- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON): Assessing Valuation Potential After Recent Share Price Rebound

Reviewed by Simply Wall St

On Holding (NYSE:ONON) has seen its stock deliver a mixed performance across recent timeframes. The stock moved higher by 12% in the past month, though it remains down over the past year. Investors are paying close attention to these dynamics as the company navigates a changing retail landscape.

See our latest analysis for On Holding.

While On Holding’s 1-year share price return is in the red, recent momentum is shifting as the stock rebounded nearly 12% over the past month. Long-term holders have still enjoyed a remarkable 124% total shareholder return over three years, which may indicate growth potential as perceptions improve.

If you’re looking for more opportunities beyond athletic brands, now may be a good time to broaden your investing radar and discover fast growing stocks with high insider ownership

With recent gains and long-term outperformance, investors may wonder whether On Holding is currently undervalued or if the share price already reflects the company's growth prospects. Is this a buying opportunity, or is the market anticipating future expansion?

Most Popular Narrative: 28.2% Undervalued

At $43.99, On Holding trades well below the narrative’s fair value estimate of $61.29. This frames the stock’s latest rally in a provocative new light for growth-focused investors. These numbers suggest that the consensus narrative sees significant room for upward re-rating if the company executes on its strategies.

The acceleration in DTC (Direct-to-Consumer) and e-commerce channels, with DTC reaching new highs (41.1% of sales in Q2 and up 54% year over year), gives On more control over brand, pricing, and customer data while increasing gross and EBITDA margins. This operational catalyst is likely to further expand profitability as DTC continues its mix shift.

Want a glimpse at the expectation engine fueling this valuation? The narrative hinges on rapid revenue growth, a surge in future profit margins, and a bold re-rating in profitability multiples. The secret formula behind this price target? The full narrative unpacks the growth assumptions propelling On Holding’s fair value sky-high—see which forecasts have bulls talking.

Result: Fair Value of $61.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on premium pricing or rapid store expansion could backfire if consumer demand shifts or operational challenges arise. This could put margins and growth targets at risk.

Find out about the key risks to this On Holding narrative.

Another View: Market Multiples Raise Caution

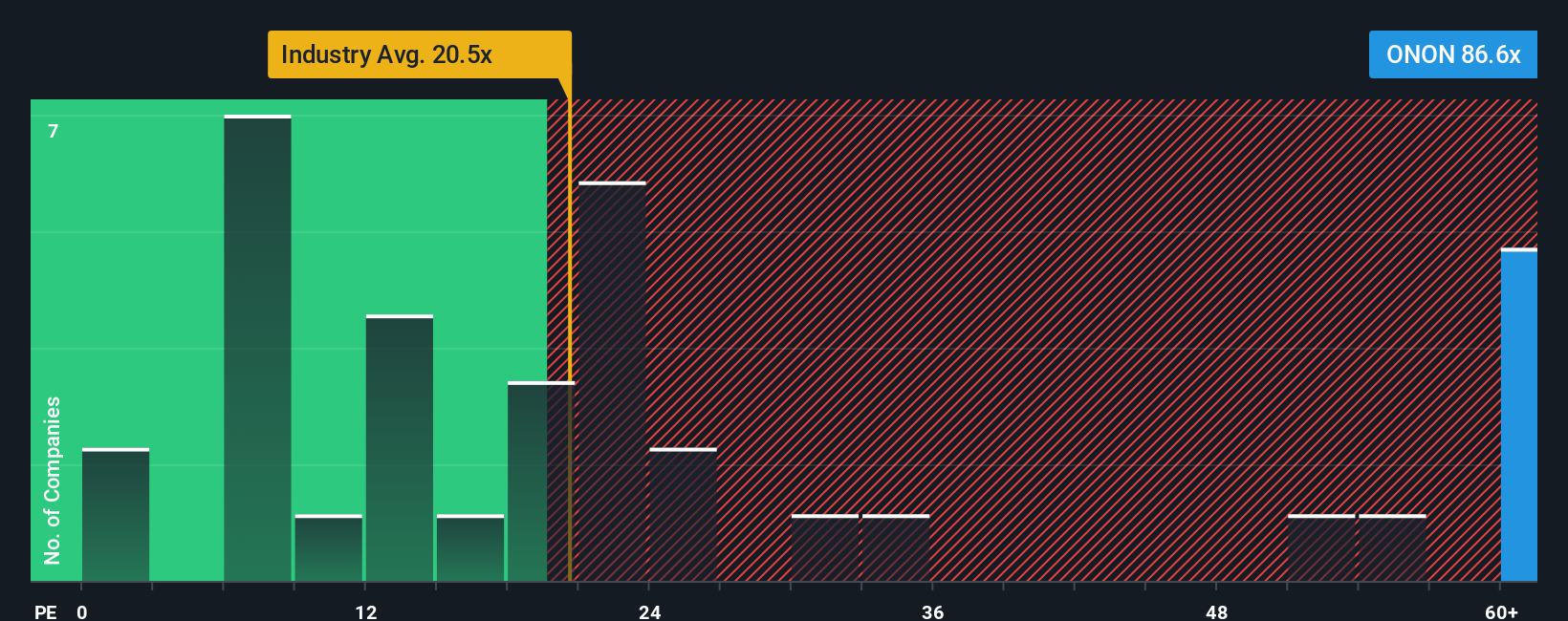

Looking at the company’s price tag through the lens of the price-to-earnings ratio paints a more cautious picture. On Holding trades at 52.6x earnings, almost double the peer average of 28.3x and the US Luxury industry’s 20x benchmark. The fair ratio, which the market could eventually move toward, is 26.8x. This wide gap suggests investors may be paying a significant premium. Does this raise the risk that expectations are running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you have a different perspective or would rather draw your own conclusions, crafting a personal analysis is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding On Holding.

Looking for More Investment Ideas?

Give yourself the edge and don't let market-changing opportunities pass you by. The right tools can help you spot tomorrow's leaders before the crowd catches on.

- Cement your portfolio’s stability with attractive yields. Tap into these 15 dividend stocks with yields > 3% offering strong income potential above 3% returns.

- Gain early exposure to transformative trends by targeting these 25 AI penny stocks poised for growth in the world of artificial intelligence.

- Catch value where the market hasn't. Zero in on these 920 undervalued stocks based on cash flows primed for potential upside based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)