Wolverine World Wide, Inc.'s (NYSE:WWW) investors are due to receive a payment of $0.10 per share on 1st of May. This payment means that the dividend yield will be 1.9%, which is around the industry average.

Check out our latest analysis for Wolverine World Wide

Estimates Indicate Wolverine World Wide's Dividend Coverage Likely To Improve

Unless the payments are sustainable, the dividend yield doesn't mean too much. Even though Wolverine World Wide isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Analysts expect a massive rise in earnings per share in the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 13%, so there isn't too much pressure on the dividend.

Wolverine World Wide Has A Solid Track Record

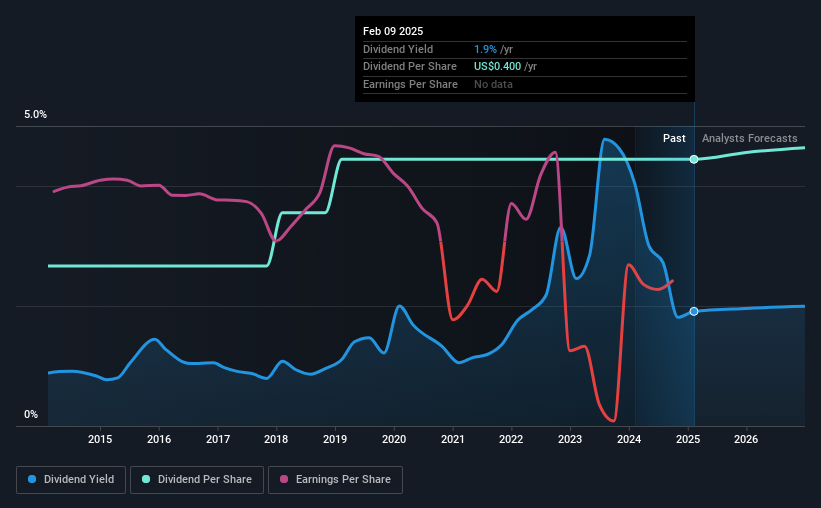

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of $0.24 in 2015 to the most recent total annual payment of $0.40. This works out to be a compound annual growth rate (CAGR) of approximately 5.2% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. Earnings per share has been sinking by 40% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Wolverine World Wide that you should be aware of before investing. Is Wolverine World Wide not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.