- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Does Costco’s Recent Earnings Surge Signal Room for More Gains in 2025?

Reviewed by Bailey Pemberton

If you are trying to make sense of Costco Wholesale’s stock right now, you are not alone. There is quite a bit to unpack, especially if you are thinking about buying shares, holding onto what you have, or taking some profits after the latest moves. Just this past week, Costco shares jumped 4.4%, making up for a bit of the sluggishness seen over the past month. That short-term increase has caught the attention of both seasoned investors and anyone who has watched this company perform over the past few years. Looking at the long term, the numbers get even more impressive. Costco has more than doubled in value in the last three years with a 111.1% return, and over five years it is up 174.3%. Moves like these often follow reports of inflation cooling and shifts in consumer spending habits, both of which tend to benefit a value-focused retailer like Costco.

This is where things get interesting, especially if valuation is your primary focus. Using a classic scoring approach across six key checks for undervaluation, Costco actually scores zero. This means that if you are hoping for obvious signs the stock is a bargain on a traditional basis, you will not find them here. In the sections that follow, we will break down how different valuation methods compare and, most importantly, what might be an even better way to think about whether Costco’s run still has momentum.

Costco Wholesale scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Costco Wholesale Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future free cash flows and then discounting those projections back to today’s dollars. In the case of Costco Wholesale, the analysis starts with its latest free cash flow figure of $8.16 billion. Analysts provide forecasts for about five years, showing steady growth. After that period, the projections are extrapolated using historical trends and industry context.

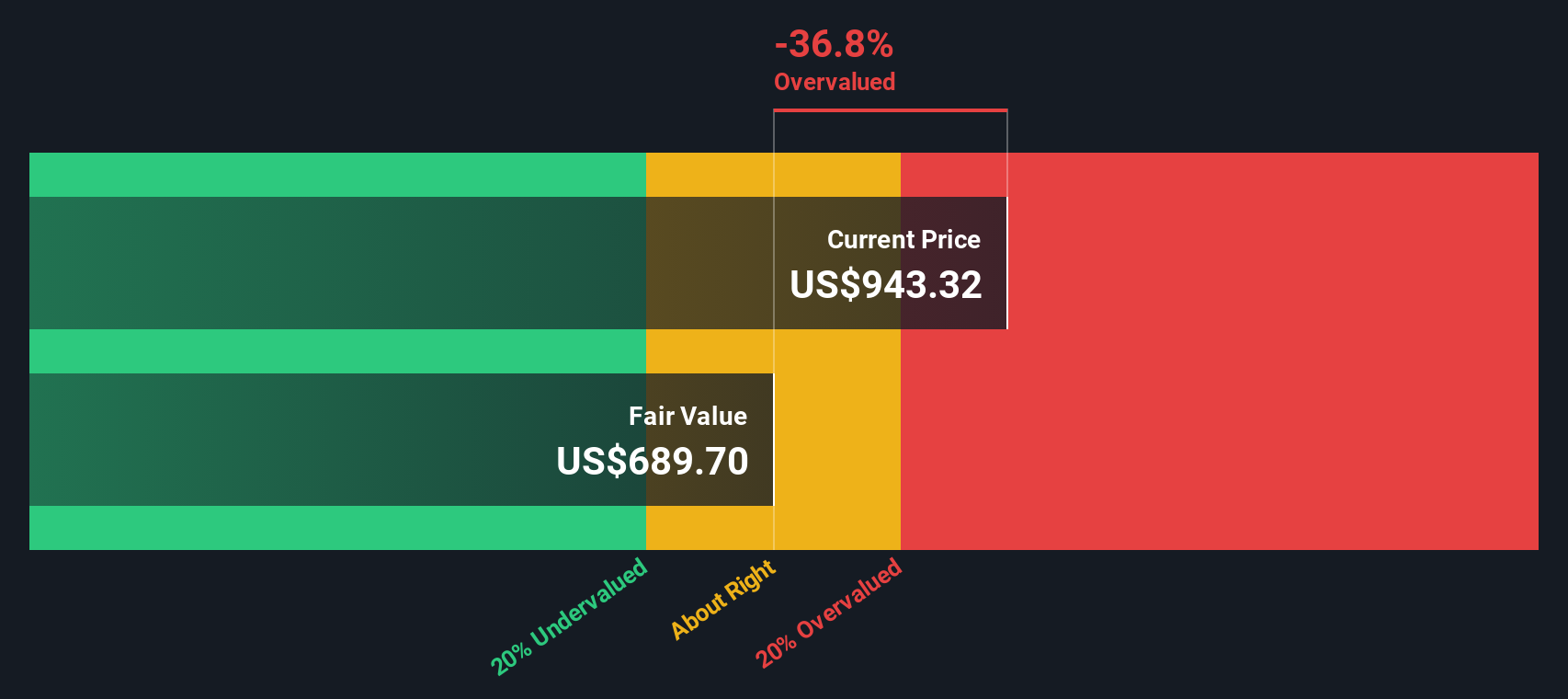

By 2030, Costco’s annual free cash flow is projected to reach roughly $12.25 billion. The methodology behind this DCF valuation compares all of that projected future cash to what an investor would pay for a share today and calculates what would be a “fair value” using this approach.

Based on these projections, the DCF model suggests an intrinsic value of $685.69 per share for Costco Wholesale. With the stock currently trading well above that mark, the DCF analysis signals the shares are around 39.3% overvalued using this framework.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Costco Wholesale may be overvalued by 39.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Costco Wholesale Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a well-established way to value established, profitable companies like Costco Wholesale. It gives investors a sense of how much they are paying today for a dollar of the company’s earnings. A fair PE ratio typically balances growth expectations with risks and the overall quality of a business. Higher expected growth and lower risk can justify a higher PE, while stagnation or elevated risk might warrant a lower one.

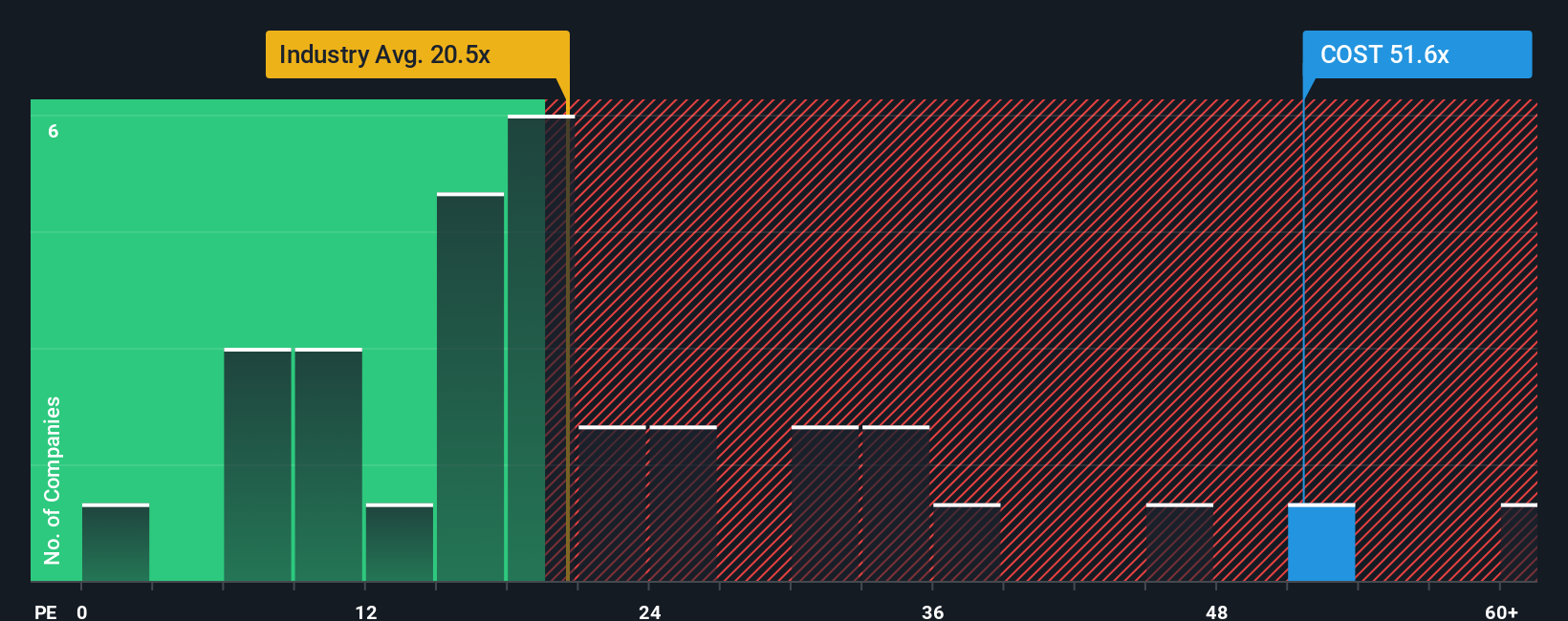

At the moment, Costco trades at a PE ratio of 52.3x. For context, the average PE across the Consumer Retailing industry stands at 21.2x, and even its major peers collectively trade at an average of 23.1x. This means Costco’s shares are priced much higher relative to its earnings than virtually all benchmarks in its sector.

This is where Simply Wall St’s “Fair Ratio” becomes a powerful lens. The Fair Ratio is calculated based on Costco’s growth prospects, profit margins, industry, size, and risk profile, and lands at 29.6x. Unlike a plain comparison against industry averages or peers, the Fair Ratio is tailored to account for Costco’s specific strengths, making it a more accurate measure of what investors should be willing to pay.

Currently, Costco’s actual PE of 52.3x is well above its Fair Ratio of 29.6x, indicating the stock is trading at a premium that may not be justified by its unique profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Costco Wholesale Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your way of connecting Costco’s story by focusing on the factors and trends you believe matter most, and linking them to a forecast of its future revenue, profit margins, and ultimately, its fair value per share.

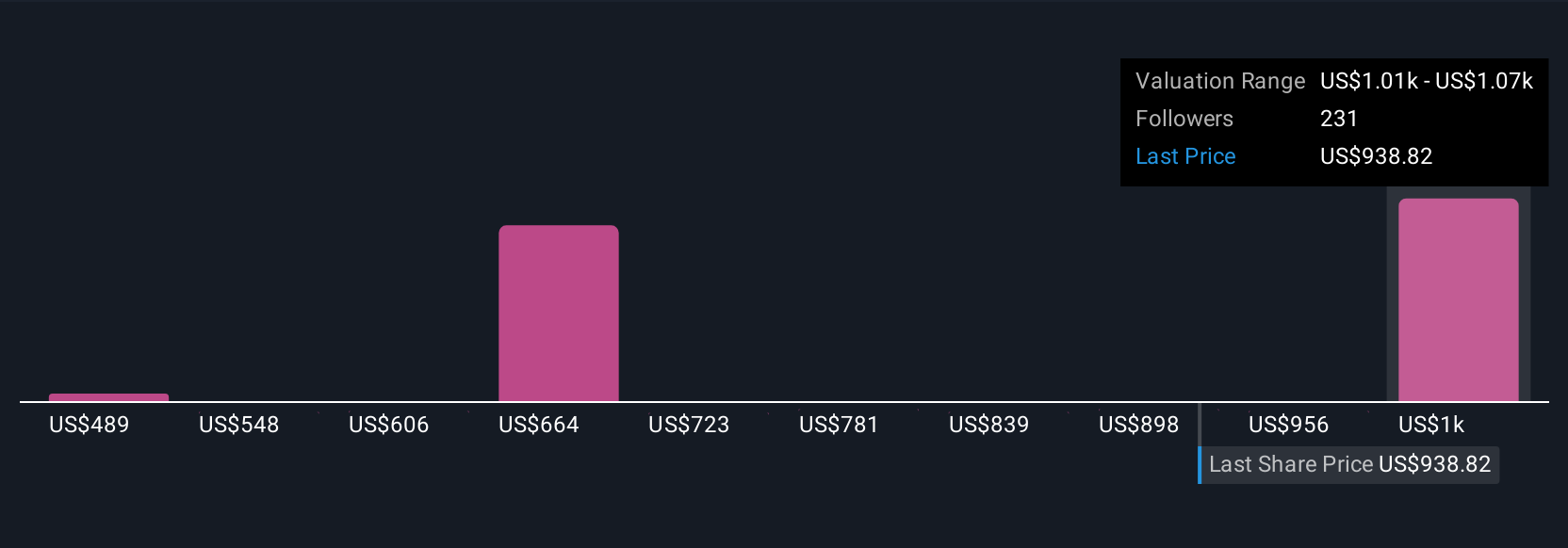

Unlike static ratios or one-size-fits-all formulas, Narratives allow you to spell out your perspective on Costco, blending your personal outlook and assumptions into a custom financial model. These are not complicated tools, as millions of investors use Narratives within Simply Wall St’s Community page to define what they think will happen next and see how it compares to market prices in real time.

Narratives help you decide if now is the right time to buy or sell by comparing the fair value you assign (based on your expectations) with the current share price. Even better, they update as soon as new data such as earnings or big news becomes available, so your view remains relevant and actionable.

For example, recent Narratives for Costco show bullish investors projecting a fair value of $1,225 per share based on robust global expansion and digital sales growth, while the most pessimistic see a fair value of just $620, citing margin pressures and elevated costs. This highlights just how different perspectives can be.

Do you think there's more to the story for Costco Wholesale? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives