- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (PII) Valuation Check After Strong Q3, Upgraded 2025 Outlook and Market Share Gains

Reviewed by Simply Wall St

Polaris (PII) is back on investors’ radar after a stronger third quarter prompted management to lift its 2025 sales outlook, with earnings expectations also trending higher as On Road, Marine and Off Road share gains stack up.

See our latest analysis for Polaris.

The upbeat third quarter and bullish 2025 outlook seem to be resonating, with Polaris posting a 90 day share price return of nearly 20 percent and a 1 year total shareholder return just over 19 percent, suggesting momentum is rebuilding after a tough few years.

If this turnaround story has your attention, it could be a good moment to see what else is revving up across auto manufacturers for fresh ideas beyond Polaris.

Yet despite the share price rebound, Polaris still trades below its own intrinsic value estimates and near Wall Street targets. This raises the key question: is this an overlooked value play, or has the market already priced in the recovery?

Most Popular Narrative: 4.1% Overvalued

With Polaris closing at $68.54 against a narrative fair value of about $65.83, the story leans toward modest optimism about earnings power and margins.

Polaris is focused on a strategic approach to mitigate the impact of tariffs through supply chain adjustments and cost control initiatives, which could potentially preserve net margins and improve earnings over time. There is strong demand for Polaris' premium products like the Polaris XPEDITION and RANGER series, indicating potential for sales growth and higher average selling prices, positively impacting revenue.

Want to see how steady but not spectacular growth, rising margins and a re rated earnings multiple all connect into that valuation call? The narrative lays out a detailed earnings ramp, calibrated revenue trajectory and a future profit multiple that would normally be reserved for faster growing leisure names. Curious which specific long term assumptions make that fair value seem achievable instead of aspirational? Read on and test whether those projections line up with your own expectations.

Result: Fair Value of $65.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and potential powersports demand softness could quickly undercut the assumed margin recovery and earnings rebound built into this narrative.

Find out about the key risks to this Polaris narrative.

Another Angle on Valuation

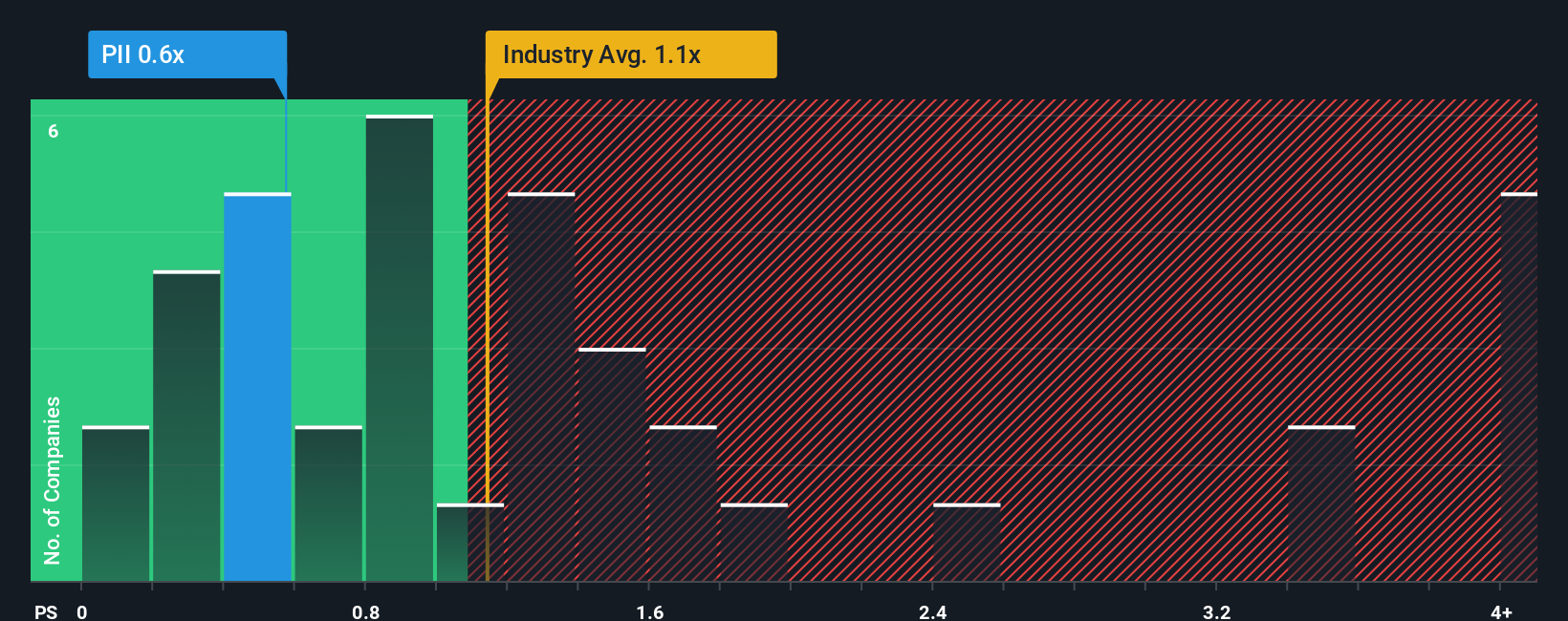

While the narrative fair value suggests Polaris is only slightly overvalued, its current price to sales ratio of about 0.5 times looks cheap next to the US Leisure industry at roughly 0.9 times and a fair ratio nearer 0.6 times, which implies some room for sentiment to improve before valuation appears stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polaris Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a personalized view in under three minutes: Do it your way

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity with tailored stock ideas from the Simply Wall Street Screener, built to match focused strategies and clear goals.

- Capture overlooked value by scanning these 909 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Position for breakthrough innovation by reviewing these 28 quantum computing stocks that may benefit from the next step change in computing power.

- Strengthen your income stream by targeting these 13 dividend stocks with yields > 3% that can help support reliable, long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)