- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Did Surging Digitally-Enabled Sales Just Shift Costco Wholesale's (COST) Expansion-Focused Investment Narrative?

Reviewed by Sasha Jovanovic

- Costco Wholesale Corporation recently reported its September sales, with net sales reaching US$26.58 billion for the five weeks ended October 5, 2025, marking an 8% increase from the same period last year.

- An interesting insight is the company’s digital transformation, as it introduced a new "digitally-enabled" comparable sales metric, revealing online sales growth of more than 26% year over year.

- We'll explore how this surge in digitally-enabled sales may influence Costco's projected earnings and expansion-focused investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Costco Wholesale Investment Narrative Recap

To own shares in Costco Wholesale, an investor must believe in the company’s ability to sustain strong membership growth, efficient global expansion, and ongoing gains in digital and warehouse sales. The latest September sales data, with an 8% net sales rise to US$26.58 billion and a 26% surge in digitally-enabled sales, reinforces the importance of digital growth as a short-term catalyst; there is no indication the recent news undermines this growth engine or introduces material new risk right now. The largest challenges ahead remain margin pressures from rising labor and supply chain costs.

Of the recent announcements, Costco’s rollout of digitally-enabled comparable sales, now including all sales that begin on a digital device, is most relevant. This metric gives greater visibility into the strength of Costco's e-commerce capabilities, supporting the case that online momentum could serve as a key revenue driver amid accelerating digital adoption and competition.

However, with robust digital growth, rising labor and supply chain costs remain critical factors that could pressure profit margins...

Read the full narrative on Costco Wholesale (it's free!)

Costco Wholesale's narrative projects $329.0 billion revenue and $10.4 billion earnings by 2028. This requires 7.0% yearly revenue growth and a $2.6 billion earnings increase from $7.8 billion today.

Uncover how Costco Wholesale's forecasts yield a $1061 fair value, a 14% upside to its current price.

Exploring Other Perspectives

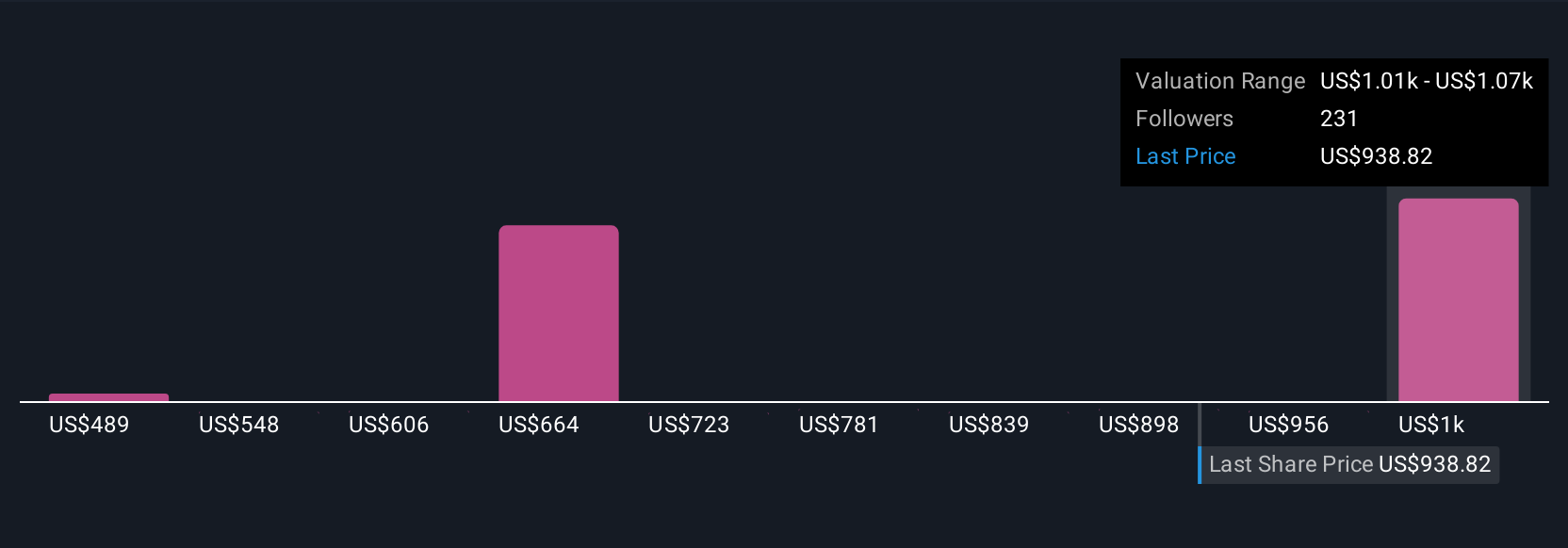

Fair value estimates from 34 members of the Simply Wall St Community range from US$489 to US$1,061 per share, reflecting broad differences in growth forecasts. Rising labor and supply chain costs continue to challenge profit margins, a risk that may shape both future outcomes and valuation views among market participants.

Explore 34 other fair value estimates on Costco Wholesale - why the stock might be worth 47% less than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives