- United States

- /

- Consumer Durables

- /

- NYSE:PHM

Does the Recent Share Decline Signal a New Opportunity for PulteGroup in 2025?

Reviewed by Bailey Pemberton

If you’ve got your eye on PulteGroup, you’re probably wondering whether its share price is signaling a golden opportunity or a warning sign. The company has seen its stock take a breather lately, dropping 11.1% over the past week and down 12.1% for the month. Year to date, though, it’s still up 11.9%. If you zoom out, PulteGroup’s five-year return stands at an impressive 172.9%. That kind of growth definitely grabs attention, even after factoring in a recent 1-year drop of 14.8%.

Big swings like these aren’t unusual in homebuilding stocks, which tend to ride waves of optimism and caution depending on broader housing market trends and economic signals. Recent headlines around shifting interest rate expectations and housing demand seem to be playing out on the chart. As any seasoned investor knows, price moves can only tell us so much on their own.

Here’s where it gets interesting: by scoring PulteGroup’s valuation across six key checks, the company comes up with a value score of 5 out of 6 for being undervalued. That’s a solid showing by most standards, especially for a stock with PulteGroup’s long-term track record. In the next section, let’s break down exactly what those valuation checks entail, and why they matter. For those who really want to get the full picture, stick around, as there’s an even smarter way to frame valuation coming up at the end of the article.

Why PulteGroup is lagging behind its peers

Approach 1: PulteGroup Discounted Cash Flow (DCF) Analysis

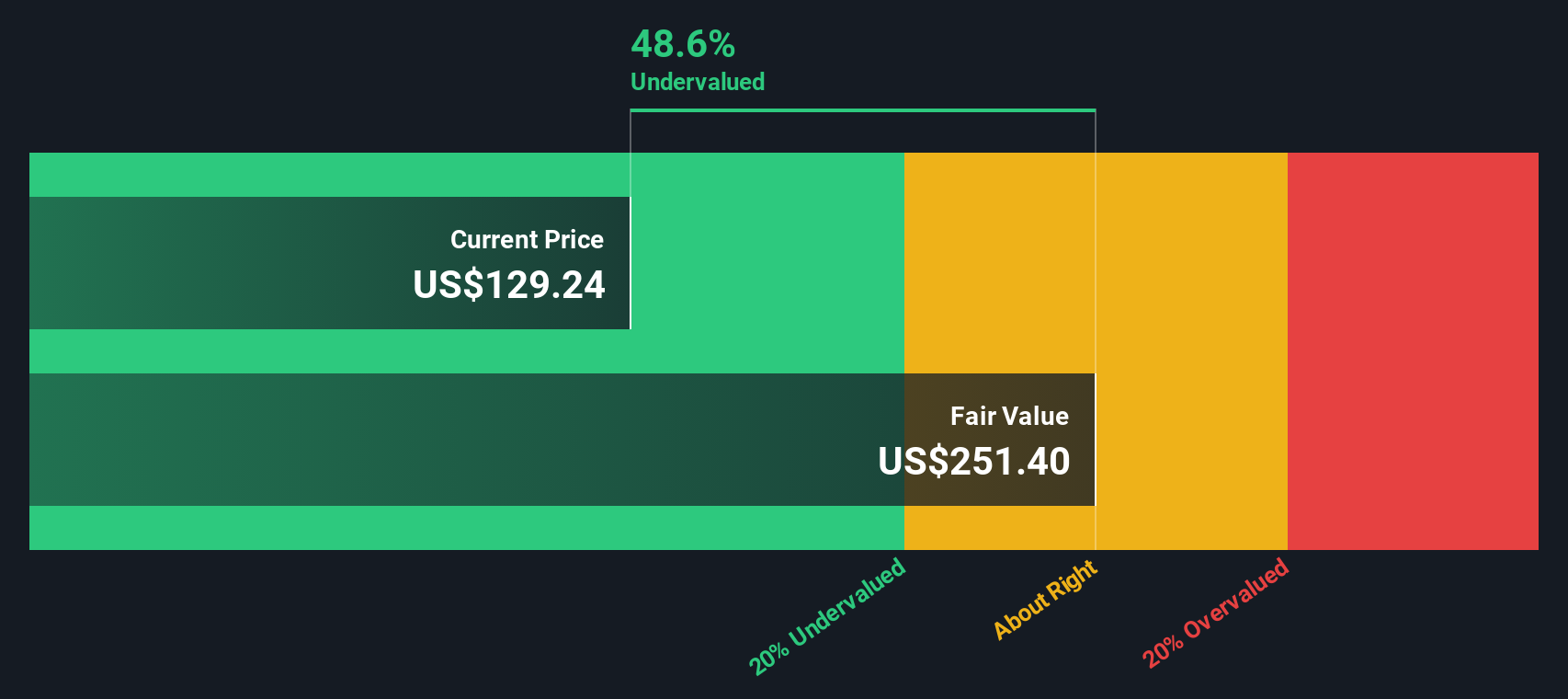

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and discounting them back to today's dollars. For PulteGroup, this approach uses actual and estimated cash flow data, factoring in growth forecasts and present value calculations to paint a picture of intrinsic value.

PulteGroup's latest Free Cash Flow stands at $1.33 billion. According to analyst estimates and extended projections, this figure could reach roughly $3.60 billion by 2035. Over the next decade, annual cash flow is expected to trend steadily higher, supported by industry forecasts and reasonable extrapolation for the outer years.

After running these numbers through a two-stage Free Cash Flow to Equity DCF model, the intrinsic value per share for PulteGroup is calculated at $250.73. This implies the stock is trading at a 51.9% discount to its estimated fair value, which may indicate potential for upside.

If you are focused on value, the DCF suggests PulteGroup shares are attractively priced based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PulteGroup is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

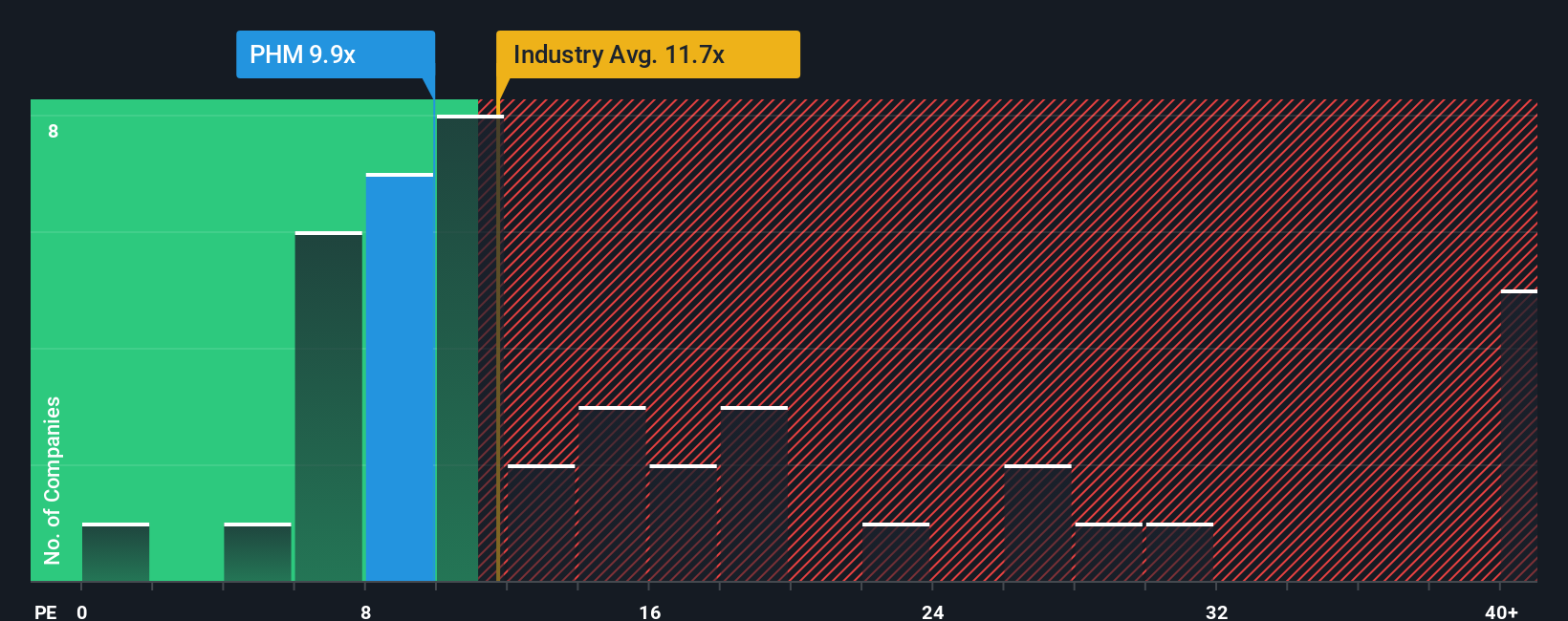

Approach 2: PulteGroup Price vs Earnings

For profitable companies like PulteGroup, the Price-to-Earnings (PE) ratio is a tried and tested way to gauge value. It helps investors compare how much they are paying for each dollar of earnings. Because a PE ratio reflects both how rapidly a company is expected to grow and the risks in its business, higher growth and lower risk typically justify a higher "normal" or "fair" PE multiple.

PulteGroup’s current PE ratio sits at 8.7x. That compares favorably with the Consumer Durables industry average of 10.2x, as well as the peer average of 11.5x. Taken at face value, this suggests PulteGroup could be undervalued relative to its immediate competition and the broader sector.

However, there is a smarter tool in the kit: Simply Wall St's proprietary "Fair Ratio." Unlike straight peer or industry averages, the Fair Ratio weighs key factors such as the company’s earnings growth, profit margins, perceived risks, and its place within the market and sector. In other words, it moves beyond the basics to capture the bigger picture. For PulteGroup, the Fair Ratio clocks in at 14.7x, which is notably above its current PE. This signals that the market may not be fully appreciating the company’s growth profile and risk factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PulteGroup Narrative

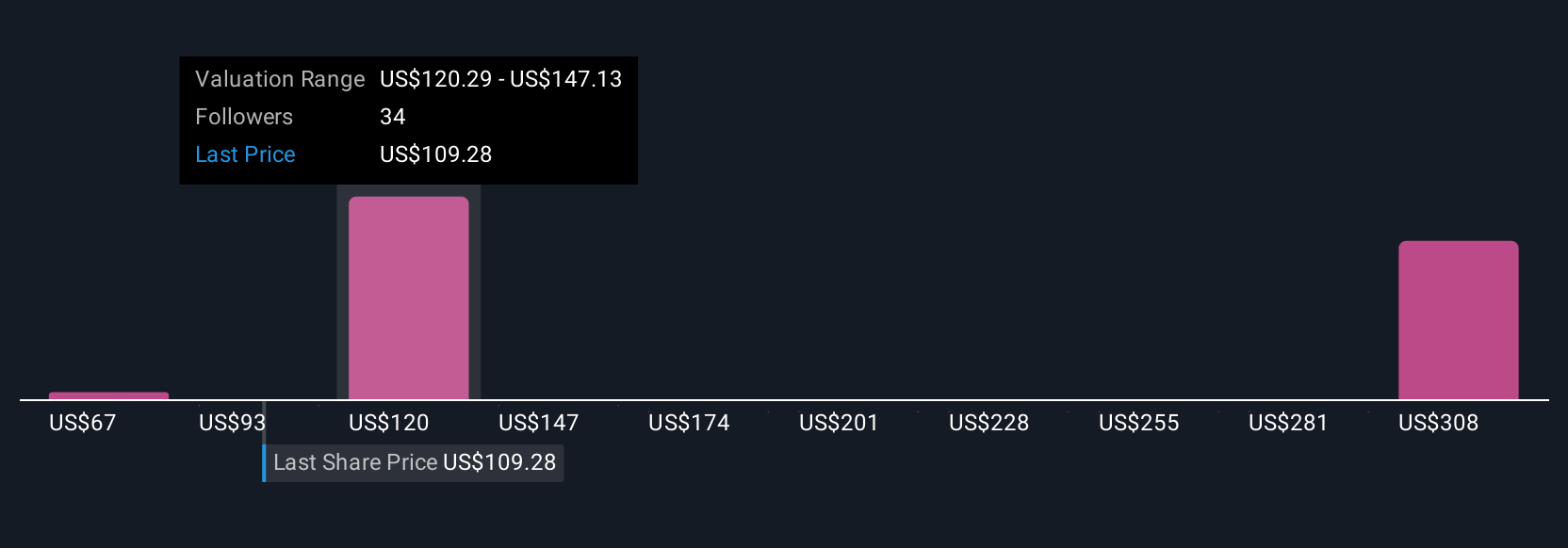

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you tell yourself, or share with others, about why a company like PulteGroup is worth what it is. It combines your view of its future revenue, earnings, and profit margins with a fair value assessment. Instead of relying solely on static metrics, a Narrative connects PulteGroup’s unique business story to your own financial forecast and price target, letting you make investment decisions that are both informed and personal.

This approach is easy to use and available on Simply Wall St’s Community page, where millions of investors publish and update their Narratives in real time. Narratives help you know when to buy or sell, as you can directly compare your estimated Fair Value to the current Price. Since they are updated dynamically when news or earnings are released, you always have the latest perspective.

For PulteGroup, you might see one investor’s Narrative projecting upside to $163 per share on strong active adult community expansion, while another has a more cautious view, seeing fair value at just $98 because of margin pressure and affordability risks. Narratives empower you to invest with confidence, using both facts and your own outlook on the future.

Do you think there's more to the story for PulteGroup? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives