- United States

- /

- Luxury

- /

- NYSE:UAA

Under Armour (NYSE:UAA shareholders incur further losses as stock declines 6.2% this week, taking three-year losses to 53%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Under Armour, Inc. (NYSE:UAA) have had an unfortunate run in the last three years. Unfortunately, they have held through a 53% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 23% lower in that time. Shareholders have had an even rougher run lately, with the share price down 34% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

After losing 6.2% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Under Armour

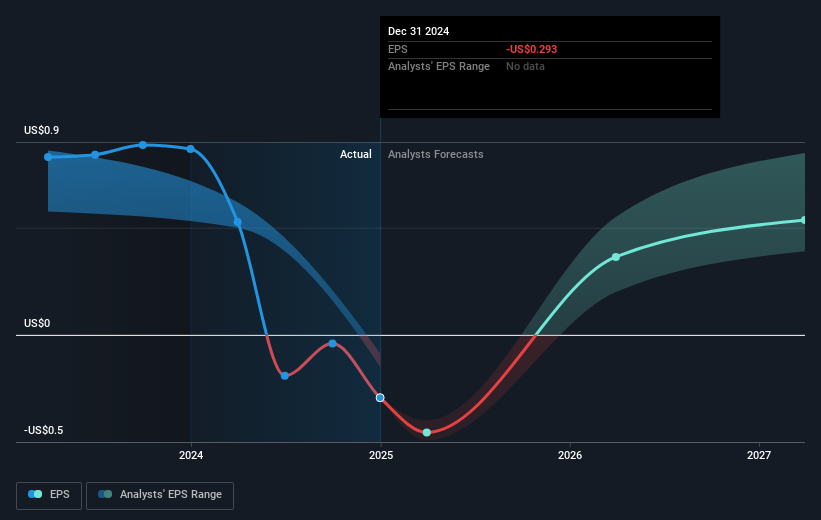

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the three years that the share price declined, Under Armour's earnings per share (EPS) dropped significantly, falling to a loss. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Under Armour's key metrics by checking this interactive graph of Under Armour's earnings, revenue and cash flow.

A Different Perspective

Investors in Under Armour had a tough year, with a total loss of 23%, against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Under Armour may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UAA

Under Armour

Engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth.

Undervalued with adequate balance sheet.