- United States

- /

- Luxury

- /

- NYSE:WWW

Wolverine World Wide's Valuation in Focus After Credit Facility Move and New Product Launch

Reviewed by Kshitija Bhandaru

Wolverine World Wide (NYSE:WWW) has taken a fresh step to bolster its financial flexibility by amending and extending its revolving credit facility, streamlining loan commitments, and refinancing existing obligations. This move could help position the company for future opportunities or changing market conditions.

See our latest analysis for Wolverine World Wide.

The recent credit facility amendment comes at a time when Wolverine World Wide’s momentum is clearly on the rise. After a choppy spell earlier in the year, the stock’s 90-day share price return is up an impressive 32.4%, while the total shareholder return over the last twelve months has soared to nearly 60%. Ongoing product innovation, like Cat Footwear’s new Reclaimer Wedge, is adding to the positive buzz and could be influencing renewed interest among investors.

If you’re watching how market sentiment shifts with strategic moves like these, it’s a great moment to expand your horizons and discover fast growing stocks with high insider ownership

With shares rallying sharply and growth expectations building, the key question now is whether Wolverine World Wide is still trading at a discount given its fundamentals, or if the market has already factored in the company’s future potential.

Most Popular Narrative: 23.7% Undervalued

With the company trading at $25.69 and the most widely followed narrative assigning fair value near $33.67, there is significant upside implied. The latest consensus sees valuation driven by global expansion and digital transformation potential, setting the tone for the long-term trajectory.

Wolverine is capitalizing on growing demand for branded footwear globally by expanding Saucony and Merrell into new international markets and activating key cities (for example, Tokyo, Paris, London). This is expected to boost revenue growth and diversify geographic exposure. The company is executing a digital transformation by prioritizing direct-to-consumer (DTC) channels, enhancing digital experiences, and launching branded apps (such as Sweaty Betty in the UK) to drive higher-margin sales and improve earnings quality.

Curious how this bullish upside is built? The narrative rests on aggressive expansion, disruptive sales channels, and sharply higher future profits. Just what kind of profit leap and margin recovery does it take to justify the target price? Unlock the full details inside and see if these high-stakes assumptions align with your view.

Result: Fair Value of $33.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on wholesale channels and uncertainty around global trade policies remain key risks. These factors could limit Wolverine World Wide’s projected upside.

Find out about the key risks to this Wolverine World Wide narrative.

Another View: Market Multiples Paint a Different Picture

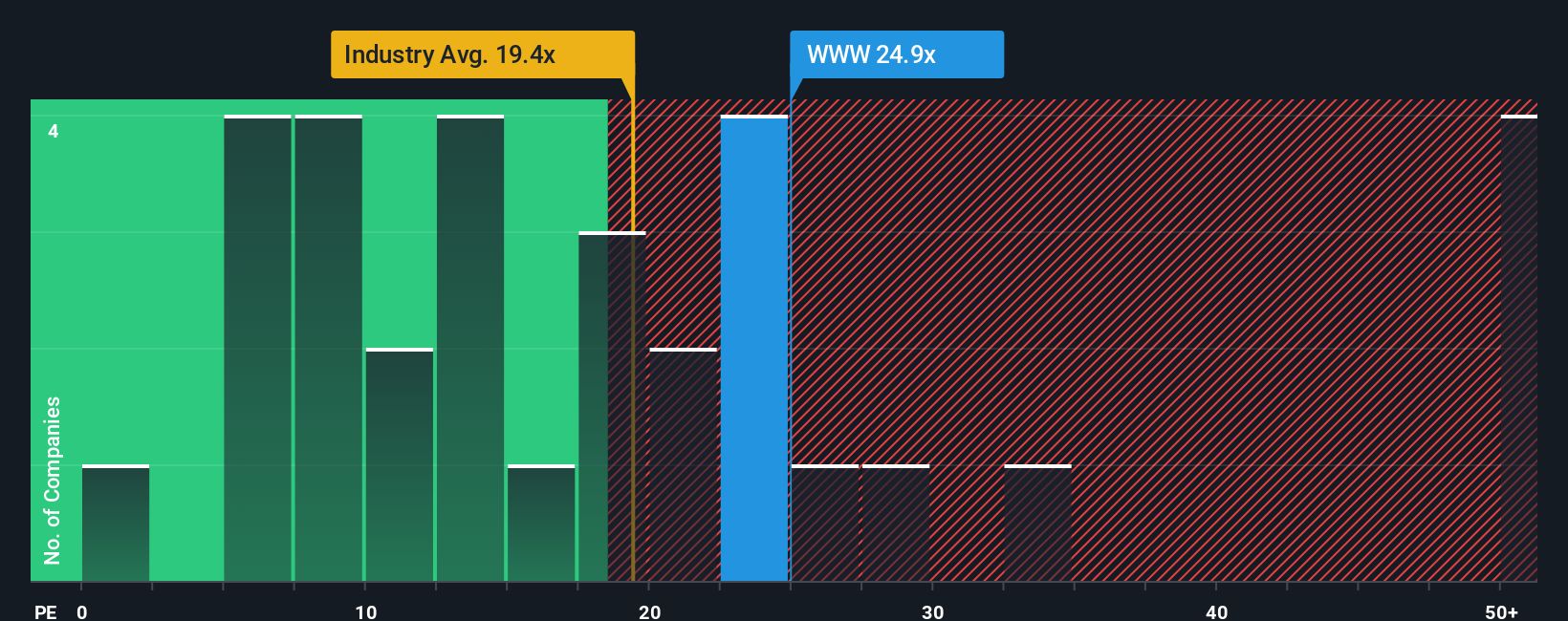

While the prevailing narrative points to upside, looking at market valuation ratios tells a more cautious story. Shares trade at a price-to-earnings ratio of 24.9x, which is higher than the US Luxury industry average of 20.9x and above the peer group average of 19.9x. Even compared to a fair ratio of 24.1x, the stock appears a bit expensive. That premium could mean investors are already pricing in ambitious growth. The question is whether there is still genuine value left on the table, or if expectations are running a little hot.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wolverine World Wide Narrative

If these takes do not quite match your outlook, or you prefer to be more hands-on with your own research, dive in and shape your own perspective in just a few minutes with Do it your way

A great starting point for your Wolverine World Wide research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t sit out on the next big opportunity. Level up your search for quality stocks that align with your strategy using these top tools now:

- Spot rising companies with robust cash flows by checking out these 892 undervalued stocks based on cash flows and see which names are attracting value-focused investors right now.

- Harness the power of artificial intelligence with these 25 AI penny stocks to uncover fast-moving companies at the forefront of transformative technology.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3%, featuring strong businesses paying reliable yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives