- United States

- /

- Consumer Durables

- /

- NYSE:SN

SharkNinja (SN) Valuation in Focus as New Products and Celebrity Push Stir Investor Interest

Reviewed by Kshitija Bhandaru

SharkNinja (SN) is making headlines after rolling out its Ninja Fireside360 outdoor heater in Canada and the Shark FacialPro Glow skincare device. Comedian Kevin Hart also joins as a new global brand ambassador. These launches and high-profile endorsements come just as anticipation grows around the company’s next earnings report.

See our latest analysis for SharkNinja.

Despite rolling out innovative products and drawing celebrity attention, SharkNinja’s recent share price return tells a more cautious story. The stock has slid nearly 24% over the past month and is down almost 18% on a total shareholder return basis for the year. Momentum has faded compared to earlier optimism, and investors are now watching closely to see if the company’s next moves and upcoming earnings can help rebuild confidence.

If these twists in SharkNinja’s story have you looking for what else could be next, it’s a great time to explore fast growing stocks with high insider ownership

With the stock’s recent slide, some investors are questioning whether SharkNinja is now trading at a discount or if the market has already factored in all the company’s future growth. Is this a buying opportunity, or is everything already reflected in the price?

Most Popular Narrative: 35.8% Undervalued

The narrative’s fair value estimate comes in well above SharkNinja’s latest close, setting up a wide gap between expectation and reality. This fuels the debate: are investors missing something, or are these targets too aggressive?

Rapid expansion of new product categories, such as beauty technology and outdoor appliances, positions SharkNinja to capture fresh demand fueled by consumer focus on health, wellness, and convenience. This supports above-market revenue growth and higher net margins through premium innovation.

Want to know why this valuation is so bullish? Find out which bold expansion plans and future profit levels underpin the optimistic fair value. Could SharkNinja’s newest categories really ignite a revenue surge and push the share price much higher?

Result: Fair Value of $137.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising production costs and dependence on viral hits could quickly undermine SharkNinja’s bullish outlook if trends or consumer spending shift suddenly.

Find out about the key risks to this SharkNinja narrative.

Another View: Looking at Earnings Ratios

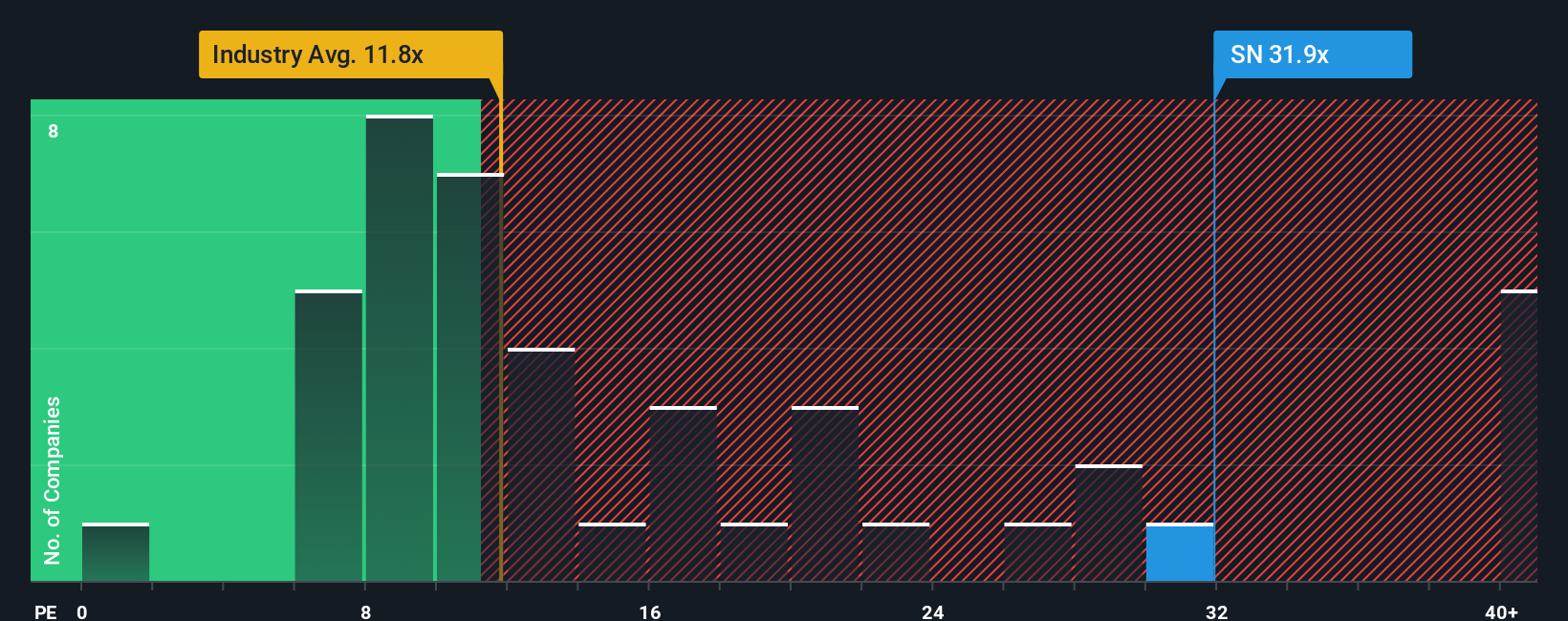

Taking a step back from projected cash flows, it is worth noting that SharkNinja’s shares currently trade on a price-to-earnings level of 24.1x. That is much higher than the Consumer Durables industry average of 10.2x, the peer average of 27.4x, and also above the market’s own fair ratio estimate of 22.6x. This suggests the stock’s valuation risk is elevated if future earnings do not meet expectations. Is the market pricing in too much optimism compared to industry standards?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SharkNinja Narrative

If you’re not sold on these opinions or want to dig into the numbers yourself, you can quickly build your own perspective and see where the facts lead. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SharkNinja.

Looking for more investment ideas?

Don’t just watch from the sidelines while new opportunities emerge. Use these expert-curated lists to find promising stocks showing growth, value, and tomorrow’s breakthroughs.

- Tap into the future of medicine and cutting-edge technology by scanning these 33 healthcare AI stocks, which is rapidly shaping the healthcare and AI landscape.

- Unlock steady income potential for your portfolio with these 19 dividend stocks with yields > 3%, offering yields over 3% and financial resilience.

- Seize undervalued opportunities before the crowd with these 898 undervalued stocks based on cash flows, spotlighting companies whose prices may not reflect their true cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives