- United States

- /

- Luxury

- /

- NYSE:UAA

Under Armour (NYSE:UAA shareholders incur further losses as stock declines 3.1% this week, taking one-year losses to 51%

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of Under Armour, Inc. (NYSE:UAA) have suffered share price declines over the last year. To wit the share price is down 51% in that time. On the bright side, the stock is actually up 5.6% in the last three years. Unfortunately the share price momentum is still quite negative, with prices down 18% in thirty days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Under Armour

Under Armour isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Under Armour's revenue didn't grow at all in the last year. In fact, it fell 7.1%. That looks pretty grim, at a glance. The share price drop of 51% is understandable given the company doesn't have profits to boast of. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

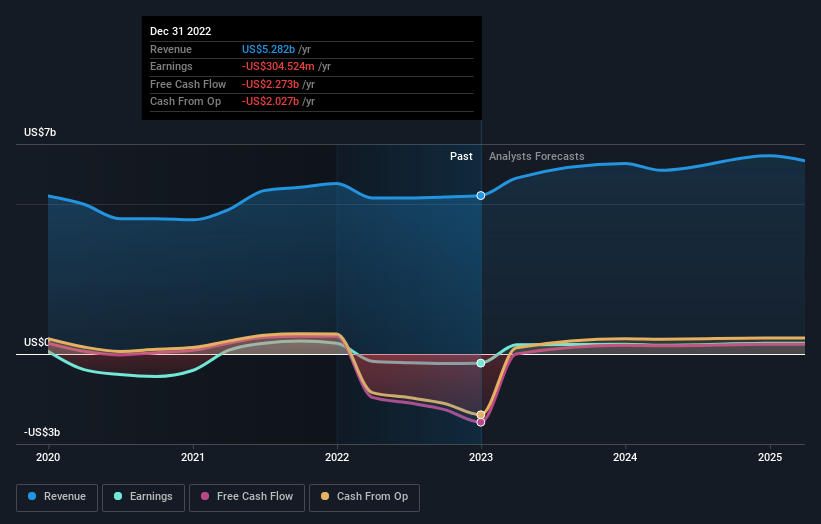

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Under Armour is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

We regret to report that Under Armour shareholders are down 51% for the year. Unfortunately, that's worse than the broader market decline of 12%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Under Armour .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UAA

Under Armour

Engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives