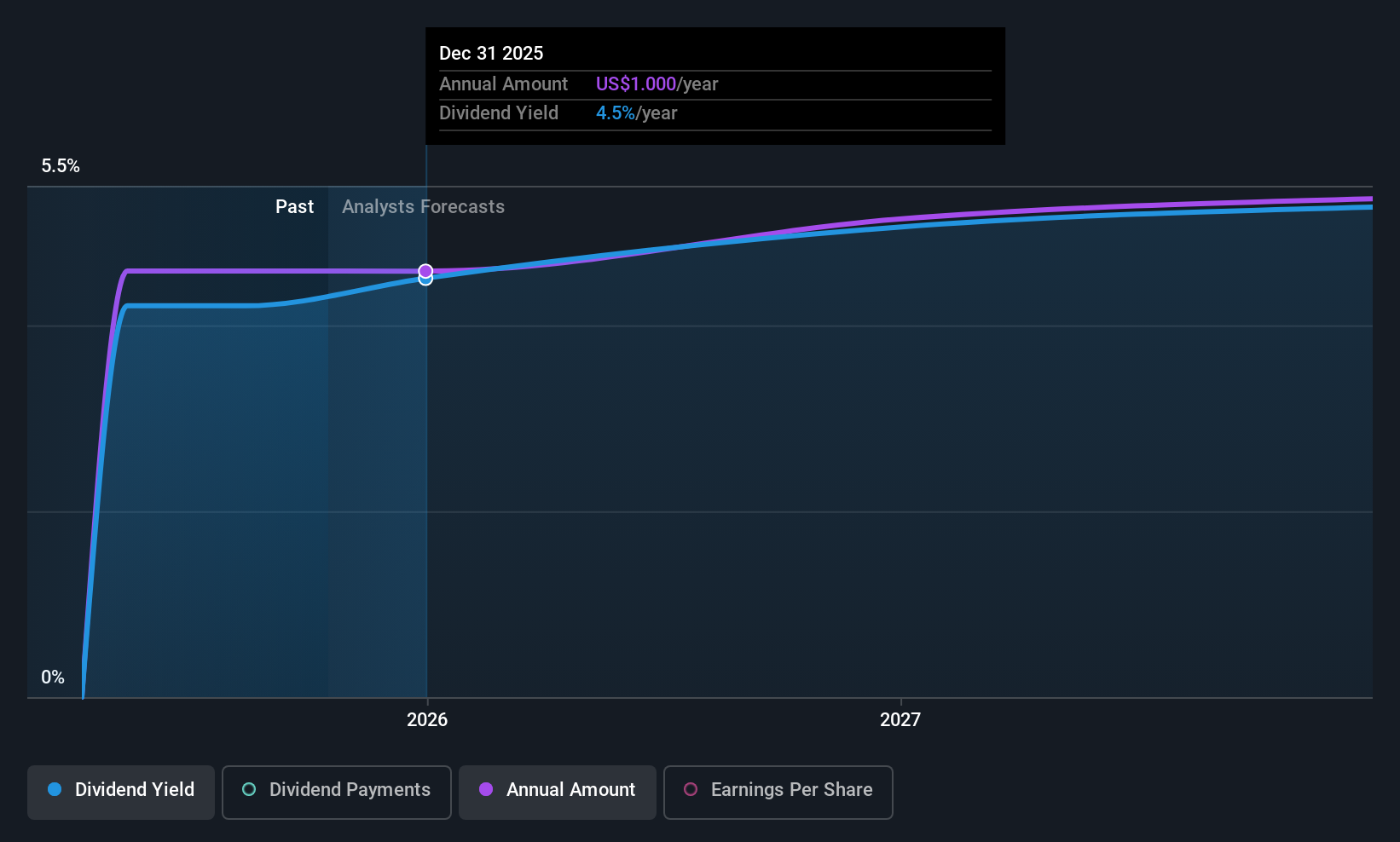

Dividend Yield: 4.5%

Smithfield Foods recently initiated dividend payments, with a quarterly dividend of US$0.25 per share. The dividends are well-covered by both earnings and cash flows, showing a payout ratio of 23.4% and a cash payout ratio of 53.6%. Smithfield's recent Follow-on Equity Offering raised US$454 million, potentially supporting growth initiatives like their M&A pursuits in North America. Despite recent net income declines, the company maintains strong sales growth and reaffirmed its fiscal year guidance for increased revenue.

- Delve into the full analysis dividend report here for a deeper understanding of Smithfield Foods.

- In light of our recent valuation report, it seems possible that Smithfield Foods is trading behind its estimated value.

Village Super Market (VLGE.A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Village Super Market, Inc. operates a chain of supermarkets in the United States and has a market cap of approximately $537.34 million.

Operations: Village Super Market, Inc. generates its revenue primarily through the retail sale of food and nonfood products, amounting to $2.30 billion.

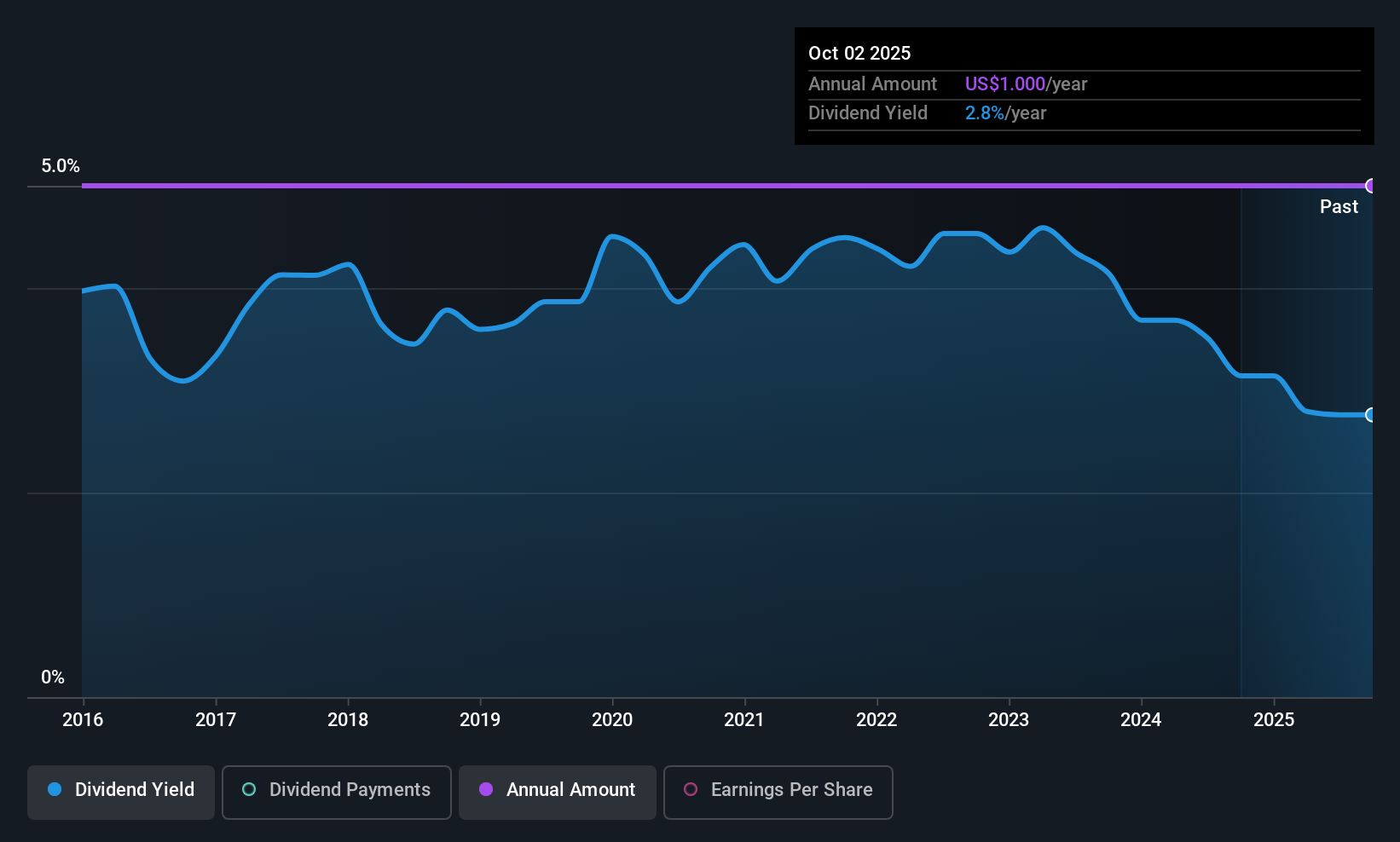

Dividend Yield: 3.1%

Village Super Market's dividend payments have been stable but not growing over the past decade, with a current yield of 3.12%, which is below top-tier US dividend payers. The dividends are well-covered by earnings and cash flows, with payout ratios of 26.3% and 40.3% respectively. Recent earnings showed modest growth in sales to US$599.67 million and net income to US$15.52 million for Q4 2025, while dividends were recently affirmed at $0.25 per Class A share.

- Click here to discover the nuances of Village Super Market with our detailed analytical dividend report.

- Our valuation report here indicates Village Super Market may be undervalued.

DHT Holdings (DHT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DHT Holdings, Inc. operates crude oil tankers through its subsidiaries in Monaco, Singapore, Norway, and India with a market cap of approximately $1.87 billion.

Operations: DHT Holdings, Inc. generates revenue of $557.64 million from its fleet of crude oil tankers.

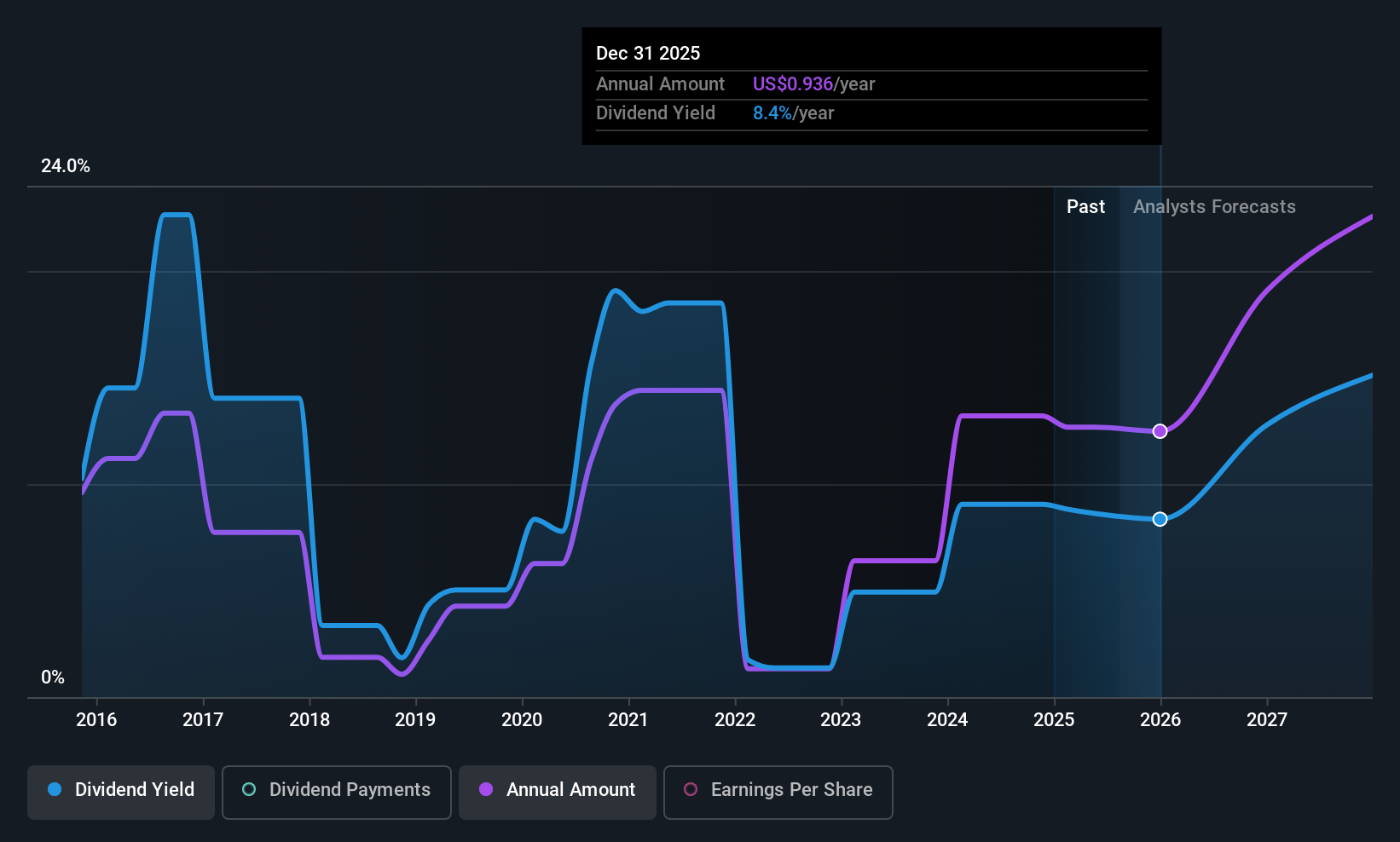

Dividend Yield: 8.3%

DHT Holdings' dividend yield of 8.3% ranks in the top 25% among US dividend payers, though its payments have been volatile over the past decade. The dividends are covered by earnings and cash flows, with payout ratios of 66% and 83.9%, respectively. Recent earnings showed net income growth to US$56.1 million for Q2 2025, despite a revenue decline to US$128.32 million. The company secured a $308.4 million credit facility for newbuild financing, indicating ongoing expansion efforts.

- Get an in-depth perspective on DHT Holdings' performance by reading our dividend report here.

- According our valuation report, there's an indication that DHT Holdings' share price might be on the cheaper side.

Key Takeaways

- Dive into all 128 of the Top US Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFD

Smithfield Foods

Produces packaged meats and fresh pork in the United States and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives