- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

What Makes Analysts Optimistic on Costco (NASDAQ:COST) after the Q4 Earnings

Reviewed by Michael Paige

Summary:

- Costco grew revenue 15.2% QoQ and 16% YoY to $2022.7 billion.

- The continued 19.4% ROE indicates that profitability is holding up well in inflation.

- They will invest some $4b CapEx in 2023 to open 25 new warehouses internationally and in the U.S.

- Management expects a slight decline of the forecasted 26% YoY revenue.

In the Q4 earnings release, Costco (NASDAQ:COST) reported that net sales for the quarter increased by 15.2% to $70.76 billion, and their net sales for the fiscal year increased by 16% to $222.73 billion. Their net income for the fourth quarter was $1.868 billion, which is $4.20 per diluted share, and their net income for the fiscal year was $5.84 billion, or $13.14 per diluted share.

See our latest analysis for Costco Wholesale

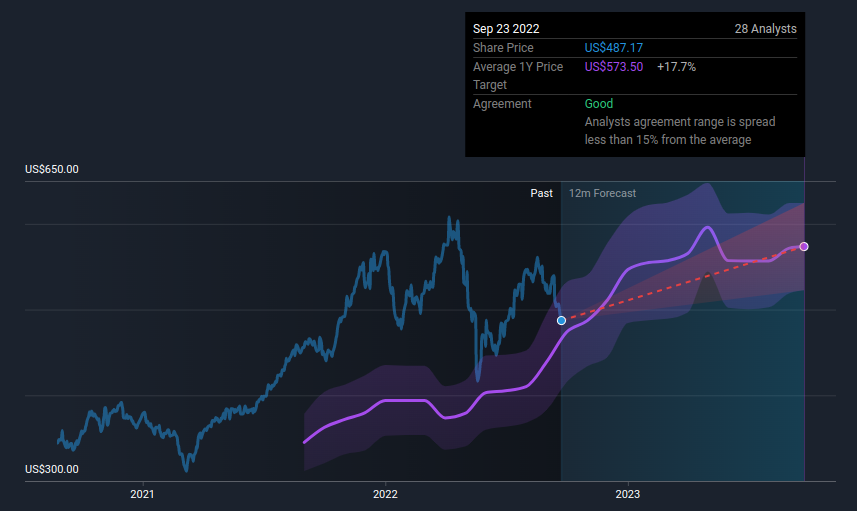

After the earnings, analysts have updated their price targets and have set an average target of $573.5 per share, representing a 17.7% potential upside. Analysts didn't see much change in the company and the target remained close to the September levels:

The Business is Still Absorbing Inflation

Management expects the FED to keep rising rates to fight inflation, with a potential pivot coming sometime in 2023. The CFO remarked that inflation in still pressuring wages, commodity and transportation prices, although spot container prices are seeing signs of normalization. They estimate that Costco absorbed some 8% of inflation in their operations.

Earnings Key Takeaways

The biggest factor impacting Costco's core three-year margin improvement was the outperformance of fresh items, which saw reduced spoilage and higher labor productivity. Other notable impacts came from changes in travel spending and consumer electronics promotions. Gas prices falling have been good for Costco's gas business overall, allowing them to be more competitive.

The company is focusing on improving data visibility for its buyers and operators, as well as driving more business with data analytics. This may increase the efficacy of the business and help maintain profitability levels.

Costco's credit card is also doing well, with high penetration, and auto-renewal rates of mid to high 50s in the U.S. The company gets a favorable effect on merchant fees which they don't disclose.

Management notes that in past recessions, Costco has done well because people still want to save money. This may give the company some defensive attributes for investors.

The Fundamental That Makes Costco a Great Company

Value creating companies make more from their investments as they grow. This means that management make smart investing decisions that generate high returns and minimize the costs. One way this shows up, is in the return on equity metric, that takes the net income and divides it by the book equity of the company. This way, investors can see if a company in deploying capital efficiently. For Costco, the ROE comes up to 19.4% which is around 10% in excess of the company's cost of equity. A positive net return means that as a company grows the bottom line, it becomes more valuable - so looking forward to growth is a viable strategy for Costco investors.

The ROE calculation simply takes the net income and divides it by the Book value of Equity.

We get: $3.976 / $20.513 = 19.4%

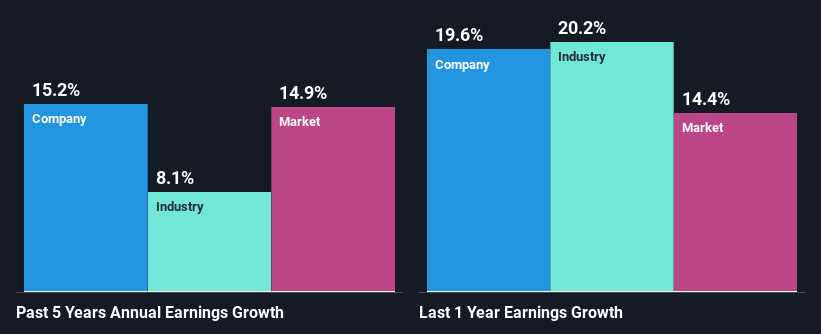

Even when compared to the industry average of 14% the company's ROE is quite impressive. This likely paved the way for the modest 15% net income growth seen by Costco Wholesale over the past five years.

As a next step, we compared Costco Wholesale's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 8.1%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for COST? You can find out in our latest intrinsic value infographic research report.

Looking Ahead

For clients, the company is committed to keeping prices low, which leaves it focused on growth and stability rather than profitability. However, there is still a chance that Costco may increase membership fees, since the last three increases were made, on average, five and a half years apart. That means, if Costco were to keep to that timetable, there could be a fee increase in 2023. The company is also continuing to invest in e-commerce and other growth initiatives.

In fiscal '23, Costco expects to open 25 new warehouses, and 5 repos. The warehouses are expected to be mostly in the U.S. (15), and 10 international, including their first locations in each of New Zealand and Sweden, and their third and fourth locations in China. The expected CapEx to fund these investments ranges from $3.8 billion to $4 billion, roughly the same as FY 2022.

Management expects the 26% YoY sales growth to decline slightly. Investors can also use analyst's forecasts to get a better picture of where the company is expected to go. Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026