Stock Analysis

- United States

- /

- Banks

- /

- NYSE:CFG

Top US Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

As the U.S. stock market exhibits fluctuations with major indexes like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite navigating through earnings seasons and economic indicators, investors continue to seek stable returns amidst uncertainty. In this context, dividend stocks emerge as particularly appealing due to their potential to provide regular income streams and relative resilience during market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Interpublic Group of Companies (NYSE:IPG) | 4.41% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.84% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.10% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.07% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.98% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.46% | ★★★★★★ |

| Marine Products (NYSE:MPX) | 5.23% | ★★★★★☆ |

| Union Bankshares (NasdaqGM:UNB) | 5.58% | ★★★★★☆ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.55% | ★★★★★☆ |

Click here to see the full list of 181 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Northwest Bancshares (NasdaqGS:NWBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northwest Bancshares, Inc., serving as the holding company for Northwest Bank, offers personal and business banking solutions with a market capitalization of approximately $1.70 billion.

Operations: Northwest Bancshares, Inc. generates its revenue primarily through its community banking segment, which accounted for $522.96 million.

Dividend Yield: 5.7%

Northwest Bancshares has a 77.9% payout ratio, indicating current dividends are covered by earnings, though its dividend history shows instability with significant fluctuations over the past decade. Recently, the company declared a quarterly dividend of US$0.20 per share payable in August 2024 despite reporting a notable decline in net income and earnings per share for both the second quarter and first half of 2024 compared to the previous year. This raises concerns about the sustainability of future dividends given current financial trends.

- Delve into the full analysis dividend report here for a deeper understanding of Northwest Bancshares.

- Upon reviewing our latest valuation report, Northwest Bancshares' share price might be too pessimistic.

SpartanNash (NasdaqGS:SPTN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpartanNash Company operates in the United States as a distributor and retailer of grocery products, with a market capitalization of approximately $0.68 billion.

Operations: SpartanNash Company generates its revenue primarily through two segments: retail, which contributes approximately $2.78 billion, and wholesale, accounting for about $8.02 billion.

Dividend Yield: 4.3%

SpartanNash offers a 4.25% dividend yield, slightly underperforming against the top US dividend stocks. Despite a stable 10-year history of dividend payments, its dividends are not well supported by free cash flows, with a concerning cash payout ratio of 429.3%. However, earnings coverage remains reasonable at a 54.6% payout ratio. Recent financials show an uptick in net income and earnings per share in Q1 2024 but lowered sales forecasts suggest potential challenges ahead.

- Click to explore a detailed breakdown of our findings in SpartanNash's dividend report.

- The valuation report we've compiled suggests that SpartanNash's current price could be quite moderate.

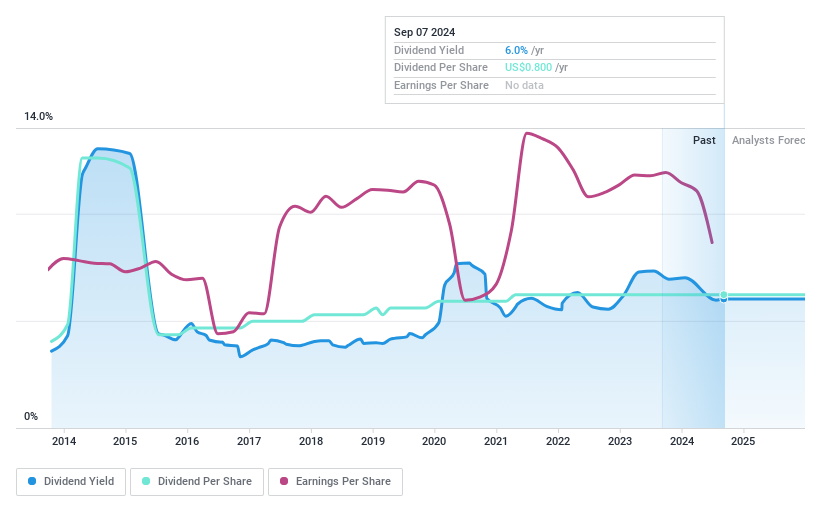

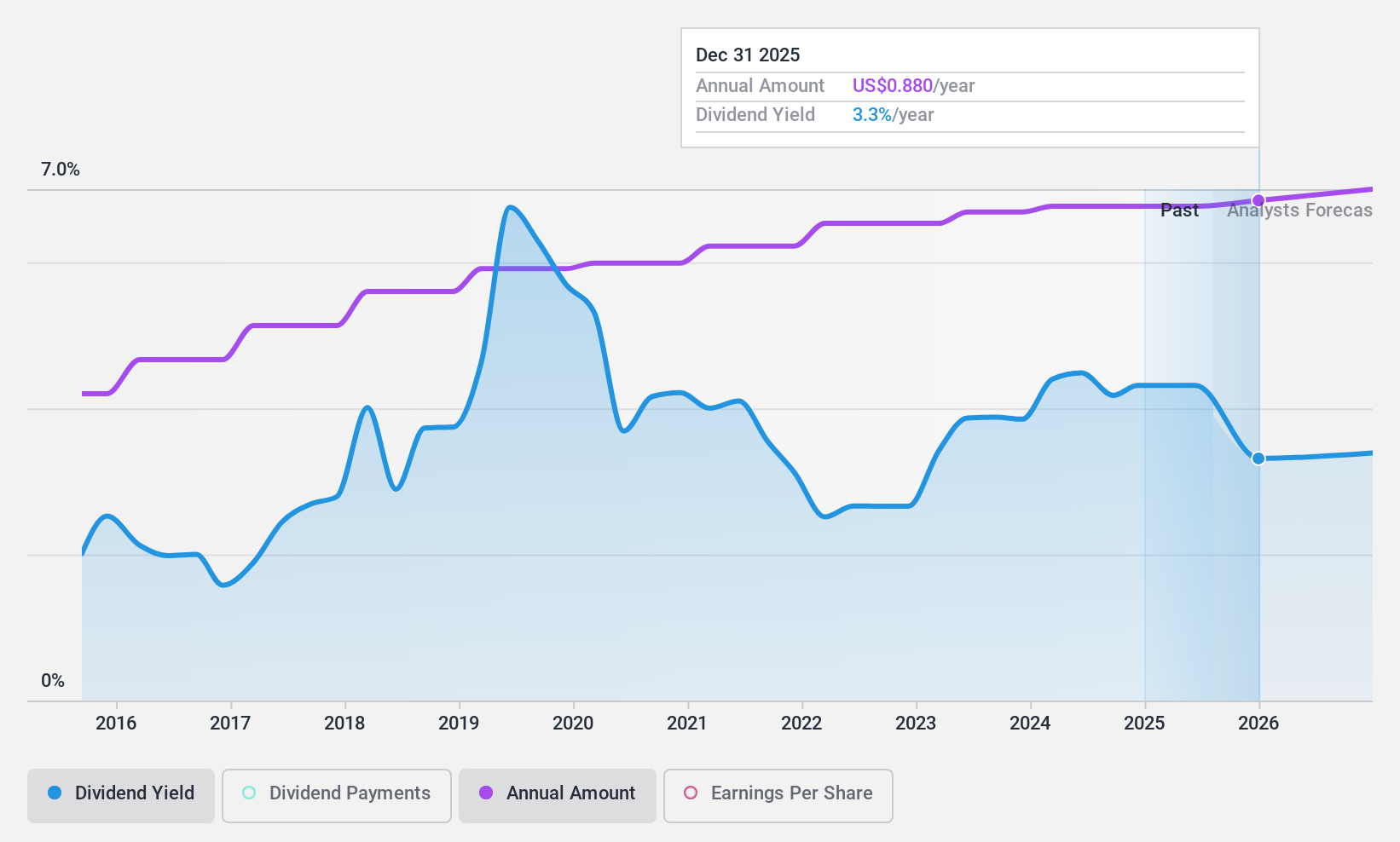

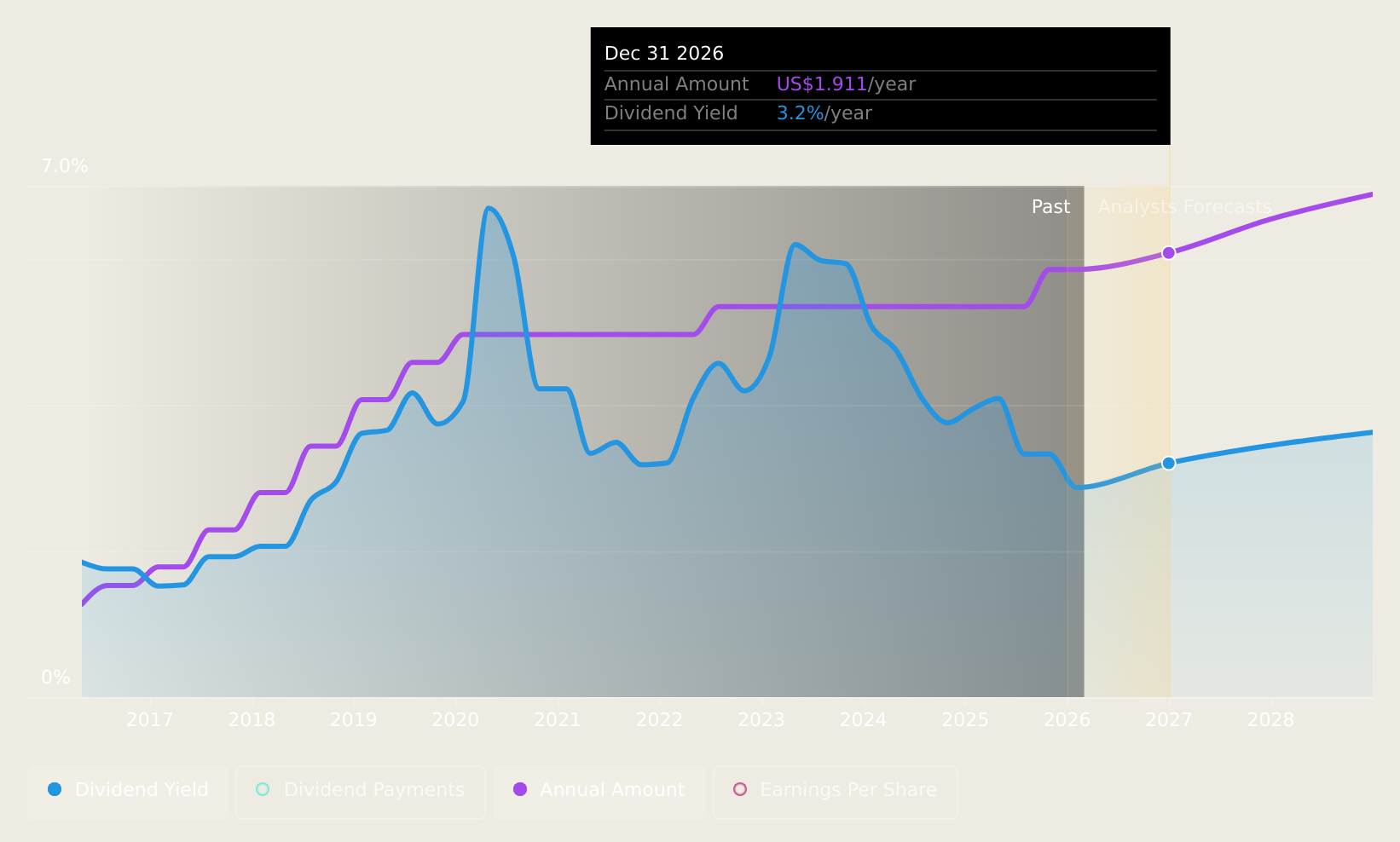

Citizens Financial Group (NYSE:CFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens Financial Group, Inc. is a bank holding company in the United States offering retail and commercial banking products and services, with a market capitalization of approximately $18.75 billion.

Operations: Citizens Financial Group, Inc. generates its revenue primarily through Consumer Banking and Commercial Banking segments, with earnings of $5.13 billion and $2.66 billion respectively.

Dividend Yield: 4%

Citizens Financial Group has demonstrated consistent dividend reliability over the past decade, with a recent affirmation of a US$0.42 per share quarterly payout, signaling ongoing commitment to shareholder returns. Despite trading 32.5% below estimated fair value and offering a modest 3.97% yield—lower than the top quartile of U.S. dividends—the dividends are sustainably covered by earnings at 63.7%. However, profit margins have declined from last year's 27.2% to 16.9%, indicating potential pressures on profitability despite forecasted earnings growth of 22.57% annually.

- Dive into the specifics of Citizens Financial Group here with our thorough dividend report.

- Our valuation report here indicates Citizens Financial Group may be undervalued.

Seize The Opportunity

- Explore the 181 names from our Top US Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Citizens Financial Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.