- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (NYSE:PII) Sees Executive Change With New Appointment As Stock Drops 12% Over Last Month

Reviewed by Simply Wall St

Polaris (NYSE:PII) recently experienced significant executive changes with Matt Winings' appointment bolstering its leadership team, and this, coupled with the company’s engagement with analysts and investors, sets the stage for its long-term strategy in the powersports market. Nevertheless, the stock’s 12% decline over the past month reflects broader market tumult, as evidenced by the Dow Jones' 4% drop amid trade war-induced volatility and fears of economic slowdown. Despite positive initiatives at Polaris, the overarching market decline has pressured the company's total shareholder returns significantly last month.

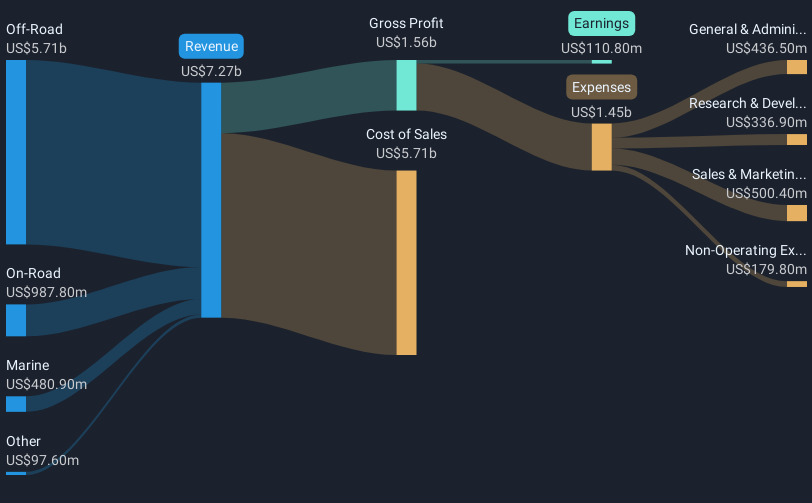

The last 5 years have seen Polaris's total shareholder returns dip by 26.14%, highlighting the challenges faced by the company. During this period, significant factors have shaped its journey. Polaris is dealing with economic pressures, including tariffs and elevated interest rates, which have negatively impacted consumer purchasing behavior and, subsequently, revenue. In late 2024, the company experienced a dramatic slide in earnings, with Q4 revenues at US$1.76 billion, a sharp decline from the previous year, contributing to reduced investor confidence. These financial pressures are exacerbated by competitive market conditions and aggressive promotions, straining margins.

Despite these setbacks, Polaris continues to focus on cost efficiencies, realizing US$200 million in savings from structural optimization. Furthermore, their proactive management of dealer inventories aims to enhance future profitability. Product innovation remains a key emphasis, as evidenced by the launch of the Indian Motorcycle Scout lineup. These efforts underscore Polaris's commitment to navigating current headwinds while aiming for future growth opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives