- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco Wholesale NasdaqGS:COST Expands with New Warehouses Despite High Valuation Concerns

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Costco Wholesale stock here.

Competitive Advantages That Elevate Costco

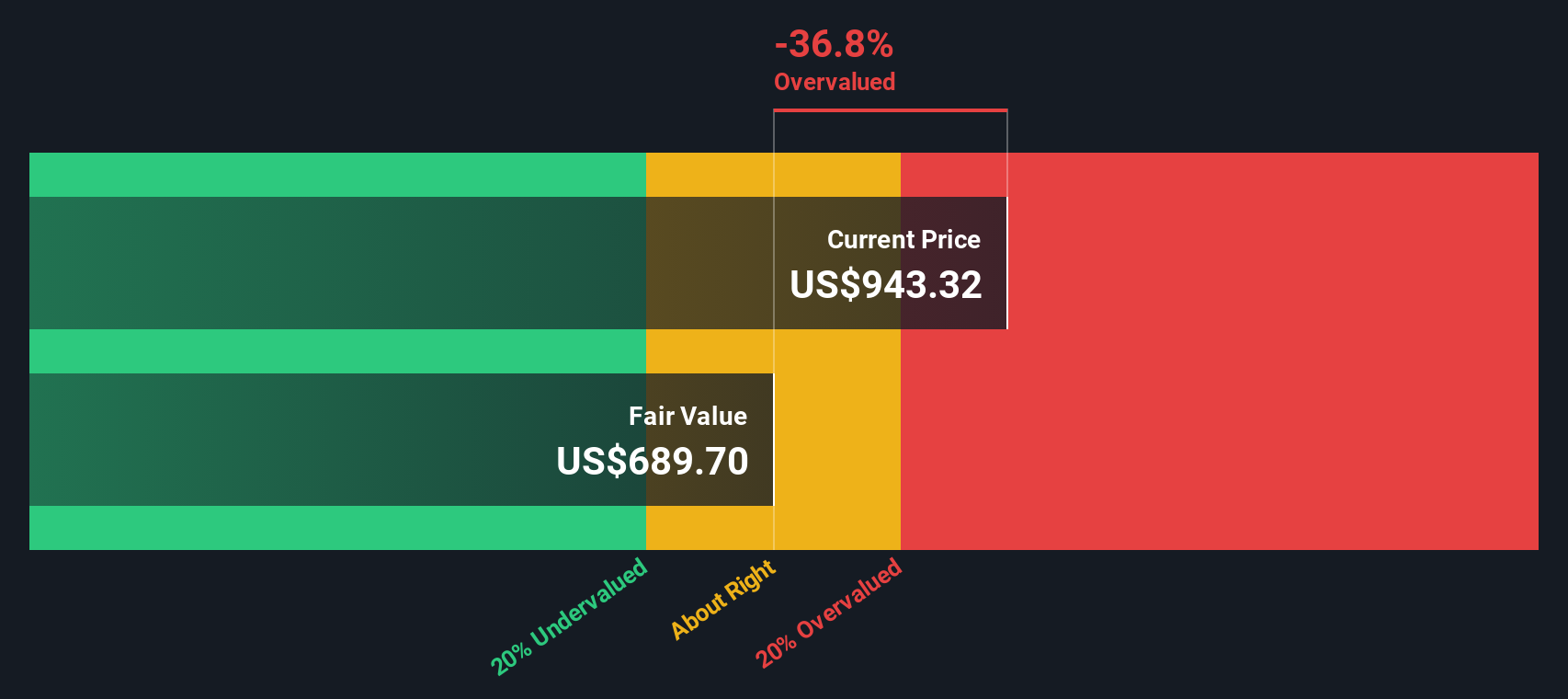

Costco Wholesale Corporation's strategic expansion initiatives, such as the opening of 30 new warehouses in fiscal year 2024, underscore its growth trajectory. With plans to add 26 more buildings in fiscal 2025, the company is poised to strengthen its market presence. The financial health of Costco is evident in its impressive net income of $2.35 billion for the fourth quarter, marking a 9% year-over-year increase. This growth is further supported by a healthy e-commerce segment, which saw comp sales rise by 18.9%, reflecting a compounded annual growth rate of over 20% over the last decade. The leadership team, with experienced management and a seasoned board, plays a crucial role in steering these strategic goals. However, it's worth noting that Costco's Price-To-Earnings Ratio stands at 52.5x, significantly higher than the peer average of 22.7x and the industry average of 22x, suggesting an expensive valuation despite trading below the estimated fair value of $954.79.

Critical Issues Affecting Costco's Performance and Areas for Growth

While Costco exhibits strong financial performance, certain metrics indicate areas for improvement. The U.S. and Canada renewal rate dipped slightly to 92.9%, and the average transaction value experienced a minor decline of 0.9% globally. Additionally, increased operational costs, such as higher wages in the U.S. and Canada, impacted the quarter's financials by approximately 4 basis points. These challenges, coupled with the company's high Price-To-Earnings Ratio, highlight potential financial constraints when compared to industry standards. Nonetheless, Costco's Return on Equity remains high at 31.2%, which is well above the 20% threshold considered strong.

Future Prospects for Costco in the Market

International expansion presents a significant opportunity for Costco, with 12 out of 29 planned openings occurring outside the U.S. This strategic move is complemented by technological advancements, such as the introduction of warehouse inventory checks via the Costco app, enhancing customer experience. Sustainability initiatives also offer avenues to reduce costs and improve efficiency. With a forecasted earnings growth of 7.53% per year, Costco is well-positioned to capitalize on these emerging opportunities. However, its revenue growth is expected to be slower than the overall U.S. market, indicating room for further expansion in this area.

Regulatory Challenges Facing Costco

Costco faces several external threats, including increasing market competition and economic factors like flat inflation rates across core merchandise. The promotional environment is intensifying, demanding strategic pricing and product innovation to maintain competitiveness. Additionally, operational risks such as potential port strikes and shipping delays in the Red Sea pose logistical challenges. These factors, alongside significant insider selling over the past three months, underscore the need for vigilant risk management to safeguard Costco's market share and long-term growth prospects.

To gain deeper insights into Costco Wholesale's historical performance, explore our detailed analysis of past performance. To dive deeper into how Costco Wholesale's valuation metrics are shaping its market position, check out our detailed analysis of Costco Wholesale's Valuation.Conclusion

Costco's strategic expansion and strong financial performance highlight its potential for continued growth, as evidenced by its plans to open numerous new warehouses and its impressive net income increase. However, the company's high Price-To-Earnings Ratio of 52.5x, significantly above the peer and industry averages, indicates that investors are paying a premium for its stock, which could constrain future returns if growth expectations are not met. Challenges like declining renewal rates and increased operational costs persist, yet Costco's high Return on Equity and international expansion efforts suggest resilience and opportunities for growth. Nevertheless, external threats such as market competition and logistical risks necessitate vigilant management to maintain its competitive edge and ensure sustained long-term performance.

Make It Happen

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Outstanding track record with excellent balance sheet.