- United States

- /

- Luxury

- /

- NYSE:PVH

PVH’s Profit Squeeze Amid Modest Growth Might Change The Case For Investing In PVH (PVH)

Reviewed by Sasha Jovanovic

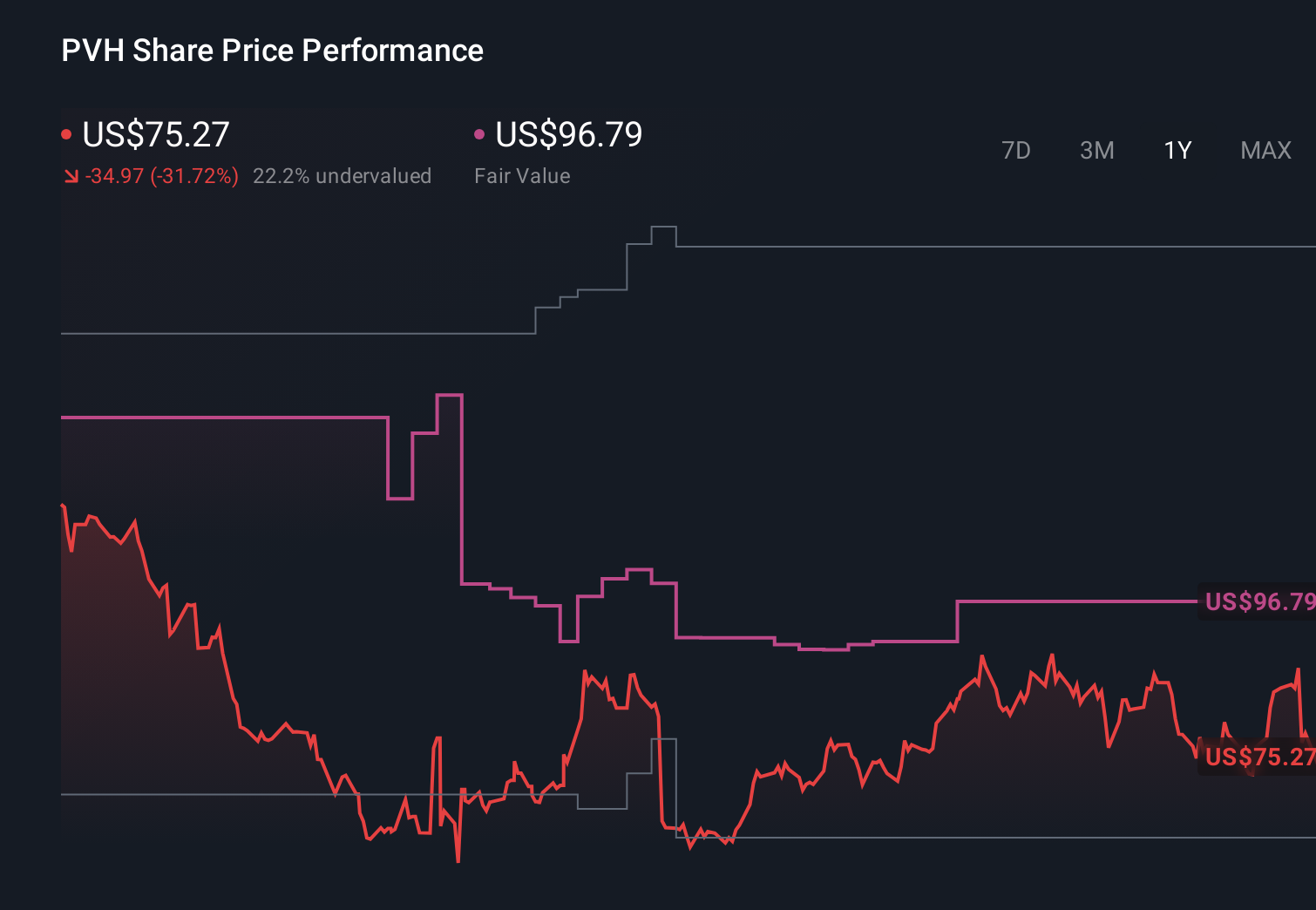

- PVH Corp. recently reported third-quarter 2025 results showing sales of US$2,294.3 million but net income dropping sharply to US$4.2 million, with diluted EPS from continuing operations slipping to US$0.09.

- Despite modest sales growth over the quarter and nine-month period, the steep earnings compression alongside only slightly positive revenue guidance and continued buybacks raises questions about the quality and resilience of PVH’s profit engine.

- We’ll now examine how PVH’s sharply weaker earnings, alongside modestly upbeat revenue guidance, reshape the company’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PVH Investment Narrative Recap

To stay invested in PVH, you need to believe its Calvin Klein and Tommy Hilfiger brands can convert modest revenue growth into healthier, more consistent earnings again. The latest quarter’s sharp profit drop, despite slightly higher sales and cautious Q4 revenue guidance, puts more weight on near term execution and margin repair, making earnings volatility the key catalyst and risk in the months ahead.

The stepped up share buybacks in 2025, including US$167.17 million spent on repurchasing 2.3 million shares last quarter, intersect awkwardly with weakened profitability, since they concentrate exposure to a business currently earning much less per share. For investors watching PVH’s turnaround story, that contrast between capital returns and compressed earnings may sharpen focus on how quickly margins can recover, or whether further operational or brand related setbacks emerge.

Yet beneath the modest revenue guidance, investors should be aware that PVH’s already pressured margins leave little room if...

Read the full narrative on PVH (it's free!)

PVH’s narrative projects $9.4 billion revenue and $707.7 million earnings by 2028. This requires 2.3% yearly revenue growth and roughly a $239 million earnings increase from $468.5 million today.

Uncover how PVH's forecasts yield a $96.79 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community value PVH between US$67.10 and US$216.96, underlining how far opinions can diverge. Against that spread, the recent collapse in reported earnings puts more scrutiny on PVH’s profit resilience and invites you to compare different views before deciding what its future performance could look like.

Explore 7 other fair value estimates on PVH - why the stock might be worth 11% less than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PVH

PVH

Operates as an apparel company in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)