- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON) Valuation Under Focus Following Executive Changes and Market Reassessment

Reviewed by Kshitija Bhandaru

On Holding (NYSE:ONON) is under the spotlight as its stock has slipped over the past month, which has triggered renewed investor caution. Recent executive team changes and shifting trends in athletic apparel are also fueling questions about the company’s future direction.

See our latest analysis for On Holding.

In the bigger picture, On Holding’s share price momentum has clearly cooled in recent months. This reflects a shift in market sentiment after a year filled with changing consumer trends and executive reshuffling. While the 1-year total shareholder return remains negative, strong revenue and profit growth still point to potential that investors may be overlooking, especially with the stock now trading well below analyst expectations.

If you’re interested in broadening your outlook beyond the latest sector headlines, now’s a perfect time to discover fast growing stocks with high insider ownership.

With shares trading well below analyst targets, but growth prospects still in play, the pressing question is whether On Holding is undervalued or if the market has already priced in all the potential upside.

Most Popular Narrative: 36.9% Undervalued

With On Holding closing at $42.10 and a consensus fair value near $66.76, market pessimism stands out compared to persistent analyst optimism. The gap sets up a story powered by big growth assumptions and ambitious expansion plans.

The acceleration in DTC (Direct-to-Consumer) and e-commerce channels, with DTC reaching new highs (41.1% of sales in Q2 and up 54% year-over-year), gives On more control over brand, pricing, and customer data. This also increases gross and EBITDA margins, making it an operational catalyst that is likely to further expand profitability as DTC continues its mix shift.

Curious what transformation fuels this sky-high fair value? Hear how bold bets on international growth, margin leaps, and product launches could redefine On’s future. The specifics behind these projections might surprise you. What’s the secret sauce that sets this price apart? You’ll want to see the full calculation for yourself.

Result: Fair Value of $66.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as slowing consumer demand or challenges from heavy reliance on premium pricing could quickly shift On Holding’s growth trajectory and valuation outlook.

Find out about the key risks to this On Holding narrative.

Another View: What Do the Ratios Reveal?

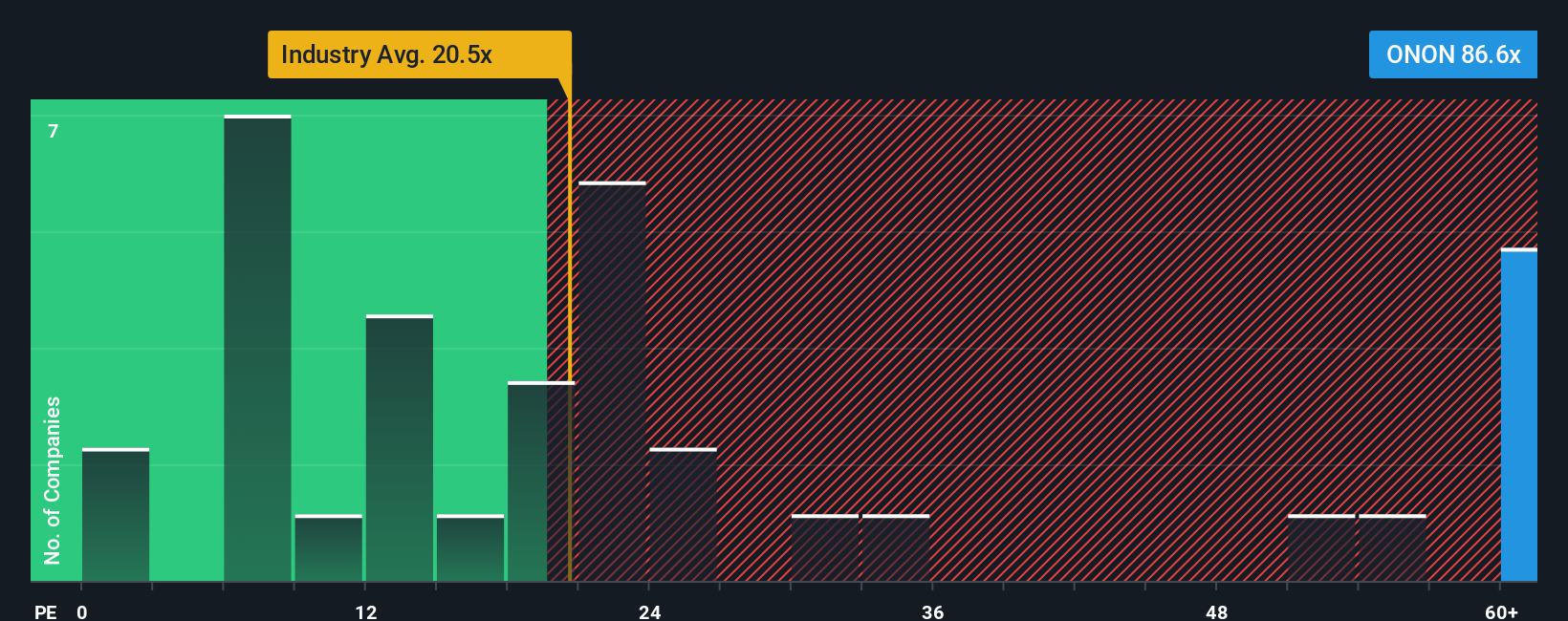

While the fair value approach suggests On Holding is undervalued, things look different through the lens of its price-to-earnings ratio. At 80.5x, On trades dramatically above both its industry average (21.3x) and the estimated fair ratio (33x), signaling stretched expectations. Does this premium reflect future growth, or set investors up for a correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you see things differently or want to dig into the numbers on your own terms, it’s quick and easy to build your own perspective. Just Do it your way.

A great starting point for your On Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Maximize your investing opportunities by exploring three handpicked strategies tailored for forward-thinking investors. Don’t let your next great stock get away.

- Boost your portfolio with potential game-changers by reviewing these 896 undervalued stocks based on cash flows and discover companies whose numbers show hidden value before the broader market catches on.

- Tap into tomorrow’s healthcare breakthroughs with these 31 healthcare AI stocks, where innovative AI in medicine highlights the sector’s fastest movers.

- Position yourself ahead of tech disruption by following these 26 quantum computing stocks to access companies pioneering quantum computing advances right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives