- United States

- /

- Luxury

- /

- NYSE:RL

Ralph Lauren (RL): Evaluating Valuation After Global Expansion and Continued Outperformance

Reviewed by Kshitija Bhandaru

Ralph Lauren (NYSE:RL) is drawing fresh attention after announcing an ambitious addition to its hospitality portfolio. The Polo Bar will soon make its London debut. Investors are increasingly curious about what this global expansion means for the company’s trajectory.

See our latest analysis for Ralph Lauren.

Ralph Lauren’s latest wave of expansion has come alongside steady momentum for shareholders. While some peers faced volatility on macro worries, Ralph Lauren’s 37% year-to-date share price return and stellar 56% total shareholder return over the past year point to building confidence around its strategy and brand execution.

If this mix of fashion-forward moves and strong performance has you curious about what else could be gaining traction, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares already racing ahead of the sector, the question now is whether Ralph Lauren’s growth story is fully reflected at today’s price or if long-term investors are being handed a fresh buying opportunity.

Most Popular Narrative: 8.2% Undervalued

With Ralph Lauren closing at $317.23 and the most popular narrative assigning a fair value of $345.74, followers see upside from current levels, building momentum beneath the recent rally.

Accelerating international expansion, especially in Asia and Greater China where sales grew over 30% and now represent 9% of company revenue (up from 3-4% a few years ago), positions Ralph Lauren to benefit from rising global wealth and middle-class growth. This supports sustained top-line revenue gains.

Just how aggressive are the profit and margin targets fueling this valuation? The narrative pegs its estimate on blockbuster growth rates, digital breakthroughs, and a premium pricing power other brands only dream about. What does this mean for the future shape of Ralph Lauren’s earnings? Get the crucial numbers and the full story inside the popular narrative.

Result: Fair Value of $345.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing European growth and rising inventories could challenge Ralph Lauren’s upbeat story if consumer demand softens or if macroeconomic instability deepens.

Find out about the key risks to this Ralph Lauren narrative.

Another View: Price-To-Earnings Tension

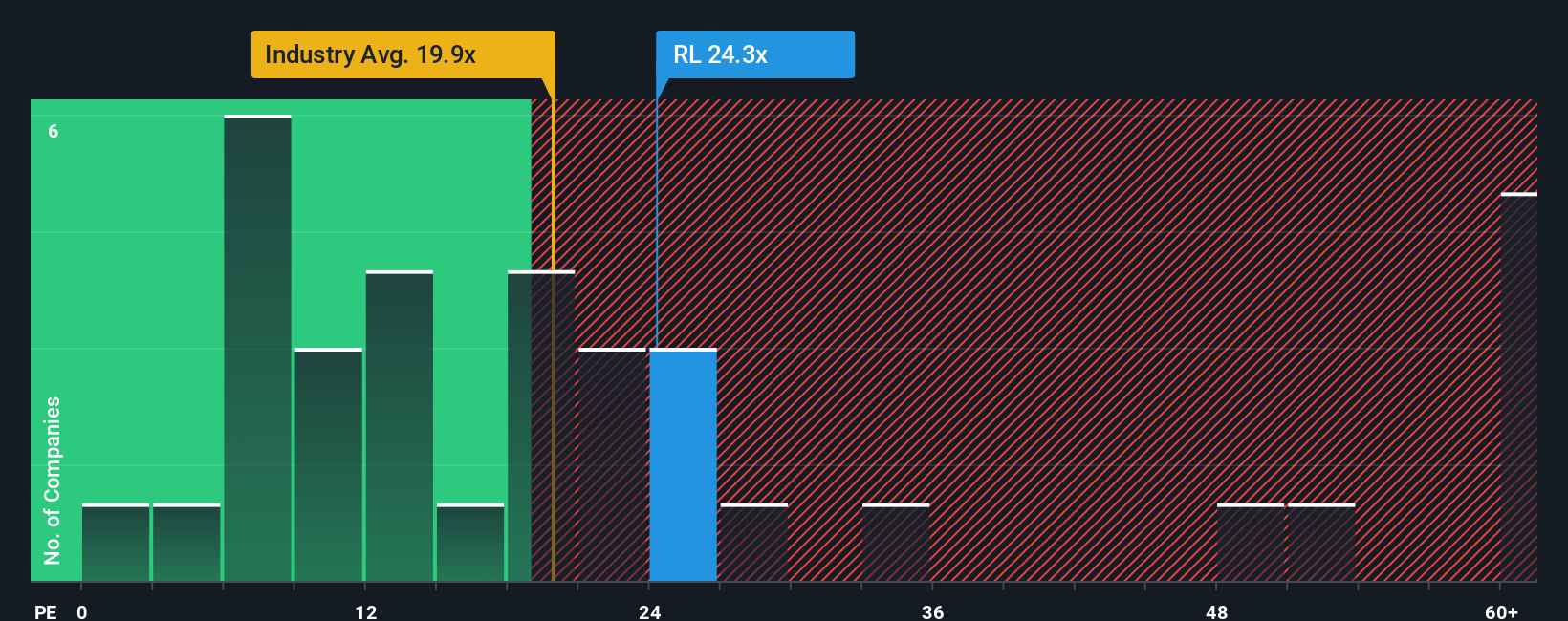

Switching gears to valuation through market multiples, Ralph Lauren trades at 24.2 times earnings. This makes it look expensive compared to the US Luxury industry's 19.8 times and a fair ratio of 18.9 times. Being priced above both industry and fair levels could put the share price under pressure if growth stalls. Will the market keep paying this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If the current analysis does not match your perspective or you would rather dig into the numbers yourself, it takes under three minutes to put together your own view, your way, with Do it your way

A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Put yourself ahead of the crowd by checking out high-potential stocks that could boost your portfolio returns. These handpicked ideas are just a click away:

- Maximize your passive income by tapping into these 18 dividend stocks with yields > 3% with yields above 3%. This can help your money work harder for you.

- Supercharge your growth potential by targeting the sector’s best with these 25 AI penny stocks, which are at the forefront of artificial intelligence innovation.

- Tap into untapped value by jumping on these 893 undervalued stocks based on cash flows, featuring companies priced below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives