- United States

- /

- Luxury

- /

- NYSE:ZGN

Is Zegna’s New Family-led Succession Plan Altering The Investment Case For Ermenegildo Zegna (ZGN)?

Reviewed by Sasha Jovanovic

- Ermenegildo Zegna N.V. has outlined a new leadership structure effective January 1, 2026, with current CEO Gildo Zegna becoming Group Executive Chairman, CFO and COO Gianluca Tagliabue stepping in as acting Group CEO pending shareholder approval, and Gian Franco Santhià moving into the Group CFO role.

- The succession plan also brings the fourth generation of the Zegna family to the forefront, with Edoardo and Angelo Zegna becoming Co-CEOs of the ZEGNA brand, underscoring a balance between heritage stewardship and a refreshed approach to brand and operational management.

- We’ll now examine how elevating Gianluca Tagliabue to Group CEO and advancing fourth-generation family leadership could influence Zegna’s investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Ermenegildo Zegna Investment Narrative Recap

To own Ermenegildo Zegna, you need to believe in its ability to turn brand strength, DTC expansion and TOM FORD FASHION momentum into profitable growth despite pressure in Greater China and Thom Browne wholesale. The 2026 leadership shift, elevating Gianluca Tagliabue and fourth generation family members, appears more continuity than disruption in the near term, so it does not materially change the key short term catalyst or the main execution risks.

The leadership announcement sits alongside ongoing investment in talent, store expansion and supply chain, including the completed Parma factory, which are central to the DTC and high end product growth story. With a seasoned management team and experienced board already in place, the handover to Tagliabue as acting Group CEO and the promotion of Gian Franco Santhià to CFO will test how effectively Zegna can keep SG&A growth in check while pushing its DTC strategy...

Read the full narrative on Ermenegildo Zegna (it's free!)

Ermenegildo Zegna's narrative projects €2.2 billion revenue and €127.2 million earnings by 2028. This requires 3.4% yearly revenue growth and about a €50 million earnings increase from €77.1 million today.

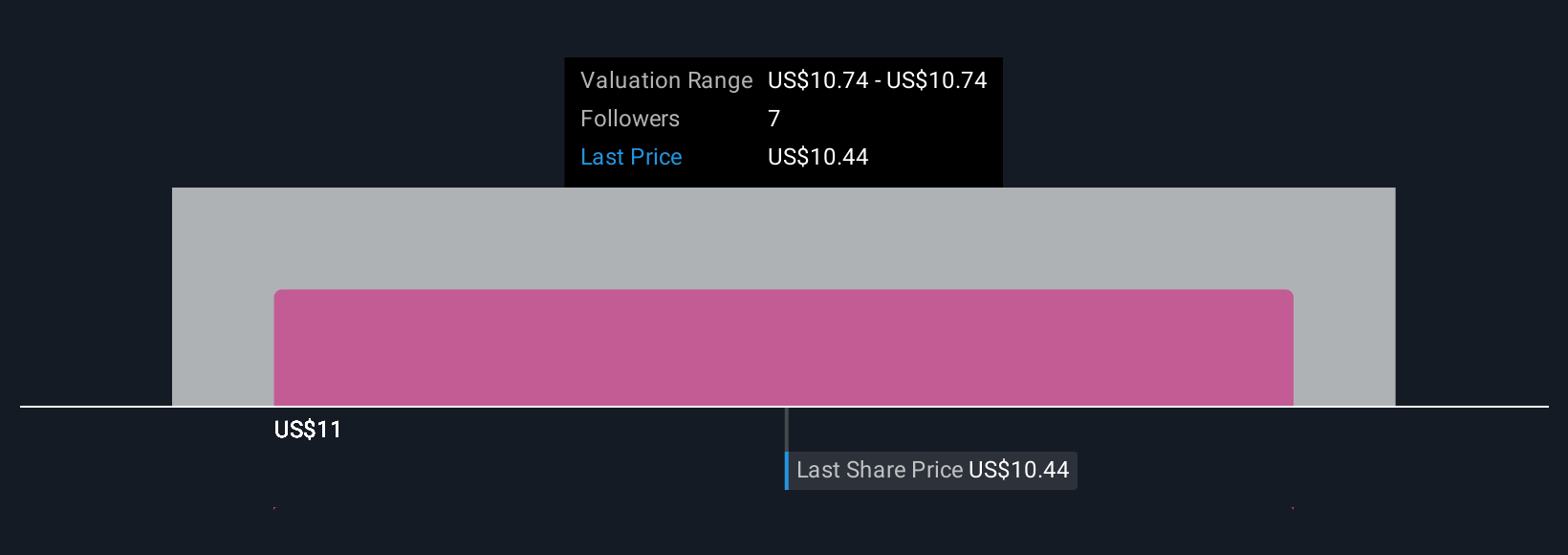

Uncover how Ermenegildo Zegna's forecasts yield a $11.45 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span about €7.25 to €11.45 per share, showing how far apart individual views can be. Against this backdrop, the planned leadership transition and its impact on executing Zegna’s DTC and TOM FORD FASHION growth plans give you several different angles on how the business might perform over time, so it is worth comparing multiple perspectives before forming your own view.

Explore 2 other fair value estimates on Ermenegildo Zegna - why the stock might be worth 34% less than the current price!

Build Your Own Ermenegildo Zegna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ermenegildo Zegna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ermenegildo Zegna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ermenegildo Zegna's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ermenegildo Zegna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZGN

Ermenegildo Zegna

Designs, manufactures, markets, and distributes luxury menswear and womenwear, children’s clothing, footwear, leather goods, and other accessories worldwide.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion