- United States

- /

- Leisure

- /

- NYSE:PII

3 Dividend Stocks On US Exchange With Up To 4.5% Yield

Reviewed by Simply Wall St

As the U.S. stock market navigates a volatile period with mixed performances from major indexes, investors are keeping an eye on dividend stocks as a potential source of steady income amidst the fluctuations. In such an environment, identifying dividend stocks with attractive yields can be crucial for those looking to balance growth and income in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.31% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.70% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.71% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.86% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.53% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

Click here to see the full list of 157 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

John B. Sanfilippo & Son (NasdaqGS:JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States with a market cap of approximately $998.19 million.

Operations: The company's revenue primarily comes from selling various nut and nut-related products, totaling approximately $1.11 billion.

Dividend Yield: 3.6%

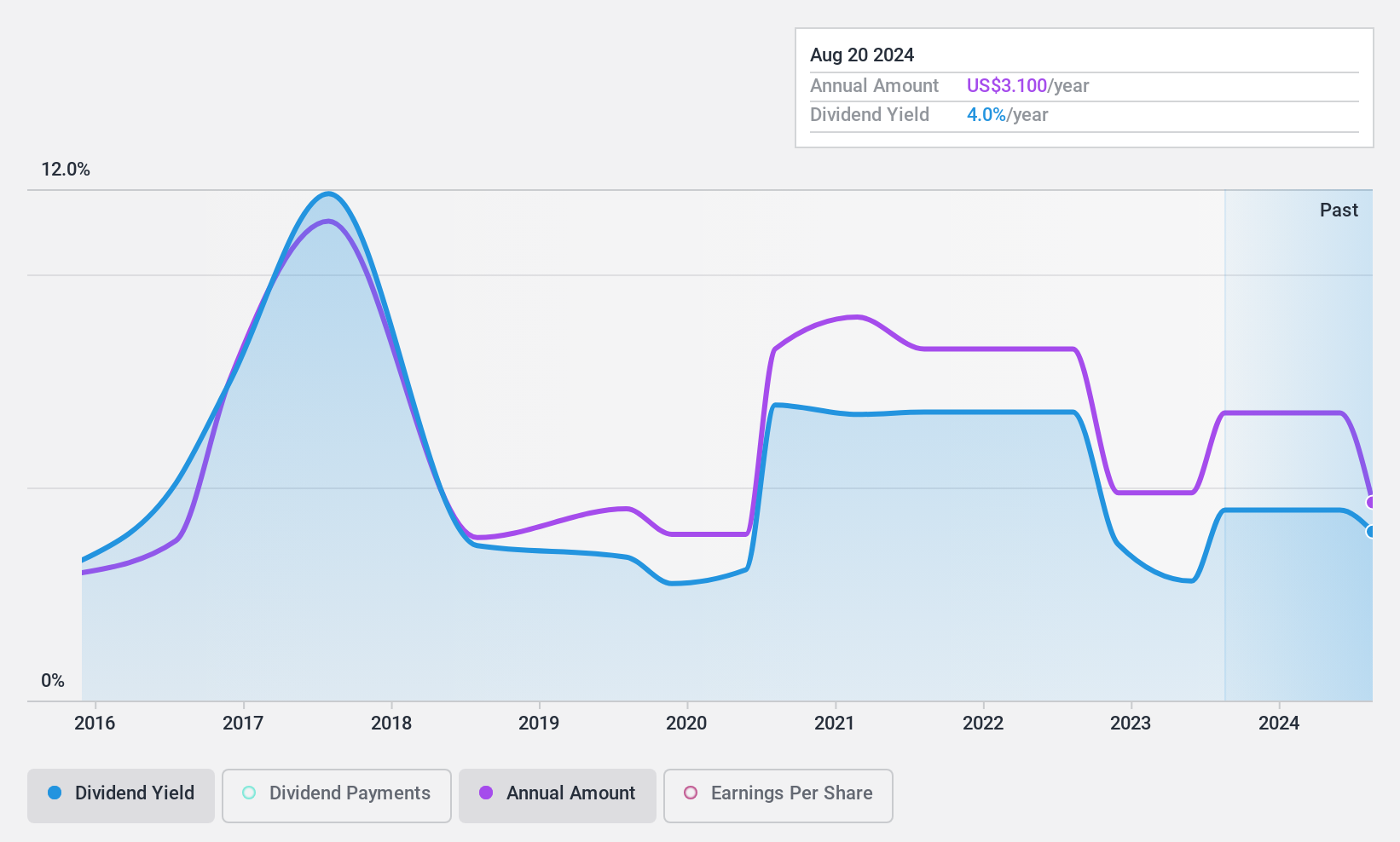

John B. Sanfilippo & Son's dividend payments are well covered by earnings with a low payout ratio of 18.2% and a reasonable cash payout ratio of 66%, though their dividends have been volatile over the past decade. The dividend yield is relatively low at 3.6% compared to top-tier US payers, yet it has shown growth over the last ten years. Recent expansions, including a new facility in Huntley, Illinois, aim to boost manufacturing capabilities and support future growth.

- Take a closer look at John B. Sanfilippo & Son's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that John B. Sanfilippo & Son is trading beyond its estimated value.

Scholastic (NasdaqGS:SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation publishes and distributes children's books globally, with a market cap of approximately $598.27 million.

Operations: Scholastic Corporation's revenue segments include Children's Book Publishing and Distribution at $932.80 million, Education Solutions at $331.10 million, and International operations contributing $273.40 million.

Dividend Yield: 3.8%

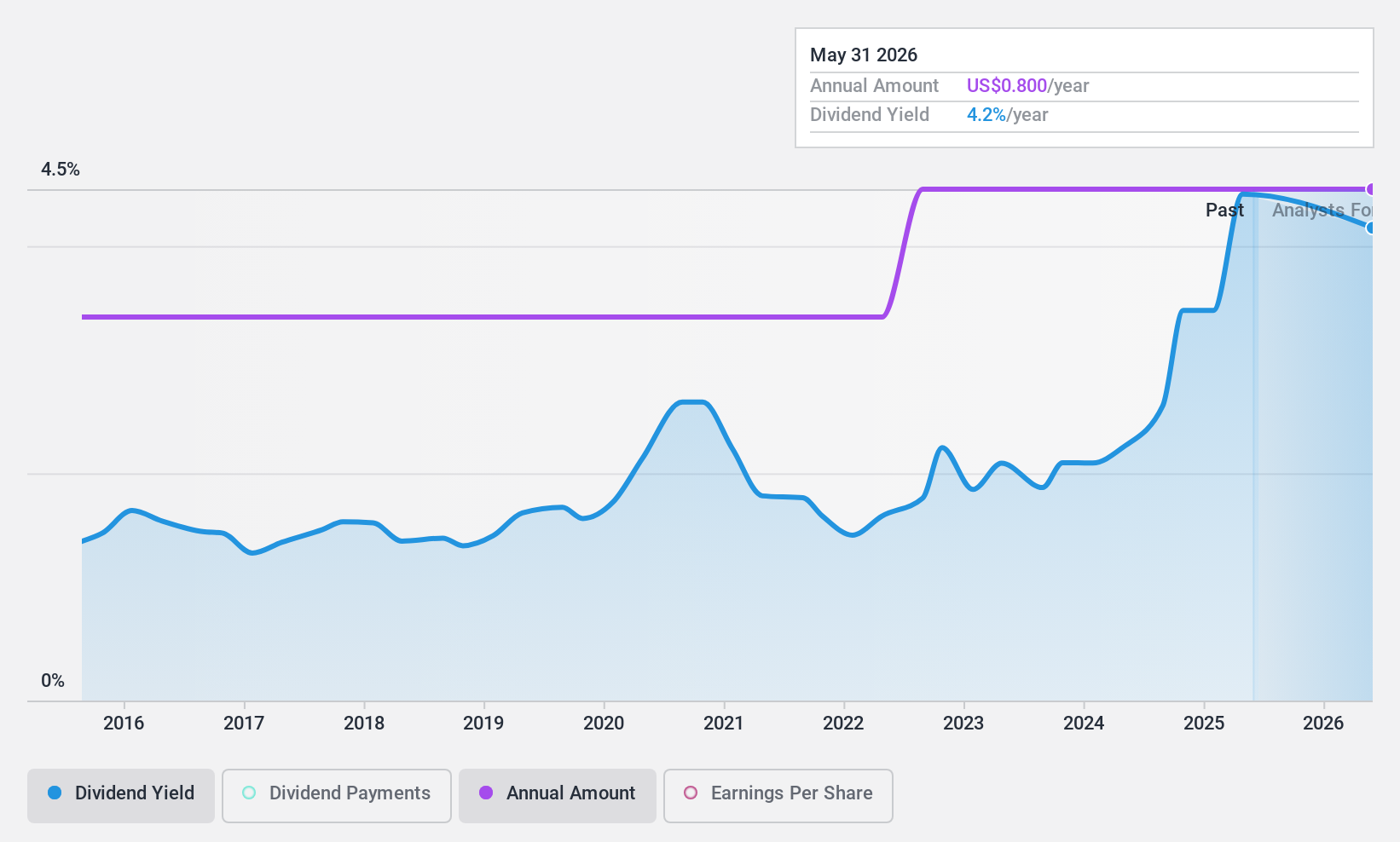

Scholastic's dividend, though stable and reliable over the past decade, is not well covered by earnings due to recent unprofitability. However, it maintains a reasonable cash payout ratio of 43.1%, suggesting dividends are supported by cash flows. The current yield of 3.76% falls short compared to top US dividend payers. Recent financial results show declining sales and net income, while strategic moves include share buybacks and acquisitions like that of 9 Story Media Group.

- Dive into the specifics of Scholastic here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Scholastic is trading behind its estimated value.

Polaris (NYSE:PII)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Polaris Inc. designs, engineers, manufactures, and markets powersports vehicles globally, with a market cap of approximately $3.20 billion.

Operations: Polaris Inc.'s revenue is primarily derived from its Off-Road segment at $6.19 billion, followed by the On-Road segment at $1.04 billion, and the Marine segment at $486.70 million.

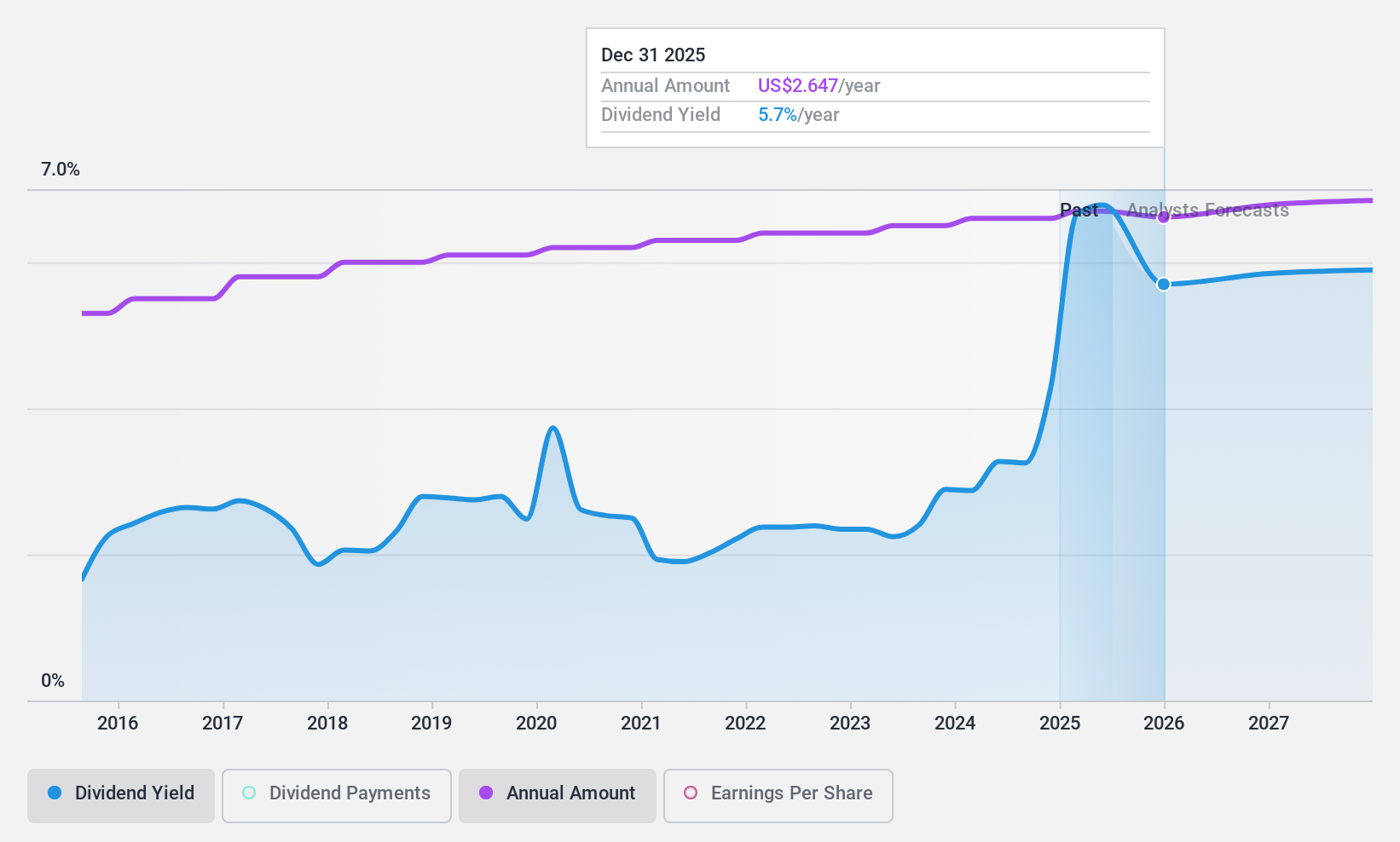

Dividend Yield: 4.6%

Polaris offers a stable and growing dividend, with payments well-covered by cash flows and earnings, despite recent financial challenges. The dividend yield of 4.6% ranks among the top 25% in the US market. However, interest payments are not fully covered by earnings, indicating some financial strain. Recent developments include a credit facility increase to $1.4 billion and leadership changes in its PG&A segment, potentially impacting future operational efficiency and strategic direction.

- Click here to discover the nuances of Polaris with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Polaris is priced lower than what may be justified by its financials.

Make It Happen

- Click here to access our complete index of 157 Top US Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives