- United States

- /

- Luxury

- /

- NYSE:RL

Will Ralph Lauren's (RL) New London Restaurant Deepen Its Premium Brand Narrative?

Reviewed by Sasha Jovanovic

- Ralph Lauren Corporation recently announced the opening of The Polo Bar Ralph Lauren in London at 1 Hanover Square, expanding its hospitality portfolio with a new restaurant expected to open in 2028.

- This development highlights Ralph Lauren’s deep, multi-decade connection to the UK market and illustrates the brand’s ongoing emphasis on luxury experiences alongside its established retail presence.

- We’ll explore how the addition of a flagship restaurant in London could reinforce Ralph Lauren’s premium positioning and global expansion plans.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ralph Lauren Investment Narrative Recap

To be a shareholder in Ralph Lauren today, you need to believe in the brand’s continued success in premium retail and its ability to elevate customer experiences across global markets. While the opening of The Polo Bar in London reinforces the company's long-term luxury positioning, this news is unlikely to materially impact the most immediate catalyst: accelerating international expansion, especially in Asia, and it does not address the most significant near-term risk, which remains exposure to inflation and tariff pressures that could affect margins and demand.

Among recent announcements, Ralph Lauren’s strong first-quarter earnings stand out, with sales and net income improving year over year. Sustained top-line growth remains a key catalyst, but market risks tied to macroeconomic uncertainty and consumer sensitivity to pricing linger in the background despite these solid results. Still, investors should be aware that if cost inflation and tariffs intensify, the effect on future margins could become more pronounced...

Read the full narrative on Ralph Lauren (it's free!)

Ralph Lauren's outlook anticipates $8.4 billion in revenue and $1.0 billion in earnings by 2028. This projection is based on a 5.0% annual revenue growth rate and an increase in earnings of $205 million from the current $794.7 million.

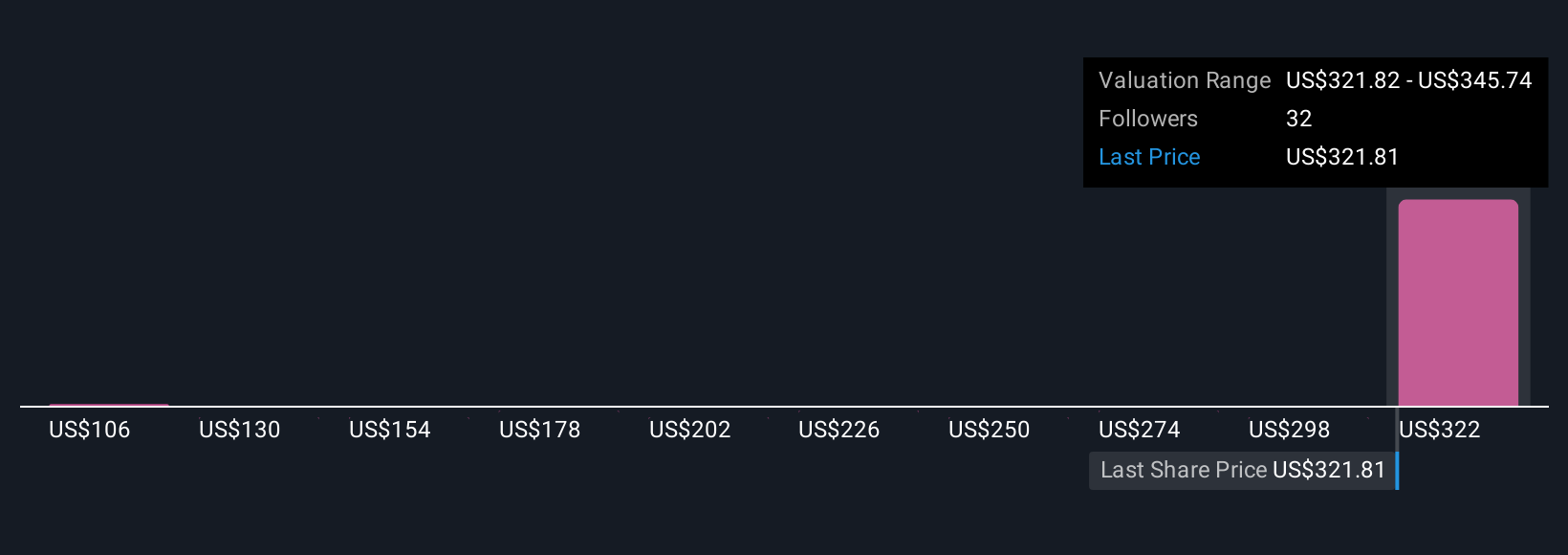

Uncover how Ralph Lauren's forecasts yield a $345.74 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The community at Simply Wall St shared seven fair value estimates for Ralph Lauren, ranging from US$106.47 to US$345.74 per share. With opinions spanning below and above today’s price, these varied perspectives highlight how accelerating expansion in Asia could influence future performance, consider how your own outlook might compare.

Explore 7 other fair value estimates on Ralph Lauren - why the stock might be worth as much as 12% more than the current price!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ralph Lauren research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ralph Lauren's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives