- United States

- /

- Leisure

- /

- NYSE:YETI

YETI (YETI): Revisiting Valuation After a 15% 30-Day Share Price Climb

Reviewed by Simply Wall St

YETI Holdings (YETI) has quietly pushed higher over the past month, and that climb is getting investors to revisit the story, especially with sales and earnings still ticking upward despite a tougher consumer backdrop.

See our latest analysis for YETI Holdings.

That recent 30 day share price return of 15.25 percent and 90 day gain of 21.48 percent sit in sharp contrast to YETI Holdings 1 year total shareholder return of just 1.11 percent, suggesting momentum is finally starting to build after a sluggish stretch.

If YETI’s move has you rethinking your playbook, it might be a good time to scan fast growing stocks with high insider ownership for other under the radar growth stories with conviction behind them.

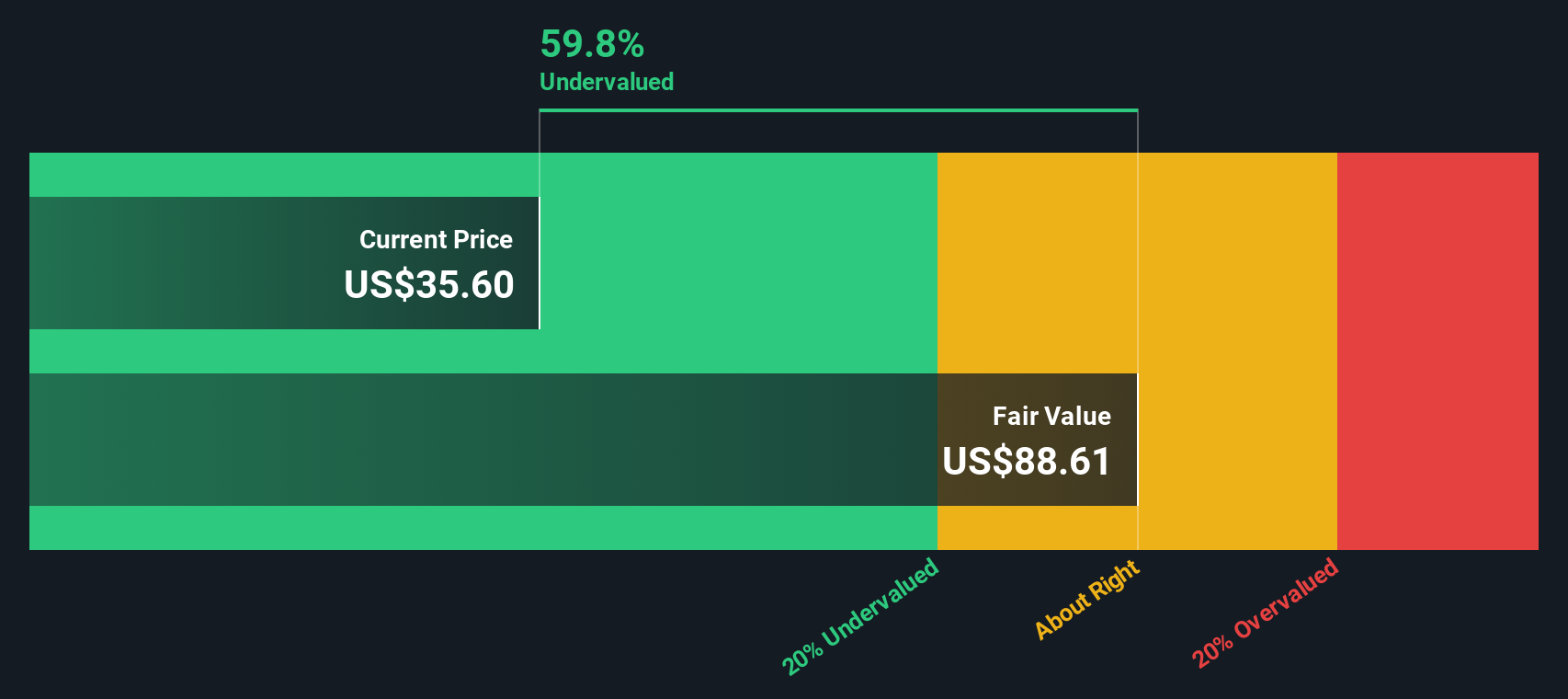

Yet with earnings still growing, a steep intrinsic value discount, and shares hovering near analyst targets, investors face a key dilemma: is YETI still mispriced, or is the market now baking in the next leg of growth?

Most Popular Narrative Narrative: 4.9% Overvalued

With YETI Holdings last closing at $42.99 against a narrative fair value near $41, the story leans slightly cautious even as fundamentals improve.

The company's accelerated international expansion, particularly robust growth and brand engagement in Europe and the rapid ramp up in Japan and Asia, is unlocking a large revenue opportunity in underpenetrated markets, this is expected to drive sustained double digit growth internationally and diversify global revenue streams.

Want to see how steady revenue gains, margin tweaks, and a lower future earnings multiple still support that price tag? The full narrative unpacks the math.

Result: Fair Value of $41 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering drinkware category weakness and execution risk around new product launches could quickly undermine both the growth outlook and today’s valuation.

Find out about the key risks to this YETI Holdings narrative.

Another Angle on Valuation

While the narrative fair value pegs YETI as about 4.9 percent overvalued at $41, our DCF model tells a very different story. It suggests fair value closer to $94.57, or a roughly 54.5 percent undervaluation. Is the market underestimating cash flow durability or overvaluing near term risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own YETI Holdings Narrative

If this take does not quite match your view, or you would rather lean on your own homework, you can build a custom narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding YETI Holdings.

Ready for your next investment move?

Do not stop at YETI, broaden your watchlist now with targeted ideas from the Simply Wall St Screener and avoid missing tomorrow’s strongest performers.

- Capture potential bargains early by reviewing these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Position yourself for the next wave of innovation by scanning these 25 AI penny stocks pushing boundaries in automation, data intelligence, and real world AI adoption.

- Strengthen your income strategy by shortlisting these 13 dividend stocks with yields > 3% that can support more reliable cash returns in a changing rate environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YETI

YETI Holdings

Designs, retails, and distributes outdoor products under the YETI brand name.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)