- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NYSE:NKE) Revamps Leadership With New Senior Appointments For Future Growth

Reviewed by Simply Wall St

NIKE (NYSE:NKE) recently announced substantial changes to its senior leadership, appointing Elliott Hill as the new CEO and promoting several key executives, as part of its "Win Now" action plan. The company's share price remained flat over the last month, during a period of market volatility marked by investor anticipation of Federal Reserve decisions and trade negotiations. While the broader market experienced fluctuations due to these macroeconomic factors, Nike’s executive restructuring and its consistent dividend announcement provided stability and business continuity, which may have provided an offsetting influence on broader market concerns.

Buy, Hold or Sell NIKE? View our complete analysis and fair value estimate and you decide.

The recent executive changes at Nike, with Elliott Hill stepping in as CEO, align with the company's "Win Now" action plan. This leadership shift comes amid strategic efforts to enhance digital integration and reposition the product portfolio towards sports performance products. These moves aim to bolster revenue and earnings by focusing on key markets and reducing reliance on declining lines. However, risks such as high inventory levels and geopolitical uncertainties could pose challenges to Nike's projected growth efforts. Despite these strategic ambitions, Nike's long-term total shareholder return paints a different picture. Over the past five years, Nike's total return, including share price and dividends, was a 33.04% decline, contrasting with its relatively stable share price over the last month.

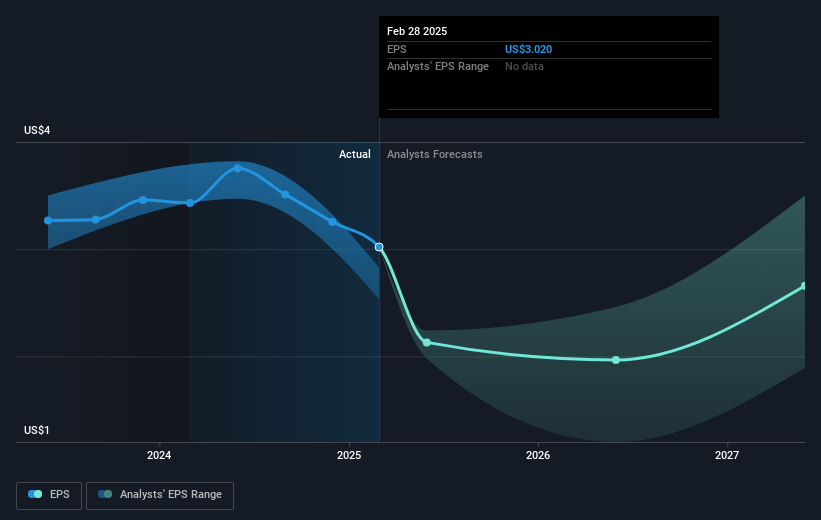

In comparison to the broader US Luxury industry, Nike underperformed over the past year, where the industry returned a decline, whereas the US market showed positive growth. This underperformance may influence market sentiment and weighs against Nike's potential bounce back. Regarding analyst forecasts, future revenue and earnings expectations could see adjustments depending on the successful execution of Nike's plans to improve gross margins and brand momentum. With a current share price of US$57.54, the analyst consensus target of US$74.92 represents a 23.2% potential upside, suggesting market optimism if initiatives materialize as planned.

Explore NIKE's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NIKE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives