- United States

- /

- Luxury

- /

- NYSE:WWW

Wolverine World Wide, Inc. (NYSE:WWW) Stocks Shoot Up 33% But Its P/S Still Looks Reasonable

Despite an already strong run, Wolverine World Wide, Inc. (NYSE:WWW) shares have been powering on, with a gain of 33% in the last thirty days. The last month tops off a massive increase of 162% in the last year.

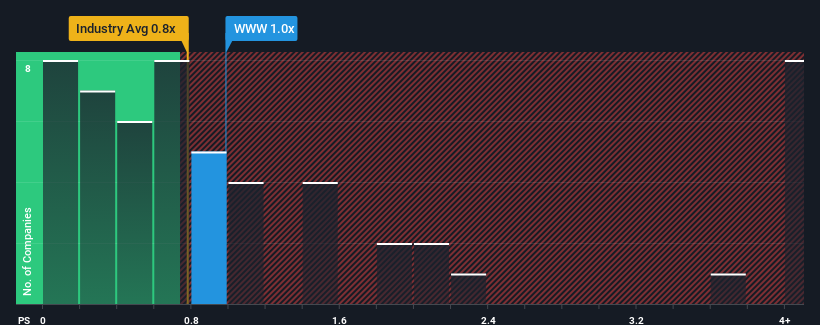

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Wolverine World Wide's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in the United States is also close to 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Wolverine World Wide

How Wolverine World Wide Has Been Performing

While the industry has experienced revenue growth lately, Wolverine World Wide's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Wolverine World Wide's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Wolverine World Wide's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 22% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 2.3% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.0%, which is not materially different.

In light of this, it's understandable that Wolverine World Wide's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Wolverine World Wide's P/S Mean For Investors?

Wolverine World Wide appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Wolverine World Wide's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Wolverine World Wide that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives