- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco (COST): Reassessing Valuation After Strong September Sales and New Digital Momentum

Reviewed by Kshitija Bhandaru

Costco Wholesale (COST) caught the market’s attention after announcing an 8% jump in net sales for September, ending October 5, 2025. Gains came from both physical stores as well as a surge in digital sales.

See our latest analysis for Costco Wholesale.

The upbeat September sales have powered Costco’s momentum, with shares recently catching a 2% boost after the numbers dropped. While the stock has drifted slightly lower in the past month, its year-to-date share price return of nearly 3% and a robust five-year total shareholder return of 170% show Costco’s long-term rewards remain meaningful for patient investors. Ongoing digital gains and store growth keep sentiment strong, even as some peers attract attention with new strategies.

If you’re interested in what’s shaping the broader retail landscape, it’s a great moment to discover fast growing stocks with high insider ownership.

But with Costco’s shares climbing on strong results and digital momentum, the next question is critical. After years of outperformance, does the stock still have room to run, or is future growth already fully priced in?

Most Popular Narrative: 11.8% Undervalued

Costco’s most widely followed valuation view sets its fair value at $1,061, which is notably above the last close of $935.56. With Wall Street’s consensus raising projections for growth and profit, expectations are high. However, the key driver behind this price target deserves closer inspection.

"Margin improvements and effective navigation of rising input costs highlight the company’s execution strengths. This supports its reputation as a defensive growth holding."

Want to know what’s fueling this double-digit premium? This narrative is based on future sales gains, margin expansion, and a profit multiple that rivals top tech stocks. Curious about the big assumptions involved? Explore further to see the ambitious numbers driving this bold fair value.

Result: Fair Value of $1,061 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor costs and currency fluctuations could weigh on margins and present challenges to Costco’s optimistic growth outlook in the coming quarters.

Find out about the key risks to this Costco Wholesale narrative.

Another View: What Do Market Multiples Signal?

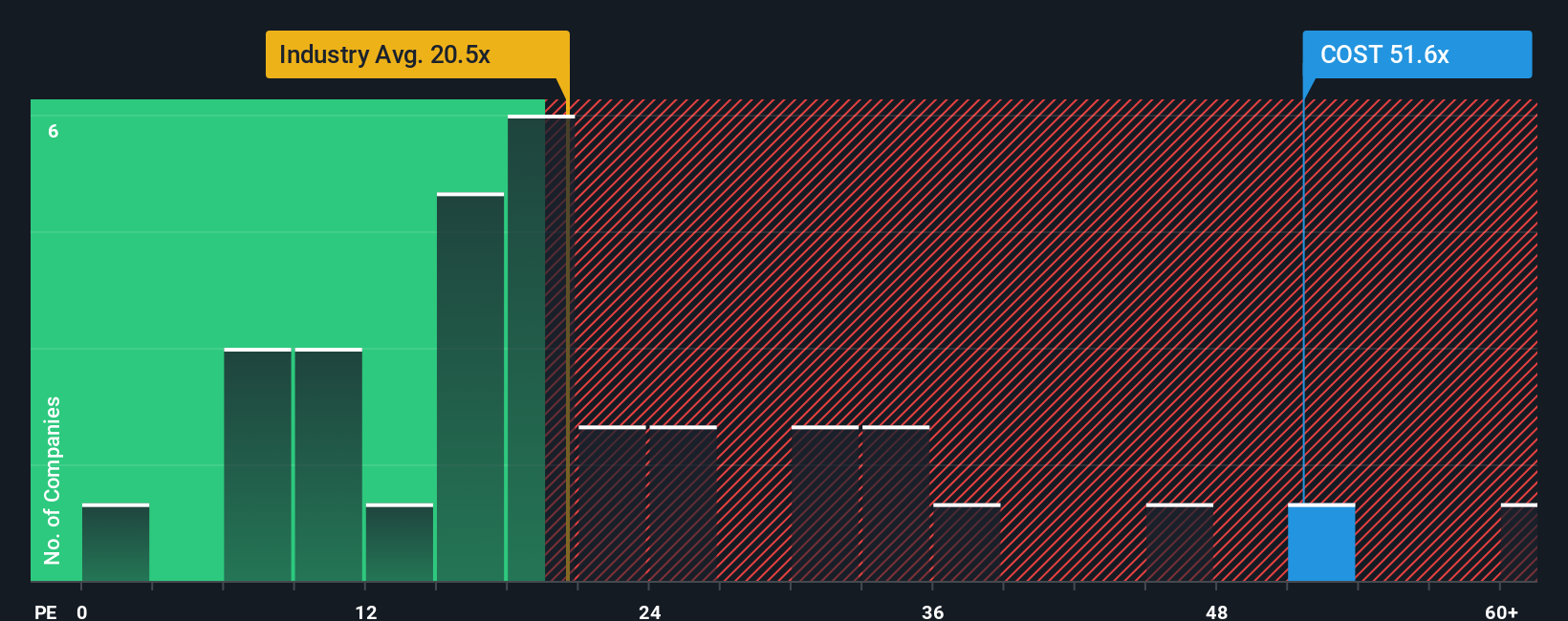

Looking beyond fair value estimates, Costco’s valuation jumps out when using its price-to-earnings ratio. Shares trade at 51.2 times earnings, far above the US Consumer Retailing industry average of 20.5 times and a peer average of 22.1 times. The fair ratio, based on market trends, is just 29.5 times. Such a gap highlights how much optimism investors are baking in, or how much risk could emerge if growth slows. Is this premium a sign of confidence, or a warning to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If you see the story differently or want to dive into the numbers on your own terms, building your own view is fast and easy. It takes just a few minutes. Do it your way

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle. If you want to stay ahead of the market and uncover fresh opportunities, put these unique stock themes on your radar today.

- Supercharge your portfolio with reliable income by checking out these 18 dividend stocks with yields > 3%, which features companies that deliver yields above 3%.

- Capitalize on rapid sector growth when you review these 25 AI penny stocks in artificial intelligence, a field poised for breakthroughs.

- Take advantage of hidden bargains by targeting these 891 undervalued stocks based on cash flows, signaling compelling value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives