- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco (COST) Valuation in Focus Following Strong August Sales and Steady Fiscal Growth

Reviewed by Simply Wall St

Costco Wholesale (COST) just delivered a bit of reassuring news, announcing an 8.7% jump in net sales for August and similarly steady increases for both its fourth quarter and the full fiscal year. For investors keeping an eye on consumer trends and the resilience of big-box retailers, this latest sales update stands out. While concerns about shifting market sentiment have lingered lately, Costco’s report is a reminder of its ability to attract shoppers and drive meaningful growth, even in moments when the market feels a little uneasy.

This upbeat sales performance comes at an interesting crossroads for Costco. The stock has spent much of the past few months in a downtrend, sliding almost 10% in the past quarter even as it gained about 8% over the year. Recent headlines about hedge fund selling and ongoing debates around future growth rates have created a tug-of-war between bullish and more cautious investors. But with revenue growth clocking in above 6% and the company’s gold bar sales regularly in the spotlight, market attention is undoubtedly fixed on what Costco will deliver next.

With shares off their highs but sales momentum still running strong, the question now is whether Costco is trading at a rare discount, or if the current price continues to reflect expectations of even bigger growth ahead.

Most Popular Narrative: 96.9% Overvalued

According to Goran_Damchevski, this narrative considers Costco’s share price far above its calculated fair value based on forward-looking assumptions and current fundamentals.

“In essence, Costco’s cheap bulk products are the value proposition for customers, and as long as it’s not losing money on turnover, it creates value from membership fees. Costco is developing its store brand Kirkland Signature, centered on providing quality products (as opposed to a focus on cheap pricing). The company is leveraging its distribution network and customer loyalty to make Kirkland a recognised brand, and has found opportunities to replace branded products with Kirkland, which costs less to produce.”

Curious how a retail giant can be labeled massively overvalued? The narrative relies on some head-turning projections about growth, margins, and the market’s willingness to pay up for future profits. Want the details that make this fair value estimate so startling? Dig into the full narrative and uncover which bold financial moves could or could not justify today’s lofty price.

Result: Fair Value of $489.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained investor optimism or a justified premium for Costco’s steady margins could challenge the outlook that shares are priced too high.

Find out about the key risks to this Costco Wholesale narrative.Another View: Discounted Cash Flow Perspective

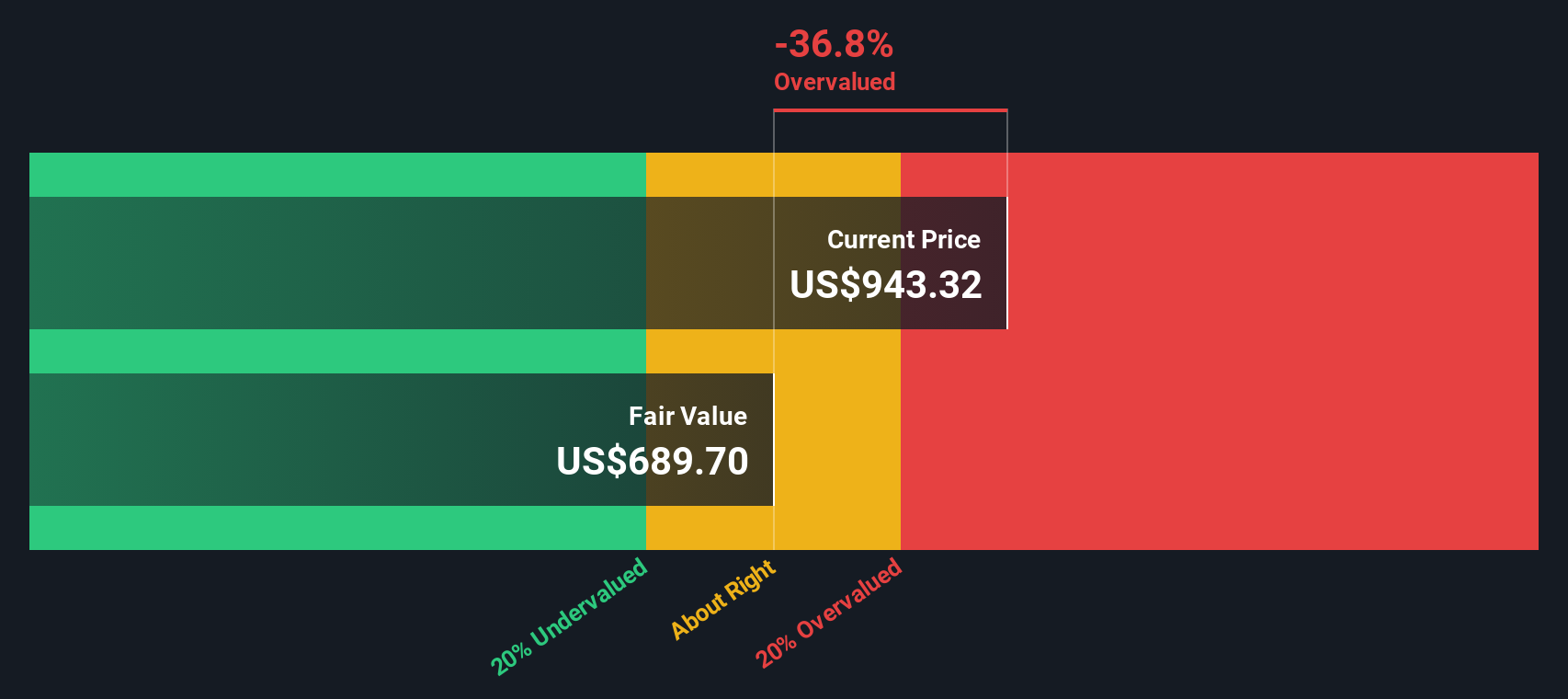

Taking a step back from the market’s bold expectations, our DCF model suggests Costco is trading above its fair value. This closer examination of future cash flows questions whether growth alone justifies the premium. Could the market be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Costco Wholesale for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Costco Wholesale Narrative

If you see things differently or want to test your own assumptions, you can create a unique Costco narrative in just a few minutes. Do it your way

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Great investing doesn’t stop at just one company. Use the Simply Wall Street Screener to find the ideas others might miss and spark your next winning move.

- Unearth early-stage companies with momentum by checking out penny stocks with strong financials. See which up-and-comers are building strong financial foundations.

- Capture steady income streams by browsing for dividend stocks with yields > 3%. This tool is designed to highlight stocks boasting generous dividend yields over 3%.

- Jump ahead of the market by hunting for tomorrow’s sector leaders with a focus on AI penny stocks. Pinpoint companies primed for growth in the fast-evolving AI space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives