- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

What Casey's (CASY)'s Midwest Store Acquisitions and Upgraded Earnings Forecasts Mean for Shareholders

Reviewed by Sasha Jovanovic

- In recent weeks, Casey’s General Stores acquired six convenience stores across South Dakota and Iowa, further expanding its regional footprint in the Midwest following previous purchases in Michigan.

- Analysts have recently increased their earnings forecasts for the company and now expect a 9.3% growth in earnings for the current fiscal year, reflecting confidence in Casey’s ability to integrate acquisitions and maintain operational momentum.

- We'll explore how the upward revision in analyst earnings estimates shapes Casey’s broader investment outlook and growth trajectory.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Casey's General Stores Investment Narrative Recap

To be a shareholder in Casey’s General Stores, you have to believe in the company’s ability to profitably expand in the Midwest while integrating newly acquired stores and steadily growing its food and merchandise business. The recent acquisitions in South Dakota and Iowa help strengthen Casey’s core markets, but they do not materially change the most important short-term catalyst: successful integration of acquired locations to deliver earnings and margin gains. The biggest current risk remains the company’s reliance on driving traffic and sales growth in rural and Midwestern regions, where demographic and economic shifts can quickly impact performance.

Among recent announcements, Casey’s reaffirmed plans to open at least 80 new stores in fiscal 2026, supporting its multi-year growth plan through a mix of new construction and further acquisitions. This highlights the company’s continued growth ambitions and underscores why effective integration of new stores and ongoing margin improvement are central to delivering sustained value for shareholders.

Yet, for all this momentum, it’s equally important for investors to remember that risks tied to regional demographic trends may affect Casey’s performance if…

Read the full narrative on Casey's General Stores (it's free!)

Casey's General Stores' narrative projects $19.5 billion revenue and $760.7 million earnings by 2028. This requires 6.0% yearly revenue growth and a $179 million earnings increase from the current $581.7 million.

Uncover how Casey's General Stores' forecasts yield a $571.38 fair value, a 3% upside to its current price.

Exploring Other Perspectives

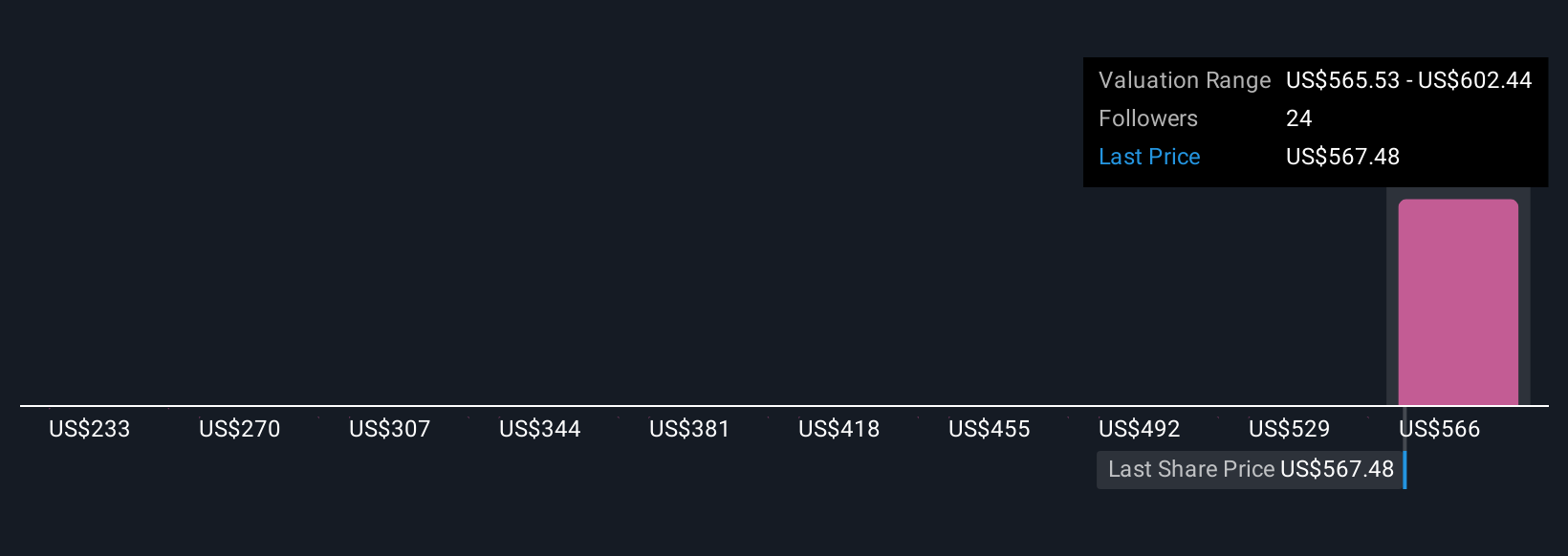

Four Simply Wall St Community fair value estimates for Casey’s range widely from US$233 to US$602 per share. While recent analyst upgrades point to earnings growth, your outlook on Casey’s future will depend on how you see its expansion moves playing out.

Explore 4 other fair value estimates on Casey's General Stores - why the stock might be worth less than half the current price!

Build Your Own Casey's General Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Casey's General Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casey's General Stores' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)