- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

Dollar Tree (DLTR): A Fresh Look at Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

See our latest analysis for Dollar Tree.

Despite the recent pullback, Dollar Tree is still up over 21% in share price terms for the year. This demonstrates impressive momentum after lagging in prior periods. The one-year total shareholder return stands at nearly 39%, which suggests that long-term holders have seen solid gains even as some short-term enthusiasm fades.

If Dollar Tree’s shift in momentum has you rethinking your watchlist, broaden your search and discover fast growing stocks with high insider ownership

But do these strong returns mean shares are trading at a bargain, or is the current price fully reflecting Dollar Tree’s growth potential? The key question for investors now is whether there is still a buying opportunity, or if the market already anticipates future gains.

Most Popular Narrative: 15.8% Undervalued

Dollar Tree’s current fair value narrative places the stock around $109.91, compared to its last close of $92.59. This creates a notable valuation gap and points to analyst assumptions about future growth drivers that may not be priced in.

The retailer's rapid rollout of multi-price point assortments beyond the historic $1.25 price cap has expanded average basket size and created margin uplift, while still retaining core value appeal. This provides a structural path to gross margin improvement and potential EPS growth.

What’s really powering this price target? The narrative hinges on bold upgrades in underlying profitability, fueled by moves that could reshape the company’s financial future. Curious about the key levers behind this optimistic outlook or which assumptions could send the fair value even higher? Dive in to see the full set of projections that make this target tick.

Result: Fair Value of $109.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff volatility and rising labor costs could erode margins. This may put pressure on Dollar Tree’s earnings outlook and valuation narrative.

Find out about the key risks to this Dollar Tree narrative.

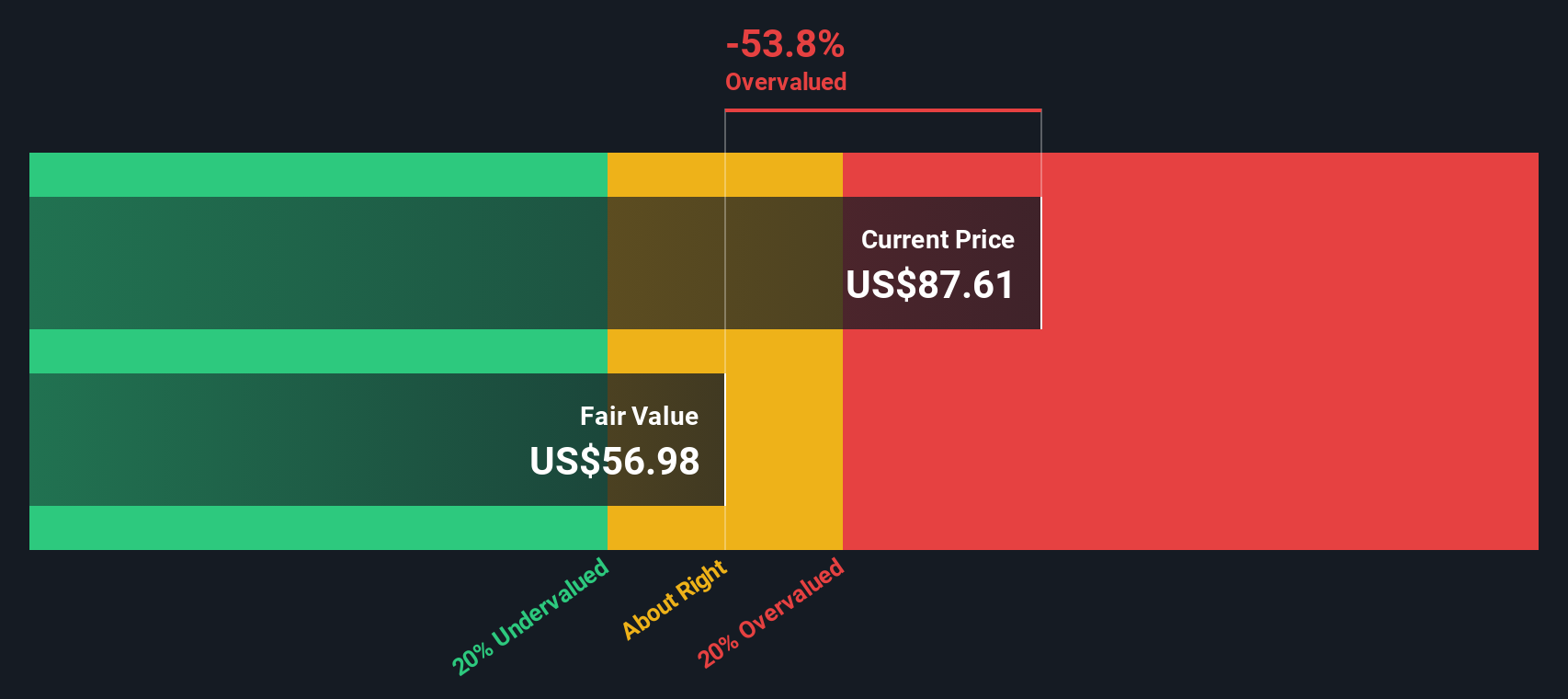

Another View: Discounted Cash Flow Suggests Overvaluation

While analysts price Dollar Tree as undervalued based on future growth estimates, our DCF model paints a contrasting picture. According to this method, the shares are priced above their fair value, which implies the market may be factoring in more optimism than fundamentals support. Which story will play out for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dollar Tree for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dollar Tree Narrative

If the current perspectives do not align with your own or you would rather dig into the numbers yourself, you have the chance to build your own take in just a few minutes: Do it your way

A great starting point for your Dollar Tree research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge and discover your next winning investment. Upgrade your portfolio with ideas shown to outperform the crowd.

- Explore tomorrow’s tech by checking out these 25 AI penny stocks, featuring companies at the forefront of artificial intelligence innovation and disruption.

- Maximize your income potential and find stability by analyzing these 18 dividend stocks with yields > 3% with attractive yields and dependable cash flows.

- Find hidden value plays before the market does by scanning these 881 undervalued stocks based on cash flows, packed with stocks that may be flying under Wall Street’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026