- United States

- /

- Consumer Durables

- /

- NYSE:TOL

How Investors May Respond to Toll Brothers (TOL) Expanding Into New Luxury and Student Housing Markets

Reviewed by Simply Wall St

- Toll Brothers, Inc. has recently announced a series of significant product launches and expansions, including new luxury home communities in Michigan, California, Texas, Nevada, Florida, Pennsylvania, South Carolina, and Washington, as well as the debut of a student housing community in Orlando, Florida.

- This wave of new offerings highlights the company's broadening presence in high-demand regions and its focus on diverse segments such as luxury homes and student living.

- We'll explore how these simultaneous community launches in key geographies could shape Toll Brothers' growth outlook and support future revenue potential.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Toll Brothers Investment Narrative Recap

To have conviction in Toll Brothers as a shareholder, you need to believe that demand for luxury homes will remain resilient, even with elevated mortgage rates and increased spec home construction. While the recent series of community openings across key U.S. markets signals progress on Toll Brothers’ short-term growth catalyst (expansion of community count and footprint), this wave of launches does not materially change the near-term risk profile, which is still most affected by margin pressure from rising incentives and potential slowdowns in luxury buyer demand.

Among the latest announcements, the launch of Coldwater Ridge in Northville, Michigan, stands out for its entry-point pricing and modern features, underscoring Toll Brothers’ push into affluent yet accessible regions. This approach ties directly to the catalyst of broadening market reach and supporting higher sales volumes, although it does not eliminate broader affordability and margin headwinds facing the luxury segment.

Yet, while new communities bring promise, investors should be aware that if incentives continue to rise and compress margins over time...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers is expected to reach $13.1 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes a 6.3% annual growth rate in revenue and a $0.3 billion increase in earnings from the current $1.4 billion.

Uncover how Toll Brothers' forecasts yield a $149.94 fair value, a 5% upside to its current price.

Exploring Other Perspectives

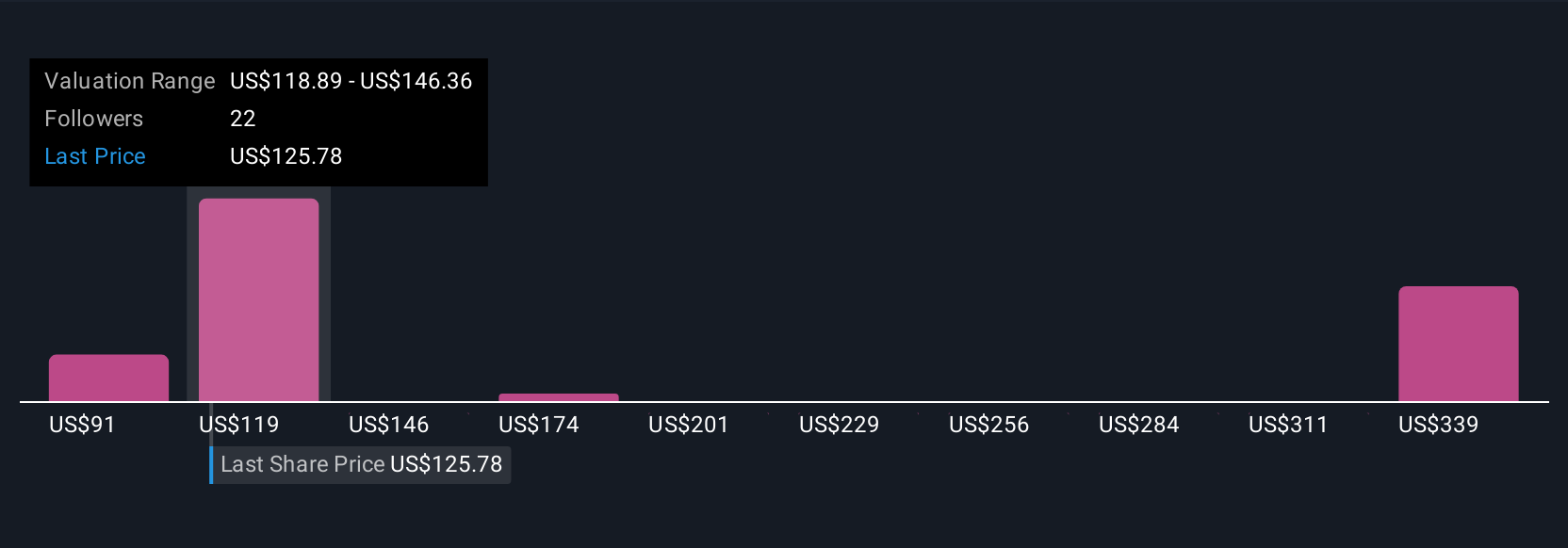

Simply Wall St Community members have published 12 fair value estimates for Toll Brothers, spanning from US$91.41 to US$194.73 per share. Despite the recent expansion news, compressed margins and climbing incentives remain a prominent concern for future profitability among many market participants.

Explore 12 other fair value estimates on Toll Brothers - why the stock might be worth as much as 36% more than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives